Melbourne unit market at 4.30 in its cycle and not yet bottomed out: Experts

The general consensus is that there is an oversupply of apartments in Melbourne.

According to figures from the Victorian Building Commission, there was a 42% jump in apartment building permits in 2011, so the oversupply problem is not likely to go away in 2012.

Valuation firm WBP believes established apartments within 15 kilometres of the CBD offer the best prospects in 2012 while new apartments further out are expected to decline in value due to oversupply.

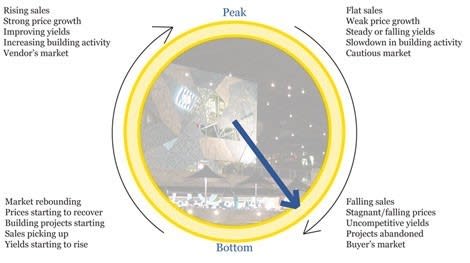

Click to enlargeTime: 4.30

Michael Yardney highlights the oversupply of inner-city and CBD apartments, with more being completed in the next few years.

“This is occurring at a time when there is less demand from the demographic of tenants that rent in the CBD. This will put downward pressure on prices and rentals,” he says.

“Many of the apartments that have been sold off the plan are coming on stream in the next few years and have been purchased by investors. Some will have difficulty getting finance and settling their purchase. Others will be disappointed to see the end value of their properties is less than their purchase price.”

Yardney expects there will be an oversupply of inner-CBD and near-CBD apartments in Melbourne for a few years, causing prices to fall slightly.

Population: 4.1 million

Median unit price: $416,000

Unit price growth in February 2012: 0.8%

Annual unit price growth to December 2011: -3.6%

Annual unit price growth to July 2011: -2%

Rental yield: 4.3%

To find out where your capital city sits on the property clock, download our free eBook.