US house prices slump to lowest point since housing crisis began: S&P/Case-Shiller

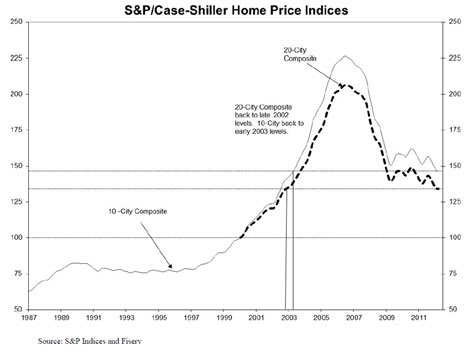

United States home prices ended the first quarter at their lowest point since the US housing crisis began, according to the Standard & Poor's/Case-Shiller index.

The index is 35% off its early 2006 peak before the housing bubble burst.

The decline is "disappointing," the chairman of S&P's index committee, David Blitzer, says.

The only consolation was the pace of the slump was the slowest since December 2010.

Home prices in 20 major cities fell 2.6% in March compared with the same month a year earlier.

In February the 20-city composite dropped 3.5%.

Click to enlarge“While there has been improvement in some regions, housing prices have not turned,” says Blitzer.

A separate national home price index released quarterly by S&P covering the entire US – not just major metropolitan areas – had the fall at 1.9% in the first quarter compared with the same period in 2011.

"The housing situation in the United States, while certainly not booming, is seeing some stability and possibly some gains," Blitzer said in a conference call with reporters, reported by the LA Times.

Home values in 13 cities dipped year-over-year, including a 4.8% slide in Los Angeles and nearly 3% in San Francisco.

Atlanta suffered an 18% plunge, reaching new lows along with Chicago, Las Vegas, New York and Portland, Oregon.