Simon Pressley returns to review Whyalla's property investment status

WHYALLA: Have we ever recommended people invest there? No. Would we invest there right now? No. Is the city on our radar? Absolutely!

One has to feel for the residents of Whyalla following last week’s announcement that the Arrium steelworks, the City’s biggest employer, was placed in to administration. Questions hang over the future of the 1600 to 3000 jobs (depending on which report we read) of those who work at the plant and the likely knock-on effect to local businesses.

Arrium’s troubles stem from a sharp down turn in iron ore prices, China currently having a glut of steel, significant debt, and an inability to fund much needed efficiency improvements.

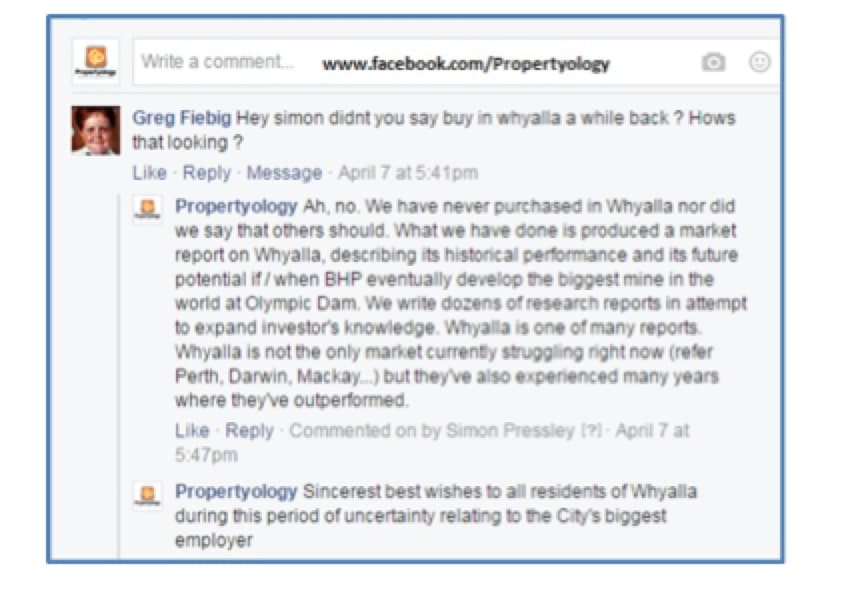

A little over a year ago, as we often do in attempt to broaden people's views about property investing, Propertyology produced a research report on Whyalla. The report still remains on our website today. Unfortunately, some people seem to interpret a research report as a 'recommendation to invest'. For the record, we've produced more than thirty research reports over the last two years (after all, market research is my profession). But, the city of Whyalla has never been amongst the seven (7) different cities that Propertyology's buyer’s agents have actively investing in during this same period.

Whyalla’s recent property market performance is a contrast to its impressive historical performance. It’s unwise to invest in a market whenever there is uncertainty surrounding a significant employer. For those who already own property in Whyalla, I'd suggest that now is not the time to sell. But, I'll also say that, even with these recent events, Whyalla (along with numerous other locations around Australia) still remains on our future 'Watch List'.

That’s right, we have a completely different view to the many narrow-minded scribes whom appear to take delight in giving every regional location a whack whenever there’s a down turn. I’ve never understood what can be gained from pulling at public heart strings with a “blood in the streets” story or from creating a perception of a future "ghost town". It’s little wonder that much of the general public have formed a belief that investing in regional locations constitutes high risk.

A significant proportion of property investors, and those who commentate on property markets, can't see past Australia’s three or four biggest cities – less than twenty per cent of all local government jurisdictions in Australia. It’s impossible for one to ever give themselves a chance of making the best decision possible without first considering one hundred percent of the options.

Historical evidence, as opposed to narrow-minded perception, has taught me that a majority of the locations throughout Australia which have produced the best total return on investment since the turn of the century are regional locations.

Sure, there are regional locations which represent much higher risk than others. There are also dozens of regional locations which have comparable risk to most capital cities but better potential for return on investment. Every location, capital city or region, has risk!

With the recent downturn of commodity prices, locations which have been adversely affected have become easy targets for some property commentators. Some people forget that the Sydney market flat-lined for six long years while many parts of Australia, especially regional Australia, sustained a long period of strong growth. Even as recently as 2011, the Sydney market declined (albeit small) and followed up with zero growth in 2012. Most properties in Brisbane declined by fifteen per cent between 2011 and 2012. Perth and Darwin are declining right now and Propertyology forecast that both have a bit further to fall. But, that doesn't mean that we should forever right them off as investment prospects.

A market downturn caused by business closures can happen anywhere. Perhaps one of the most famous examples is the closure of BHP’s steelworks in Newcastle in 1999. The 10,000 direct and indirect jobs lost certainly had a big impact on the workforce of 56,000 people [Census 2001]. Over the next fifteen years, Newcastle’s property market produced a total average annual return (capital growth plus rental yield) which saw it ranked 175th out of 550 local governments in Australia – only two capital cities performed better (Darwin and Perth).

Another example of a market downturn brought on by major business closures is Geelong (Alcoa, Shell and Target circa 2011). In 2014, there was a serious threat of the SPC Ardmona food manufacturing plant closing in Shepparton. More recently, the Clive Palmer owned Queensland Nickel plant in Townsville went in to administration. Meanwhile, after seventy years of operation, Australia’s biggest white goods manufacturer, Electrolux in the regional city of orange, rolled its last fridge off the production line this week.

In each case, the businesses in question employed a significant portion of the workforce. Yes, business closures certainly do have an immediate impact on the economy, local confidence, and its property market. But the locations which I referenced earlier each have a long term property market performance that is better than average; I’d always have an open mind to investing there from time to time.

Still today, Brisbane’s property market is spluttering through its recovery from thousands of administration job losses as a result of the coal industry downturn and public service cuts. Melbourne and Adelaide will soon feel the brunt of car manufacturing closures (watch this space).

Risks to investors come from a range of factors. Natural disasters such as floods, hail storms, bush fires, cyclones, and drought have hit numerous capital cities and regional locations over the years. Airline strikes, high oil prices, exchange rates, terrorist attacks could have a significant impact on the economy of Australia’s biggest cities. And, not to be under-estimated, an over-zealous construction industry risks property price reductions through over-supply of housing (refer Gladstone, Mackay, Darwin, inner-Melbourne, and more to come).

One of the most important considerations for property investors when evaluating the potential risk to a market is the cost of a typical property. The higher it is the further it can fall. Imagine the potential impact on a market where the typical property costs $800,000 to $1,000,000, the typical mortgage is seventy to eighty per cent of that, and interest rates rising by one to two per cent. What do you think the typical mortgage balance is in a location where standard properties cost between $250,000 and $450,000?

There’s risk in everything. To get that right balance of managing risk and targeting better opportunities, my own investment strategy is not that dissimilar to an astute share investor. Rather than sink 100% of my investment capital in to one (or two) expensive assets which fewer people can afford to buy, I prefer to carve up my capital and spread it across more markets, in assets which more people can afford, and with more sources of rental income. I maintain balance within my portfolio by strategically selecting locations in different states and through towns and cities which each have different industries that drive their economy.

Capital cities and regions: I invest in both! But, I won't shy away from the fact that I favour more regional markets right now than capital cities. Lots more!

A typical property in a location such as Whyalla may only require (say) $40,000 of my investment capital and have an impact on my annual cash flow of a couple of thousand dollars. A comparable property in a big city will require two to three times as much of my capital to purchase it and in excess of $10,000 per year to hold it. Risk?

For the record, Whyalla’s Arrium plant has not closed, it has been placed in administration. All forms of governments and advisors, including Paul Keating, are reviewing options. While closure is certainly a possibility, there is also a possibility that Arrium could survive and come out of this in a stronger in years to come.

Paul Billingham from Grant Thornton (Arrium’s Administrator) was quoted over the weekend saying "…We’re talking about capital improvements that actually make the operation from mining right through to milling more efficient. The debt burden of the company didn’t make it possible to make those investments while they were operating. This plant is viable. These jobs can survive".

In spite of the recent downturn, the enormous reserves of gold, copper, zinc and uranium nearby to Whyalla have not evaporated. The multi-billion-dollar steel factory infrastructure is likely to still be standing when iron prices turn the corner. The existing deep sea port infrastructure isn’t about to be dragged away by a humpback whale. Housing is still affordable. Core fundamentals remain!

The ‘watch-this-space’ factor for Whyalla is the large BHP owned Olympic Dam projects which Propertyology referred to in our research report. If / when that project were to get given the green light, just imagine what that would do for Whyalla’s economy. Just imagine the return on investment from that initial $40,000 capital outlay.

Simon Pressley is Managing Director of Propertyology, a REIA Hall Of Fame Inductee, property market analyst, accredited property investment adviser, and Buyer’s Agent. Propertyology works exclusively with property investors to purchase properties in strategically chosen locations all over Australia.