Adelaide detached housing market has bottomed out but sluggish unit market still in a downswing: WBP

The Adelaide detached housing market may be about to turn the corner but the unit market outlook is weaker with take up of new apartments remaining sluggish, according to the WBP Property Group.

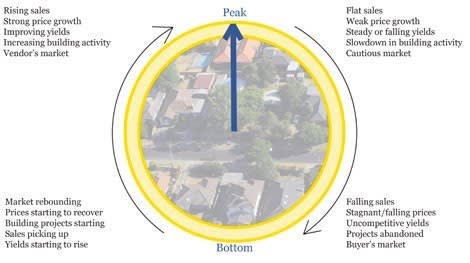

The valuation and advisory firm places Adelaide houses at six o’clock on the property clock, indicating that the market has just bottomed out.

However, it says the unit market is still at five o’clock indicating that supply still exceeds demand.

- At 12 o’clock the market is at its peak (demand exceeds supply)

- At 3 o’clock the downswing has set in (an evenly supplied market)

- By 6 o’clock it has bottomed out (an oversupplied market)

- At 9 o’clock the market is rebounding (supply tightening)

WBP says the Adelaide residential market is showing “some signs of recovery, in particular well located stock that has realistic market expectations”.

"Property values appear to have stabilised in most parts of metropolitan Adelaide," says WBP.

However, it adds that recent announcements regarding BHP Billiton’s shelving of the Olympic Dam mining project expansion “may have a negative effect on the state economy and confidence”.

WPB says the Adelaide unit market is relatively flat “with a number of new unit apartment projects struggling to get off the ground as a result of lack of pre-sales and other funding issues”.

“Existing stock remains slow to move, with significant price reductions being experienced,” says WBP.

One of the biggest Adelaide apartment projects is the recently announced Mayfield mix-used urban regeneration project in the heart of the CBD, which will feature 427 apartments – including one-, two- and three-bedroom residences.

“Ongoing stamp duty incentives will only help projects like this succeed,” says WBP.

Under a two-year trial, stamp duty has been abolished for people who buy an apartment off the plan for under $500,000, but only in the Adelaide CBD and North Adelaide.

The $240 million Mayfield project covers the 7,377-square-metre site of the former Mayfield Electrics factory bordered by Sturt, Gilbert, Norman and Myers streets and is being developed by Sturt Land, having been designed by architects Woods Bagot.

In her departing speech as presiding member Adelaide City Council Development Assessment Panel (DAP) earlier this month, Shanti Ditter said developers needed to build a variety of dwellings including those that cater for families.

"DAP has expressed its concern that if that were to continue, the city will see lots of one and two bedroom apartments which will drive a particular sector of the market or demographic and potentially leave out another sector of the demographic that might be interested in living in the city,” said Ditter in a speech reported in The Australian.

According to the latest RP Data-Rismark monthly index, Adelaide house prices are up 1.1% to $385,000 for the three months to September 30 while unit prices have risen 3.4% over the same time frame to a median value of $315,000.

Adelaide first-home buyers can access the $7,000 first-home owner grant as well as up to $8,000 under a bonus grant that will cease from July 1, 2013.