The Queensland councils charging higher rates for investors

Following an investor complaint about Brisbane City Council’s differential rating system, Property Observer looks at the other Queensland councils that charge higher rates for non-owner occupied properties.

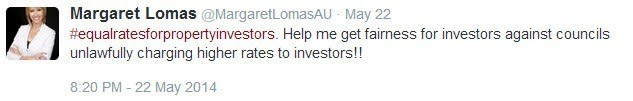

Last week, television host and Destiny Financial Solutions director Margaret Lomas launched a public campaign against the practice on social media, urging investors to “band together to force these money- grubbing councils to stop targeting property investors”.

In Brisbane City Council, single residential properties are largely categorised as either “Residential – Owner Occupied” or “Residential – Non-owner occupied or mixed use”.

Owner occupied residences are described as: “residential dwelling houses and dwelling units where the sole use is as the principal place of residence of the owner/s. In this instance, eligible ownership is limited to individuals only and does not include premises owned or partially owned by a company, trust, organisation or any entity other than an individual. This is regardless of whether the premises are occupied by a shareholder or even the sole shareholder of that company, trust, organisation or entity.”

That rules out rental properties, holiday homes and anything that’s owned under your company’s name. These properties attract a rate of 0.3064 cents in the dollar, with a minimum general rate of $503.40.

Category 7 or “Residential – Non-owner occupied or mixed use” properties are defined as “predominantly residential premises" where:

"(a) the premises is not the principal place of residence of at least one person who constitutes the owner of the property; and/or

"(b) the owner or occupier conducts non-residential activities upon the property not in excess of [certain limitations that would see it defined as a commercial property]."

These properties attract a rate of 0.3904 cents in the dollar, with a minimum general rate of $628.72 in Brisbane.

While Lomas has been tagging her posts on the topic with #equalratesforpropertyinvestors, it is not just investors who see higher rates than owner occupiers. If you own a house in Noosa that you visit four times a year, you will be paying a higher rate than an owner occupier, even though you don’t generate income from your holiday home.

A pensioner now living in a retirement community, but still holding on to her old house – perhaps to allow relatives to stay in it, or because she’s waiting for the right time to sell – will pay higher rates in Brisbane than an owner occupier.

There is no evidence to suggest that non-owner occupied properties present a greater burden on the council than owner occupied homes. In fact, when investor Andrew Hancock enquired about the rates to the Brisbane City Council, they offered the following explanation:

“This is done to ensure that properties that are the principle place of residence of their owners do not pay as much as those which are income producing. Income producing properties also have the advantage of being able to offset such expenses against taxation. Council’s principal motivation is to ensure, through its differential rating system, that the owner-occupied, single unit dwelling sector of the community contribute to a level that is affordable and value for money.”

The following Queensland councils charge higher rates for non-owner occupied homes than owner occupied homes:

- Brisbane City Council

- Central Highlands Council

- Fraser Coast Regional Council

- Gold Coast City Council

- Ipswich City Council

- Logan City Council

- Moreton Bay Regional Council

- Mackay City Council

- Mount Isa City Council

- Redland City Council

- Noosa Shire Council

- Rockhampton Regional Council

- Scenic Rim Regional Council

- Somerset Regional Council

- Sunshine Coast Regional Council

- Townsville City Council

- Whitsunday Regional Council

So far, Property Observer does not know of any councils outside of Queensland who charge different rates for owner occupiers and residential investors.

Earlier this year, a judge in the Supreme Court ruled against the Mackay City Council’s decision to charge higher rates for non-owner occupied properties in a civil suit launched by investors Ayril Paton and Peter Crossan. Judge Duncan McMeekin said, “To justify the categorisation the Council impermissibly took into account characteristics personal to the owners of the land and failed to restrict itself to characteristics of the subject land itself. It is simply a misuse of language to claim that the owner’s decision to reside on land, or not, is in some way a characteristic of the land.”

Mackay City Council is reportedly appealing the decision.

Do you know any other councils that charge higher rates to non-owner occupied properties? Let us know in the comments below.

Update: As of yet, there is no sign that the councils will be required to refund rates to investors. This article mistakenly included South Burnett in the list of councils that charged different rates for investors. South Burnett does not currently charge a different rate for non-owner-occupied properties and owner-occupied properties. The article has been amended.