High unemployment "remains a restraint" for Townsville market: Herron Todd White

Townsville's residential property market is currently at the "start of recovery phase", according to Herron Todd White's March Month in Review report.

The northern Queensland city was once touted as a hotspot, with both Australian Property Investor and Your Investment Property both naming Townsville in their annual respective Hot 100 and Top 100 lists in 2011. But a sharp economic downturn quelled enthusiasm for Townsville's property market as unemployment rose.

Now, the valuation firm Herron Todd White is cautiously optimistic about the market. The real estate agency predicts that the recent interest rate cut is unlikely to have a great affect on the sluggish market.

"Over the past 12 months on the back of record low interest rates and subdued market conditions, activity remained slow and we believe that the most recent cuts in interest rates will provide little stimulation at a local level with economic factors still being the main driver of our market," says the report.

However, the agency advises that it is currently "a good time to buy" in Townsville, given low median prices and low interest rates. According to the Real Estate Institute of Queensland (REIQ), Townsville's median house price was down 5.6% in the September quarter to $340,000, with a 27% increase in sales activity.

5 Fulford Annex, in the outer eastern Townsville suburb of Bohle Plains, sold for $331,000 earlier this month. The three bedroom house on a 520 square metre corner plot overlooks parklands and comes with a garden shed and side access (pictured below).

The vendors made a loss on the sale, paying $350,000 in November 2011. They attempted to sell it once before, in early 2014. The property spent 61 days on the market, with its asking price reduced to $355,000, before the vendors pulled the listing. When it returned to the market in late January this year, its price guide had dropped further, to $349,000.

The house had been used as an investment property, and was last advertised to rent at $340 per week, in April 2014. Assuming the rent has remained constant, the property sold at a yield of 5.1%.

While the vendors of 17 Janelle Street in Kelso (pictured below) did not make a price loss on the sale of the house, its growth has been subdued over their nine years of ownership.

They paid $310,000 for the four bedroom, two bathroom house in 2006. It sold for $322,000 in January this year, reflecting just 3.9% price growth in nine years.

In the September quarter of 2014, units and townhouses had a median price of $251,750, down 6.8% from the previous period. Units did not see the escalation in sales activity that Townsville's house market did in the same period, with sales activity down 6.8% for the quarter.

The price of 402/2 Dibs Street in South Townsville has steadily declined since it was purchased in June 2007 for $355,000. When investors bought the property in September 2011, they paid just $300,000 – a 15.5% price drop. At its sale earlier this month, it traded for $255,000 – down another 15% from its 2011 price and $100,000, or 28%, from its 2007 price.

Its advertised rent has also dropped, from $400 per week throughout 2013 to $350 per week in May 2014. At that rental rate, it sold at a 7.1% yield.

The "economic factors" cited by the Herron Todd White report include "lingering high unemployment levels" and doubts over job security, which continue to hinder the market despite surrounding "positive vibes". While Townsville is widely regarded as being less exposed to volatile single-industries as some other regional Queensland towns, its economy still suffered last year over a range of industries. Data released in July 2014 showed Townsville had the highest unemployment rate in Queensland, at 10.5%. At the time, regional economist Colin Dwyer told the ABC there were many factors contributing to the poor employment factors:

"That is more likely to be ... structural issues within the regional economy and that's likely to be in the areas of construction, likely to be in the areas of transport, likely to be in the areas of mining and also agriculture, so it's not a single item that's contributing to the high unemployment rate," Dwyer said.

In September, Local Government, Community Recovery and Resilience Minister David Crisafulli told the ABC that the economy was suffering under a "perfect storm" of factors.

Since then, Townsville's economy appears to have improved, perhaps indicating the beginning of a recovery, as identified by Herron Todd White. Figures released in February show Townsville's unemployment rate is now at 8.0%, with areas like Cairns and Mackay showing weaker employment figures.

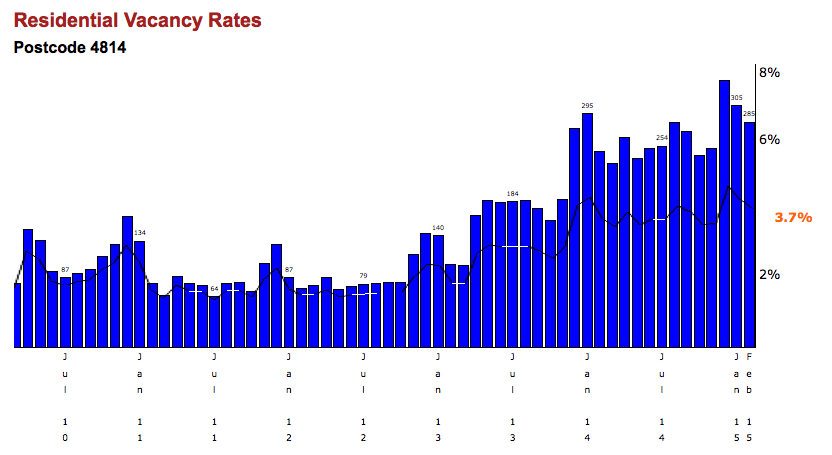

As for Townsville buyers most likely to benefit from the current "depressed market" and low interest rates, Herron Todd White believes it is those who already have money saved, including investors. According to the REIQ, though the Townsville rental market remained "weak", with a 4.7% vacancy rate, it was steady, while vacancy rates in many other Queensland regions, including Cairns, were increasing.

Currently, this three bedroom Queenslander in Garbutt, at 45 Chandler Street, is being offered with the first week rent free (pictured below).

The advertised rent for this investment property has decreased from $575 per week in December 2010 to $500 per week in September 2012, down to the currently advertised $450 per week.

The owners paid $461,000 for the house in 2008. If they can secure a tenant at the currently advertised rate, it will reflect a rental yield of 5.07%. In 2010, it was yielding 6.49%.

SQM Research has tracked an escalation in Garbutt's vacancy rate from mid-2012.

While low interest rates currently on offer may entice some investors, Herron Todd White observe that it's the local economy, not interest rates, which will have the biggest effect on Townsville's recovering market.

"Overall the impact of low interest rates is not currently having any dramatic impact on the market, and until our local economic conditions improve, this is likely to remain the status quo", reads the report.