Brisbane's "weak" inner city vacancy rates climbing

Brisbane's inner city rental market has been termed "weak" by the Real Estate Institute of Queensland (REIQ).

The REIQ recorded a 3.8% vacancy rate in Brisbane's inner ring (0 to 5 kilometres from the city centre) in December 2014.

Any vacancy rate figure above 3.5% is categorised as "weak", while a market is considered "tight" if it has a vacancy rate below 2.5%, and healthy with a vacancy rate between 2.5% and 3.5%.

The other "weak" Queensland markets in December were in Bundaberg, Gladstone, Rockhampton, Mackay and Townsville, with Mackay topping vacancy rates at 10.3%.

The Brisbane inner market is the only greater Brisbane region with a "weak" market. The REIQ notes that vacancy rates are trending upwards.

In a release, REIQ chief executive Antonia Mercorella said: "Residential vacancy rates are prone to seasonal fluctuations over the Christmas/New Year period and 2014 was no different."

"Many REIQ agents reported softer tenant demand in December, with many leases expiring as students finish up their studies and others also take up employment opportunities in new locations."

However, Brisbane's inner market is experiencing weaker conditions than in previous years: In December 2012, the REIQ recorded a vacancy rate of 2%. In the same month of 2011, Brisbane had an inner city vacancy rate of 1.9%.

According to the REIQ, the median price of a unit in Brisbane was $420,000 in the September Quarter. In the latest HSBC Downunder Digest report, HSBC forecasts 6% to 7% price growth for Brisbane homes in 2015, with 4% to 7% forecast for 2016.

Click to open in new window:

201/9 Kurilpa Street in West End will be available to rent in March at $540 per week. The two bedroom "near new" apartment was advertised to rent in September at $550 per week, with the asking rent lowered last month.

At its current advertised rent, investors who paid $510,000 in May 2013 will be receiving a yield of 5.6%.

Buyers paid $465,000 for this National Rental Affordability Scheme (NRAS) unit in July 2014. It was listed to rent late last month for $397 per week - slightly less than the $400 per week the previous owners were expecting this time last year.

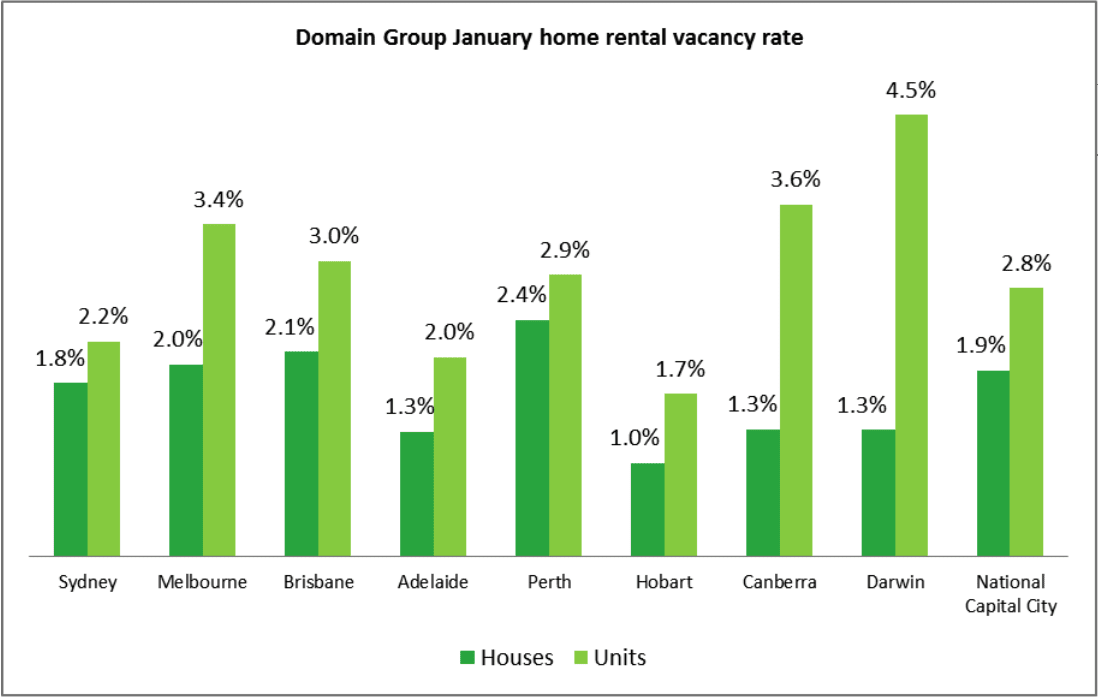

According to Domain Group, vacancy rates for units in the greater Brisbane area were higher for units than houses in January, which is normal across all the capital city markets (see graph below).

Source: Domain Group

The unit at 1401/67 Linton Street, Kangaroo Point, has two bedrooms and two bathrooms. Its current advertised rental rate reflects a 4.4% yield.

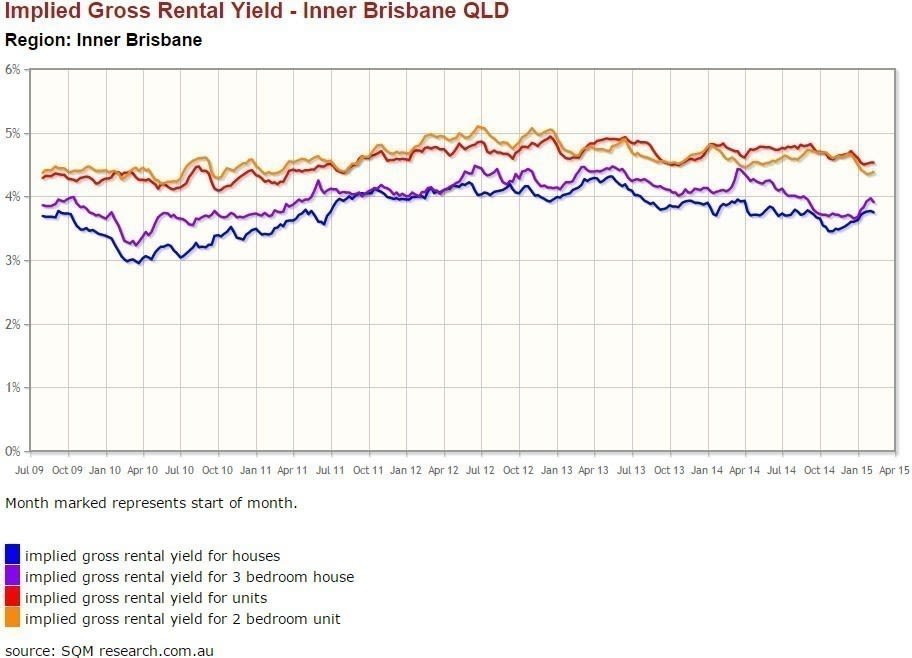

SQM Research data shows that asking rents for units in the Brisbane inner region have remained relatively stable over the past five years.

Click to open in new window:

However, there have been recent warnings, including one from columnist Terry Ryder, about the threat of oversupply in the Brisbane inner market, while in September Urbis' Jon Riviera told Property Observer he had heard reports of rents softening, with rents previously "quite inflated".