Terry Ryder's top 10 Queensland hotspots

Terry Ryder was one of a number of property commentators who tipped that this year would be Brisbane's time to shine.

The hotspotting.com.au founder stands by his claims, releasing a new report detailing his 10 Queensland "hotspots" - areas Ryder and his team believe show good potential for price growth and are strong investment material.

Ryder names 10 areas in Brisbane and regional Queensland that he predicts will benefit from tourism, infrastructure investment, agriculture or resources. Unfortunately, it's not all sunny for the sunshine state. According to Ryder, areas including Emerald, Mackay and Gladstone are all suffering from over-supply and don't present good prospects for investors.

"Markets to avoid include Gladstone, Mackay and Emerald," writes Ryder. "Gladstone continues to have enormous economic growth factors, particularly from the LNG infrastructure under construction, but its property market has been destroyed by over-building by property developers.

Mackay and Emerald have both been afflicted by oversupply as a time when demand from the coal industry has weakened. Emerald is likely to recover first, once one of the Galilee Basin coal mining projects start construction."

Ryder also cautions those who are hoping to jump into the Gold Coast market.

"The seeds of the next over-supply are already being sown on the Gold Coast and any gains are likely to be short-term. This is a market for speculators, rather than long-term investors," explains Ryder.

Terry Ryder's top 10 Queensland hotspots:

Brisbane Northside

Brisbane Northside

Ryder's reasons for growth:

- Jobs nodes

- Education medical

- Transport infrastructure

- Ripple effect

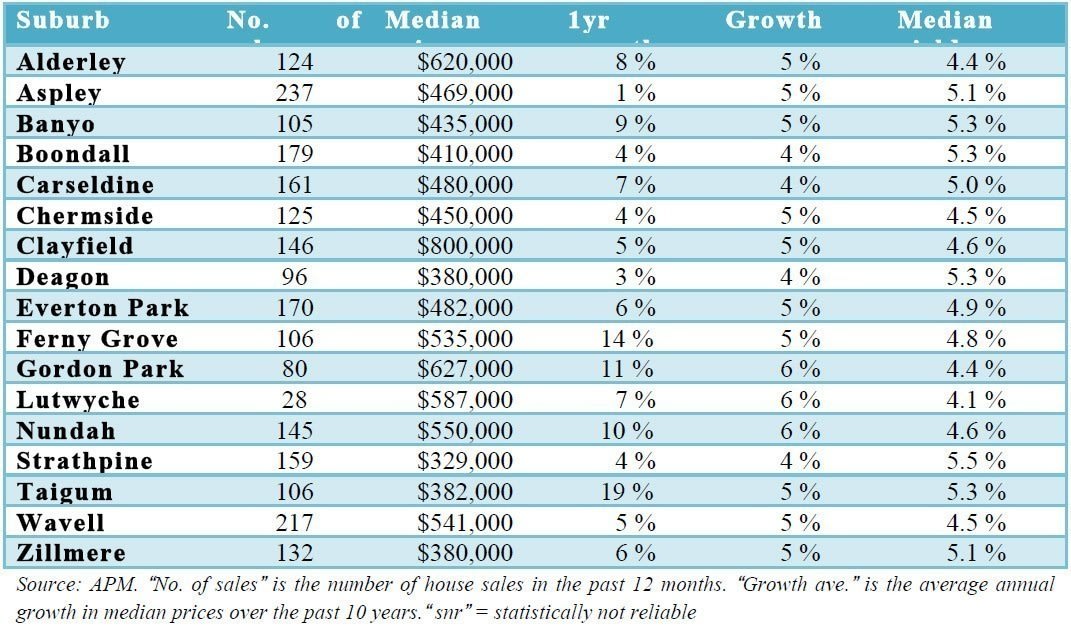

Ryder nominated the northern suburbs of Brisbane as the number one hotspot in Queensland. According to Ryder's report, the area features a mix of affordable and middle market suburbs, good transport links, and is close to major employment hubs. He also notes its proximity to the airport and seaport.

The area includes:

- Chermside

- Deagon

- Zillmere

- Alderley

- Aspley

- Nundah

- Gordon Park

- Lutwyche

- Taigum

- Banyo

- Brighton

- Carseldine

- Everton Park

- Ferny Grove

- Wavell Heights

In Aspley, a buyer may be looking at a $469,000 for a typical house, according to the report. The three bedroom Aspley house pictured below sold for $450,000 last month.

"The suburb of Aspley," states the report, "has lifted quarterly sales from around 50 in each of the September 2012 and December 2012 quarters, to 70–80 in each of the 2013 quarters and the March 2014 quarter."

The population in Brisbane Northside is projected to reach 310,000 by 2036, according to the report.

Ryder's summary of Brisbane's Northside house market:

Ryder's summary of Brisbane's Northside unit market:

Cairns

Cairns

Ryder's reasons for growth:

- Sea change

- Education medical

- Transport infrastructure

- Government decisions

According to Ryder, Cairns is making an "economic comeback".

"Having been hit hard by the Global Financial Crisis, which reduced overseas tourist numbers on which the Cairns economy has largely depended, Cairns has recently shown signs of economic revival," he writes.

Though Cairns has been outperformed by Townsville, "there are plenty of positive signs that Cairns is ready to challenge again, boosted by tourism and investment from China, a proactive local council, spending on infrastructure and success in efforts to diversify the city’s economy," explains Ryder.

He notes strong population growth in the city coupled with the revival of the tourism industry, including a $4 billion resort. Other big spending items for the city include a $450 million hospital upgrade, a $1 billion airport redevelopment, a $110 million port project and an upgrade to the Bruce Highway.

On the more affordable end of the city's housing market, $303,000 is the typical price of house in Bungalow, according to the report. This four bedroom house (below) sold for $308,000 in June.

Though Ryder has a positive outlook for the area, he does warn investors about the high insurance premiums that have hit some property owners following cyclones and floods in Cairns.

Ryder's summary of Cairns' house market:

Ryder's summary of Cairns' unit market:

Hervey Bay

Hervey Bay

Ryder's reasons for growth:

- Government policy

- Sea change

- Boom towns

"Hervey Bay’s housing market was flat from 2010 to 2012 but is now showing signs of growth – and is likely to be boosted by growing numbers of fly-in-fly-out mining workers settling in the area. The development of major new medical facilities is likely to increase the area’s appeal for retirees," writes Ryder.

Although Ryder states that oversupply had previously dampened capital growth in Hervey Bay, he believes that the dwellings glut has since been absorbed, and the market "has recently experienced increased some sales activity and some movement in rents, with prices starting to follow".

The area, roughly a three and a half hour drive north of the state's capital, has been described as a "sea change for battlers", according to the report, with an economy driven by tourism, agriculture and construction.

According to the report, a typical house in the Hervey Bay suburb of Urraween costs around $330,000. This house, with three bedrooms, sold for $320,000 last month.

Ryder writes: "During late 2013 and early 2014, demand has become more consistent across the Hervey Bay region, reducing the gap between extreme positive and negative growth."

Ryder's summary of Hervey Bay's house market:

Ryder's summary of Hervey Bay's unit market:

This article continues on the next page.

Ipswich

Ipswich

Ryder's reasons for growth:

- Cheapies with prospects

- Government decisions

- Transport infrastructure

- Urban renewal

Big projects coming for Ipswich, in Brisbane's south west, include the $2.8 billion Ipswich Motorway Upgrade, $12 billion Springfield project, the $1.5 billion Springfield rail link and the Orion shopping centre, along with expansions to the RAAF base, and large industrial estates. Ryder also claims the area has a strong economy, with multiple employment hubs and affordable properties.

"The Ipswich corridor is now well-known as a growth region. Prices rose strongly in the five years to 2009 (before tapering off), giving the suburbs of Ipswich City the strongest capital growth averages

in the Greater Brisbane region," writes Ryder.

"Ipswich has shown strong growth in the past but we believe its evolution into a headline hotspot of national standing will continue well into the future. There remain many suburbs that are attractively affordable for first-home buyers and investors on a budget."

For those after an affordable option, the report states that a $250,000 house is typical for North Ipswich. The two bedroom home pictured below sold for $245,000 this month.

"The Ipswich [Local Government Area] is dominated by couples-with-children households with an above-average proportion of single-parent households. The average age of 33 is younger than the Brisbane average and the average income is lower," states the report.

Ryder recommends investors look at the town's Redbank precinct, the inner eastern suburbs and the southern precinct.

Ryder's summary of Ipswich's house market:

Ryder's reasons for growth:

- Transport infrastructure

- Urban renewal

- The stayers (steady growth)

Big transport infrastructure investments are coming for Kelvin Grove in Brisbane's inner-city, including the $1.5 billion Legacy Way tunnel, the Inner City Bypass and the Inner Northern Busway.

"Few factors generate real estate growth like new transport infrastructure development. And few places in Brisbane have that factor working as strongly as does Kelvin Grove," writes Ryder.

According to Ryder, the area's proximity to the Royal Brisbane Hospital and the Queensland University of Technology also drive rental demand in Kelvin Grove, particularly among young people.

"The suburb has shown good growth in the past 10 years, but it presents as an area that’s under-rated and under-valued. It’s one to watch: it presents as an option for investors as it offers relatively affordable apartments in an area of strong tenant demand close to major jobs nodes."

The report states that Kelvin Grove is one of the inner-city's most affordable suburbs, though it has begun to catch up with suburbs like Red Hill and Herston.

The suburb's median house price is $652,000 according to Australian Property Monitors, while the median unit price is $460,000. The suburb has seen 4% median price growth in the past 12 months, and Ryder expects that growth rate to rise in 2014.

Ryder's summary of the Kelvin Grove market, with comparisons with nearby suburbs:

Logan City

Logan City

Ryder's reasons for growth:

- Cheapies with prospects

- Urban renewal,

- Transport infrastructure

"Affordability and amenity are the keys to the appeal of Logan City," writes Ryder. The area, spread over 957 square kilometres, is midway between Brisbane and the Gold Coast, with connections via road and rail.

Ryder notes the area's affordable properties with above-average rental yields, transport links and the diverse mix of industries providing employment.

"Logan City is mortgage belt country with 43% of Logan households paying off a mortgage. Only 23% own their homes outright and 31% rent," the report states.

"Logan City is attractive to investors because of the steady long-term growth and above-average rental returns. Many of the suburbs show a growth rate of 5-6% per year (average annual rise in median house prices over the past 10 years)."

On the more affordable end of the scale, Ryder says a typical house in Beenleigh will cost $285,000. This three bedroom Beenleigh home sold for $280,000 in July.

Ryder's summary of the Logan house market:

Ryder's summary of the Logan unit market:

This article continues on the next page.

Redcliffe

Redcliffe

Ryder's reasons for growth:

- Transport infrastructure

- Lifestyle features

- Urban renewal

Despite Redcliffe Peninsula's situation about 28 kilometres north-east of Brisbane, the lack of adequate transport links has impacted the area.

"However, a long-promised electric rail connection now seems much closer to reality, with the announcement in September 2013 that the construction contract had been awarded to Thiess," writes Ryder.

According to Ryder, the area is relatively affordable for a bayside residential precinct, particularly for units, and now perceptions are changing about its status as a "downmarket" area.

"Redcliffe had its years in the sun when its suburbs were identified by people looking for affordable real estate within striking distance of employment. It had a major price peak in 2004 and another in 2008," writes Ryder.

"Growth has been more subdued since then, with most of the peninsula markets experiencing declines in median house prices in 2011-12, before the first signs of a return to growth in 2013. This has continued in 2014, with several Peninsula suburbs recording solid growth in the past 12 months."

A typical unit in Kippa-Ring will cost around $260,000, according to the report. This three bedroom unit sold for $263,000 earlier this year.

However, Ryder notes that Redcliffe's unit market operates on a two-tier basis of up-market apartments and low-priced older units. After strong demand depleted the high-end apartment market a few years ago, older apartment sales may have skewed the median over the past year.

Ryder's summary of the Logan house market:

Ryder's summary of the Logan unit market:

Sunshine Coast

Sunshine Coast

Ryder's reasons for growth:

- Education medical

- Government decisions

- Lifestyle features

"The Sunshine Coast market is returning to growth for the first time in six years. Having previously been hampered by a struggling tourism economy, an over-supply of dwellings and poor affordability, the coast is moving into a new growth phase," Ryder writes.

A strengthening tourism market, the increasing popularity of apartments, infrastructure investments and balancing supply and demand have all boosted the Sunshine Coast's property market, according to Ryder.

The biggest infrastructure investment coming to the precinct is the new $2 billion Sunshine Coast University Hospital, which is currently under construction.

"The Sunshine Coast University continues to expand, with a $37 million engineering learning hub the latest project to be announced. That combination of medical and education facilities is always powerful in driving real estate demand," the report states.

Ryder notes that the Sunshine Coast has been "one of the worst performers on capital growth in Queensland over the past six years, but is now moving into an overdue growth phase".

According to the report, a typical unit in Pialba will cost around $317,000. This duplex unit in a private complex sold for $310,000 in April.

Ryder's summary of the Sunshine Coast house market:

Ryder's summary of the Sunshine Coast unit market:

Toowoomba

Toowoomba

Ryder's reasons for growth:

- Boom towns

- The stayers

- Government decisions

"Toowoomba ranks as one of Australia’s strongest regional centres, benefiting from a diverse local economy and proximity to the Surat Basin resources province. It has been recently ranked the jobs capital of Australia and as the leading regional economy in Queensland," writes Ryder.

The city, 130 kilometres west of Brisbane, is a major employment hub. Although the January 2011 floods devastated the area, Ryder believes they did not change the city's "long term growth prospects".

Citing June 2014 figures from the Real Estate Institute of Queensland, Ryder notes that Toowoomba "is the highest performing market in the state", with 95% of houses and 92% of units sold on a profit.

"One of the key characteristics about Toowoomba is its status as one of The Stayers: it delivered at least some growth each year for 10 years – until 2012, when some suburbs experienced minor decline. Growth resumed in 2013 and 2014, with Toowoomba’s median house price rising 16% in the 12 months to May 2014," states Ryder.

A typical house in Toowoomba's Rockville might sell for $310,000, according to the report. This three bedroom house sold for $305,000 in May.

Ryder's summary of the Toowoomba house market:

Ryder's summary of the Toowoomba unit market:

Townsville

Townsville

Ryder's reasons for growth:

- Boom towns

- Government decisions

The far north Queensland city of Townsville "ranks as the sturdiest regional economy in Australia", according to Ryder.

He notes the diversity of the city's economy, with military, government administration, tourism, education, manufacturing and exports all providing employment in the area.

"Its property market experienced an unbroken run of double-digit growth years from 2002 to 2007 – and, after a pause for the past couple of years, is ready to resume its forward progress.

"Townsville’s comeback will be boosted by major projects, including residential estates, retail development, CBD commercial projects and infrastructure spending. It will also receive considerable economic impetus from the expansion of the city’s military economy," writes Ryder.

Although some suburbs "remain in decline", Ryder says that modest growth is emerging in other areas, especially in suburbs such as Currajong and South Townsville, which have shown 13-14% growth in median house prices over the past year.

However, Ryder writes: "Units fared badly in the past year with double-digit decline, but have strong yields around 6–7%."

Ryder expects that Townsville's property market will peak by the end of 2016.

Ryder's summary of the Townsville house market:

Ryder's summary of the Townsville unit market:

All 10 of Ryder's hotspots are characterised by strong current infrastructure or planned infrastructure investment.

The full Top 10 Brisbane and Queensland Hotspots 2014 (August - November) is available on hotspotting.com.au.