Gladstone property hotspot facing headwinds, with investor demand 'grossly outstripping owner-occupier demand': PRDnationwide

Property prices and land prices in the Queensland mining town of Gladstone are expected to begin to ease once new and more affordable housing projects are completed, according to new analysis from PRDNationwide.

This easing will occur over time, with the biggest residential development project in the region – Devine’s $1.4 billion Riverstone Rise community – being completed in stages over the next 15 to 20 years.

However, the report for the March half-year warns of a number of headwinds facing investors including an expanding fly-in, fly-out workforce, requiring investors to revise down rental expectations to secure tenants.

Gladstone ranked third in Your Investment Property magazine’s 2012 list of Top 100 suburbs and was ranked second last year. The town is home to the world’s biggest alumina refinery, Australia’s biggest aluminium smelter and the country’s largest cement operation.

There are currently $69 billion worth of projects currently in the early stages of construction, and projects worth a further $26 billion are expected to commence in the next few years.

The PRDnationwide report says that high rental yields can still be achieved in the current market, but warns investors to be diligent to not only buy at the right price, but to buy something that has competitive tenant appeal.

“Vacancy rates have been quiet turbulent during the first half of 2012, as investor demand grossly outstrips owner occupier demand,” says the report.

“Uncertainty surrounding rental vacancy is exacerbated by an ever expanding fly-in, fly-out workforce, with many workers vacating to mining/construction campsites.

“As a result, many investors are forced to make sizeable revisions to their rental price expectations in order to secure a tenant on a reasonable lease. Given the current median prices recorded across all markets, there is no doubt that some investors, particularly those who entered the market in 2012, paid a premium on their investment with a heightened expectation of strong cash-flow.”

PRDnationwide Queensland analyst Rob Matta, who compiled the Gladstone Region Highlight Report, says Devine’s project is likely to ease the housing shortage in the Gladstone region and alleviate price growth pressures.

Construction of stage one of Devine’s $1.4 billion Riverstone Rise community in Gladstone has commenced. The project which is expected to take 15 to 20 years to complete, has been approved for 2,900 homes, two shopping centres and a new school.

It is located in Benaraby, approximately 20 kilometres south of Gladstone City, the new community aims to provide an affordable and diverse alternative to the offerings within Gladstone City.

Stage one features 120 allotments ranging in size up to 740 square metres and prices starting from $165,000.

Matta says there are several projects are several other projects in the pipeline, but the problem remains that few of these projects are delivering stock at a realistic price point.

Currently, though, PRDnationwide says house and land prices in the Gladstone region continue to go “from strength to strength”, with a median house price of $479,750 and a median land price of $250,000 for the March 2012 half-year period.

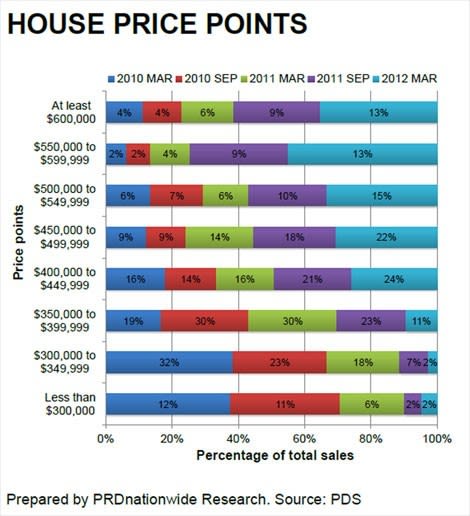

More than 87% of Gladstone houses that sold over the March 2012 half-year sold for more than $400,000, compared with 67% that sold over this price point a year ago.

Giving an indication of just how rapidly house prices have shifted upwards in Gladstone over the past two years, in the March 2010 quarter, just over a third (37%) of houses sold above this price point.

Click to enlargeFor more, download our free eBook Residential Property Investment Amid Queensland's Resources Boom.

However sales volumes have eased significantly due to the unaffordability of house and land over this period, with sales across the region down 27.3 % compared with the March 2011 half-year period and land sales down by 48.9 %.

PRDnationwide says there were 327 houses sold across the 12 suburbs that comprise the Gladstone City Area and 149 land transactions in the six months to March 2012.

Sales volumes also decreased in the unit market, which failed to sustain the exploding uplift in activity experienced during 2010-11, registering a total of 107 transactions in the March 2012 half-year period a decrease of 20.7% from the level of volumes recorded in the corresponding period in March 2011.

“The lack of affordable house and land is driving sales volumes back down, exacerbated by unprecedented rental growth which continues to inflate values accordingly,” says Matta.

Matta says the development of the Devine project repesents both good and bad news for the people of Gladstone City – depending on what side of the fence they sit.

“The good news is, that developments like this are likely to entice would-be investors and perhaps first-home buyers to snap up an opportunity they could not previously have afforded,” he says.

“The bad news is, for developers, investors or those who have recently paid a premium to live in the area, that rental vacancy may increase in the market, with rents and subsequent prices likely to correct as a result,” he says.

“As relenting as the fight is for the market to find equilibrium, the earmarked growth in the region’s economy and workforce is likely to ensure the fight continues for a long time to come.”

The PRDnationwide report attributes the revival of the Gladstone property market “solely to the booming resource industries in the Bowen and Surat basins”.

“Substantial projects such as the Curtis Island LNG facility have provided the catalyst for the recent flurry of investor interest, with many looking to capitalise on the opportunity for solid capital growth and attractive rental yields,” it says.

The report investigated three main areas – Agnes Water, Tannum Sands and Gladstone City – and found that demand for investment properties is rising in the Agnes Water Area.

PRDnationwide Agnes Water director Tim Lawry says the property market continues to benefit indirectly from the mining boom – with up to 80% of inquiry and purchases coming from the central Queensland region.

For more, download our free eBook Residential Property Investment Amid Queensland's Resources Boom.