Darwin house market at five o'clock, with potential for quick movement: Experts

Darwin has been one of the more stable property markets in 2011, with modest price declines relative to the falls in Perth, Melbourne and Brisbane. The pace of house price depreciation slowed in the second half of 2011.

The housing market is likely to get a boost from the Japan energy giant Inpex’s decision to go ahead with its $33 billion Ichthys liquefied natural gas (LNG) project, which will pump gas up from offshore gas fields in Western Australia along a 889-kilometre pipeline to Darwin for processing. The project will require about 2,700 workers during peak construction (expected to begin later this year) and create a further 300 jobs once it is up and running, with speculation that it could push up property prices in Darwin and lead to an influx of people seeking work.

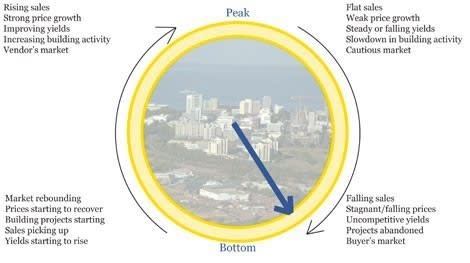

Time: Five o'clock

Century 21’s Charles Tarbey says Darwin is heavily influenced by such development and investment in the area.

“Darwin’s position on the clock could move from five o’clock to seven o’clock very quickly,” he says.

However, Louis Christopher says Darwin remains a really risky market. “There has been a bit of a peak in stock levels, and it’s not out of the woods yet.”

Population: 128,000

Median house price: $487,500

House price growth in February 2012: 6.2%

Annual house price growth to December 2011: -2.2%

Annual house price growth to July 2011: -3%

Rental yield: 5.8%

To find out where your capital city's house or unit market is on the property clock, download our free eBook.