Property consumers changing their behavioural spending patterns to online: Robert Simeon

It is quite apparent that many have already taken the Global Financial Crisis (GFC) for granted despite it being the largest and sharpest capitulation in global markets in over twenty years.

What many forget is that a large number were still at school when Australia experienced the recession “we had to have” in the early 1990s. Top-end property markets were the hardest hit as to the personal losses so this would explain why this demographic market remains lethargic to say the least.

The GFC brought about a re-calibration of asset prices which divulged an over-extension of debt which then saw for the first time in Australia for many years a complete turnabout where consumers cut back on spending and therefore lifting their savings.

The same applied for businesses that embarked on radical cost-saving initiatives combined with in-depth business analysis to seek new markets by establishing aggressive new online platforms.

This new platform has resonated further where consumers are now all over online shopping as they look for savings – the mantra “greed is good” is no longer the case and won’t be for some considerable time either.

The world for businesses and consumers dramatically changed when Apple released their iPad on April 3, 2010 – that insatiable desire to acquire has re-invented consumer behaviour.

The online superhighway has progressively moved from two lanes to ten lanes and growing fast to such an extent that the way we do business today in the real estate industry will bear no resemblance to the way we do business in 2018.

With the benefit of hindsight in years to come the GFC will be looked back on as a renaissance period that modernised business platforms where technology emerged not just as an add-on but rather the key ingredient to guarantee business longevity.

Simply put: in this modern age if your business is not online-savvy the chances of survival are terminal.

The GFC has proved to be an enormous learning curve – where today businesses are now paying enormous catch-up.

What we are seeing anecdotally is consumers changing their behavioural spending patterns to such an extent that it is not that far off when the majority of vendors spend more on online than they do in print.

When that happens the number of real estate agencies in Australia will reduce by a quarter given that 25% (that’s conservative) are IT illiterate.

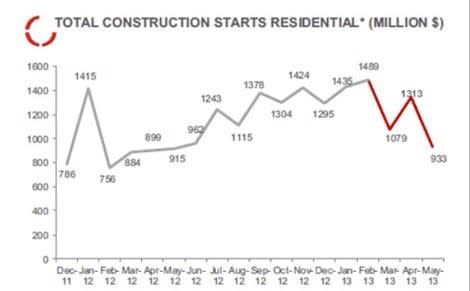

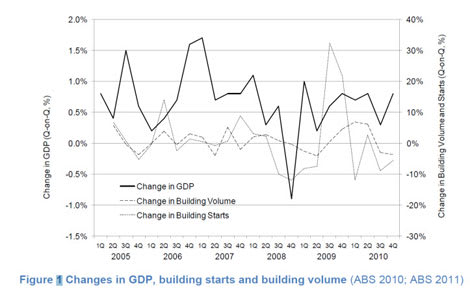

On another matter 2012 was an abysmal year for Australia’s construction industry with more than 80 firms entering administration – although just the one inquiry.

The Housing Industry Association (HIA) report for the December quarter 2012 – “Total residential building volumes in the final quarter were up by 1.7 percent on the previous quarter.” In 2013 it is already looking quite different.

A slight improvement in the number of new listings on the market for Mosman houses this week although well down on the same time last year.

The same can be said for Mosman apartments where we believe households are consolidating and paying down debt levels with no future plans of taking on more debt.

A valuable lesson learnt from the GFC – on top of that concerns for employment remain first and foremost.

It is also interesting to note that First Home Buyers remain in decline where it remains at 14.9% for the second consecutive month. This is the lowest since June 2004 – the long-run average is 20.1%. It is obvious that our record-low cash rate is failing to attract this market demographic.

Investors scramble as rental crisis bites the number of suburbs where it is cheaper to buy a home on a variable rate mortgage than to rent rose to 494 in December, up from 388 two months earlier. What we are seeing is First Home Buyers struggling to build a deposit due to climbing rents and a construction industry going into reverse: a recipe for disaster.

Source: Domain Property Monitors

MOSMAN – 2088

• Number of houses on the market this time 2012 – 141

• Number of houses on the market last week – 103

• Number of houses on the market this week – 108

• Number of apartments on the market this time 2012 –114

• Number of apartments on the market last week – 76

• Number of apartments on the market this week – 78

CREMORNE – 2090

• Number of houses on the market this time 2012 – 17

• Number of houses on the market last week – 17

• Number of houses on the market this week – 15

• Number of apartments on the market this time 2012 – 24

• Number of apartments on the market last week – 15

• Number of apartments on the market this week – 12

NEUTRAL BAY – 2089

• Number of houses on the market this time 2012 – 19

• Number of houses on the market last week – 14

• Number of houses on the market this week – 12

• Number of apartments on the market this time 2012 – 64

• Number of apartments on the market last week – 43

• Number of apartments on the market this week – 41

For this week’s sales in Cremorne real estate, Cremorne Point real estate, Mosman real estate, Beauty Point real estate, Clifton Gardens real estate, Balmoral real estate, Neutral Bay real estate, Cammeray real estate, click here.

Robert Simeon is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985. He has also been writing real estate blog Virtual Realty News since 2000. The RWM real estate model has sold in excess of $1 billion in database sales globally.