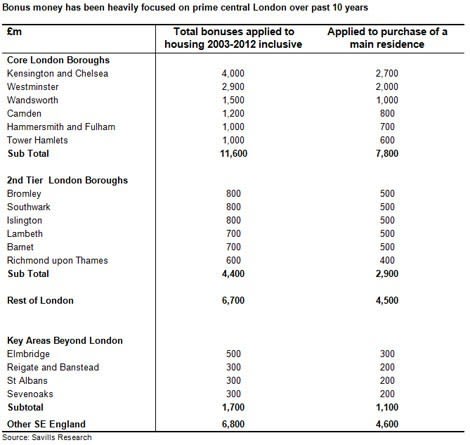

London's prime housing markets bouyed by £23 billion of executive bonuses over the past decade

The prime London housing markets have benefited from an estimated £23 billion of bonus money from the financial and insurance services sector over the past ten years, according to Savills.

Bonus money also added a further £14 billion invested in London's prime commuter markets, Savills says.

Over half of the influx was generated by "traditional City bonuses."

But Savills noted the influence of the annual cash injection had declined since 2008, reflecting a shift in earning power from large City corporate to the West End financiers.

Financial and business service sector buyers typically account for some 50% of buyers in prime central London and are prominent in some outer London prime markets, most notably south west London, the report noted.

"We estimate that some £3 billion bonus money was injected into prime London and South East markets in 2012, with traditional bank bonuses accounting for just under a third," it said.

Savills has previously acknowledged that bonuses insulated London from the harshness of the continued property downturn. In early 2011 Savills suggested the London financial services sector total £7 billion bonus - some 45% less than the 2007 bonus pot - would curtail any falls in prime London to a marginal 1.0% fall compared to an anticipated 3.0% fall for the UK as a whole.

Financial and business service sector buyer share of prime central and SW London residential markets

Prime Central London | Under £1m | £1m - £2m | £2m - £3m | £3m - £5m | £5m+ |

Financial, Business & Professional Services | 58% | 50% | 53% | 61% | 52% |

South West London | Under £500k | £500k - £1m | £1m - £2m | £2m+ |

Financial, Business & Professional Services | 42% | 45% | 62% | 62% |

“Bonuses from the financial sector were a key driver of house price growth across the prime markets of London in the run up to the credit crunch and price movements were closely linked to payouts,” says Lucian Cook, director of Savills residential research.

“Since then, the prime domestic markets have adjusted to much lower bonus levels, with price growth more dependent on the recycling of existing wealth in the banker and broker belt and the trickle down effect from overseas buying activity in central London.

“A capping of bonuses means there won’t be the significant injections of cash to fuel future seasonal spikes or larger booms, but an increase in salary to compensate for a loss of future bonuses is expected to underpin prices - particularly as it is likely to be easier to get mortgage finance on these salaries as opposed to uncertain bonus payments,” he said.

Last weekend Savills was in the news itself on the issue of bonuses after giving its top staff the opportunity to defer bonuses until the start of the next tax year to avoid the soon-to-be-abolished 50% top rate of tax.

Executives at the firm, some of whom earn more than £1m a year, could delay taking bonuses until the lower 45p rate is in place.

The top rate of income tax will be cut from 50% to 45% from 6 April. The top rate is levied on incomes of more than £150,000. The Guardian also reported in January that London-based insurer Aon was helping 250 of its best-paid staff avoid the 50% rate by deferring bonus payouts.

Click to enlarge