Investor home lending slows: Craig James

What do the figures show?

Business indicators

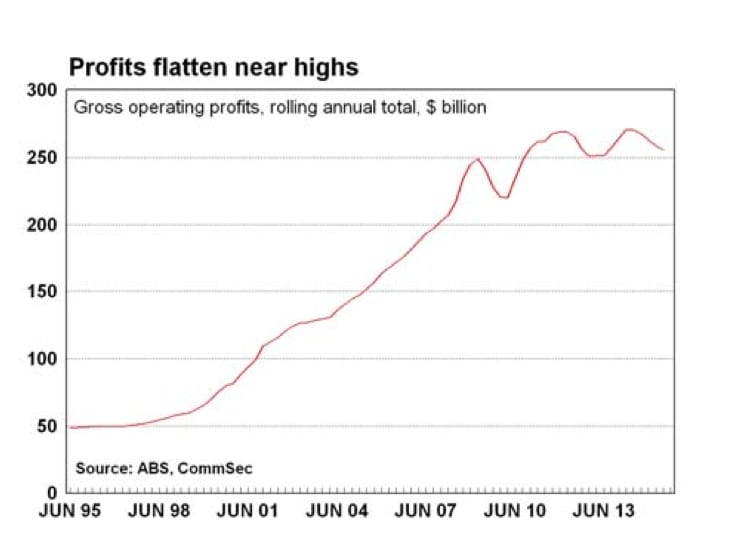

Company operating profits fell for the fifth straight quarter, dropping by 1.9 per cent in the June quarter. Profits fell in 10 of the 15 industry groups. Profits fell by 9.9 per cent in Mining, fell by 0.8 per cent in Manufacturing and fell by 4.7 per cent in Construction. But profits rose by 3.3 per cent in Retail Trade.

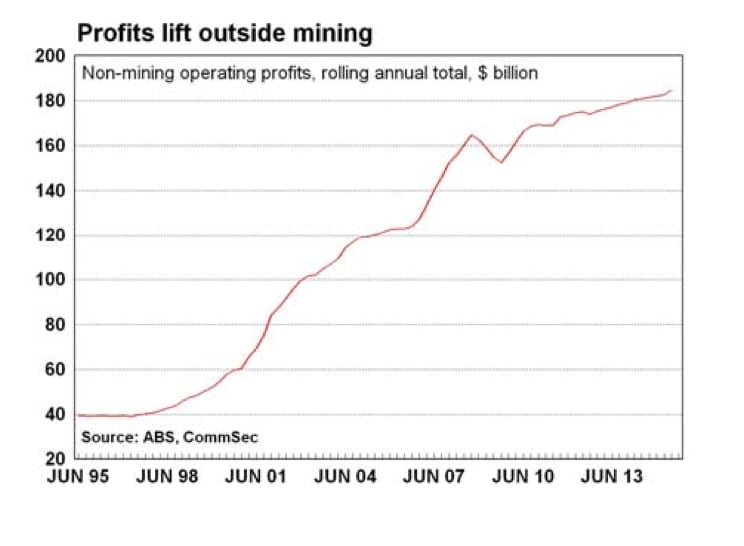

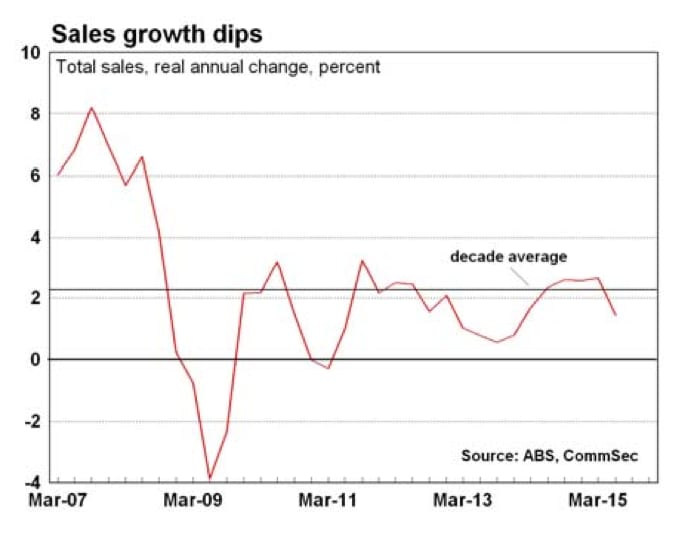

In the year to June (2014/15 year), profits totalled $255.8 billion, down 5.4 per cent over the year and the biggest annual decline in just over two years. Non-mining profits rose by 2.2 per cent to a record $184.7 billion in 2014/15.The value of all sales by industry fell for only the first time in nine quarters, down by 0.2 per cent in real terms in the June quarter to be 1.4 per cent higher than a year ago. In the March quarter sales were growing at the fastest pace in 31⁄2 years.

In current prices, sales rose in five states and territories in the June quarter: NSW & Queensland (both up 1.5 per cent), Tasmania (up 1.1 per cent) and Victoria & South Australia (both up 1.0 per cent).

Sales fell in Western Australia (down by 3.7 per cent), ACT (down by 1.1 per cent) and Northern Territory (down 0.4 per cent).

Wages & salaries rose by 1.1 per cent in the June quarter to be up 1.6 per cent over the year, weaker than the 2.3 per cent annual growth in the Wage Price Index.

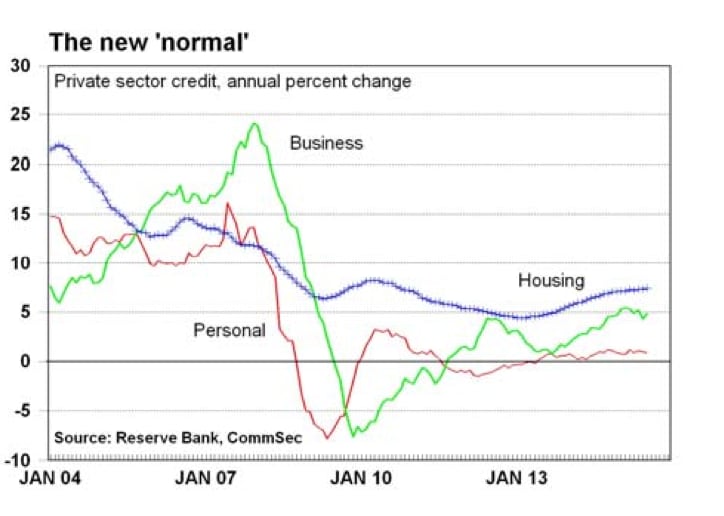

Private sector credit (lending) rose by 0.6 per cent in July after a 0.4 per cent gain in June. Annual credit growth

rose from 5.9 per cent to 6.1 per cent.

Housing credit grew by 0.6 per cent in July after a similar rise in June. Housing credit is up 7.4 per cent on a year ago – the strongest annual growth since October 2010.

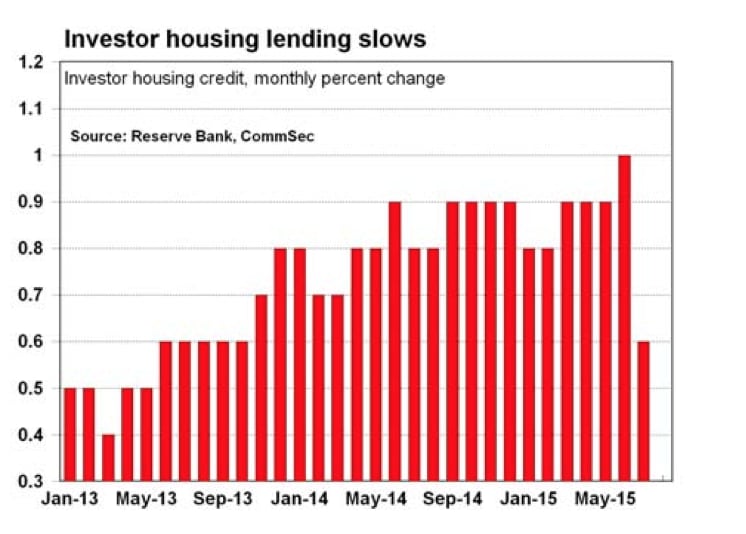

Owner occupier housing credit rose by 0.5 per cent in July to stand 5.3 per cent higher than a year ago – the fastest annual growth since April 2012. Investor housing finance lifted 0.6 per cent in July – the slowest growth in almost two years (equal the rate in October 2013). Investor housing credit was up by 10.8 per cent over the year, down from 11.1 per cent annual growth in June.

Personal credit was unchanged in July after rising 0.3 per cent in June. Personal credit was up 0.9 per cent over the year.

Business credit rose by 0.7 per cent in July – the biggest rise in six months. Business credit is 4.8 per cent higher than a year ago.

Term deposits held with banks rose for the first time in six months, up by $4.7 billion in July to $511.3 billion. But term deposits are down 5.0 per cent on a year ago – the sharpest decline in 12 years. Term deposits have been regularly falling in annual terms for 20 months – the longest period in records going back almost 30 years.

What is the importance of the economic data?

The quarterly Business Indicators publication by the Bureau of Statistics contains measures such as inventories, company profits and income from sales. Higher inventory (stock) levels can be either intentional or unintentional. If stocks are low and sales are expected to rise in the future, businesses will seek to build up stocks. However an unintentional build-up in stocks is where sales fall short of expectations, leaving more goods on the shelves than desired. If profits are increasing then this may point to increased capital spending and employment in the future. Rising profits are also a sign of favourable business conditions.

The Housing Industry Association releases data on the sales of new homes each month. The HIA collects the data each month from a sample of Australia's largest 100 home builders. The survey covers around 14 per cent of the home building industry.

New home sales

New home sales fell by 0.4 per cent in July. Sales of multi-units fell by 4.2 per cent while detached house sales rose by 0.7 per cent.

The Housing Industry Association reported: “In the month of July 2015 detached house sales increased by 4.2 per cent in New South Wales. Detached house sales fell by 2.3 per cent in Victoria and by 4.9 per cent in Western Australia. Sales were close to flat for the month in Queensland (-0.6 per cent) and South Australia (-0.2 per cent).

The annual peak for detached house sales has passed. Over the three months to July this year detached house sales fell by 2.8 per cent to be 3.4 per cent lower when compared to the three months to July 2014.

The Australian economy is evolving as best as can be expected. There is no need for the Reserve Bank to either lift rates or cut rates in the current environment.

Over the last seven years the Australian economy has experienced the biggest structural swings in a century. Mining investment and prices soared; resource prices retreated; mining investment was completed; mining production has ramped up to record highs; interest rates fell to record lows; and home building approvals hit record highs. Major swings and transitions have already occurred and the process is a long way from over.

The Reserve Bank can feel justifiably happy about how the process has gone so far.