Infrastructure investment key to stable returns: Lev Driker

GUEST OBSERVER

Infrastructure investment at the mature operating stage provides predictable revenue and growth in revenue above the rate of inflation, providing high levels of inflation protection.

Infrastructure is classified as either economic or social. Economic infrastructure includes assets that facilitate transportation and telecommunications or utilities that generate and distribute power, water and gas. Social infrastructure includes assets in which services such as education, health and correctional facilities are provided.

The majority of infrastructure assets operate in regulated environments with revenue increases linked to inflation through long term concession agreements and government contracts. There are usually high barriers to entry through large upfront establishment capital costs. Established infrastructure assets have monopoly/quasi-monopoly market positions with long useful lives of 20+ years and low operating costs. Infrastructure assets provide services where demand is consistent or functions where demand exhibits resistance to business cycles and are linked to non-discretionary spending as a result. These attributes generate stable income returns.

Access to investment in infrastructure assets with these investment characteristics may be achieved through listed securities and unlisted funds. Listed infrastructure securities are available on the ASX and consist of companies that own economic infrastructure assets. Unlisted infrastructure funds may invest in listed securities or a portfolio of infrastructure assets either directly or through unlisted funds. Investors may also gain exposure to the infrastructure asset class through superannuation funds that invest in infrastructure through unlisted funds.

Listed and unlisted infrastructure is similar as the characteristics of the underlying physical assets are the same. Over the medium to long term returns are expected to converge between the two. Over the short term differences in pricing of listed and unlisted infrastructure investments will result in different returns and volatility of returns. Liquidity profiles differ with listed infrastructure securities readily tradeable on the ASX while unlisted funds are not liquid. Listed infrastructure securities also have a more diverse portfolio of assets both in location and type which will also affect the profile of returns.

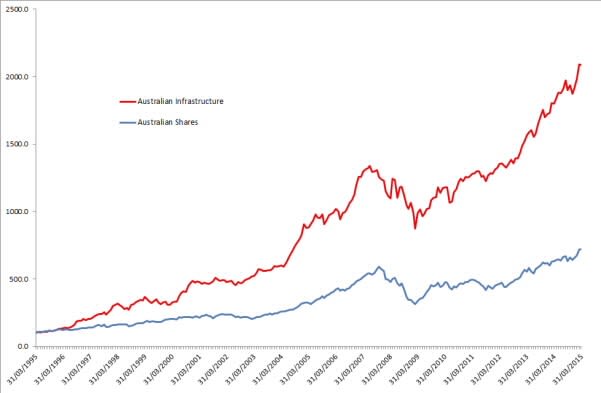

Australian infrastructure assets have outperformed Australian shares over the long term. In chart 1 (below) is shown the growth in value of $100 invested over 20 years from March 1995 to March 2015 in listed Australian infrastructure securities and Australian shares.

Source: UBS Infrastructure and Utilities Accumulation Index, S&P ASX 200 Accumulation Index

Chart 1 shows that listed infrastructure generated a higher cumulative return than Australian shares over a 20 year period to 31 March 2015. Listed infrastructure generated a return of 16.4% p.a. while Australian shares generated a return of 10.4% p.a.

Infrastructure assets provide stable and predictable cash flows with inflation linked revenue. Exposure to the infrastructure asset class can be achieved through listed securities, unlisted funds or superannuation funds that may invest in infrastructure. Listed and unlisted infrastructure is similar and has return profiles that differ over the short term and converge over the long term.

Lev Driker is an Investment Analyst for Atchison Consultants. He can be contacted here.