Fragmented Brisbane CBD office market shows correlation between size and vacancy: JLL

On the surface, the Brisbane CBD office market has all the appearance of a market on the nose.

At 14.2%, the city has the highest vacancy rate in the country and a shrinking public sector but new research from Jones Lang LaSalle paints a vastly different picture of the Brisbane market.

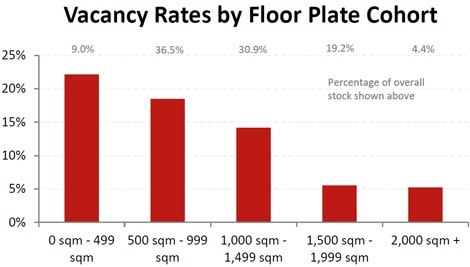

Analysis of the office market showed a "broadly negative correlation between floor plate size and the vacancy rate," said the author of the report, Peter Gueverra, who is a senior market research analyst at JLL.

Specifically, he said the vacancy rate in buildings with floor plates of greater than 1,500 square metres - which accounted for around a quarter of all stock - was just a low 5.5%.

In stark contrast, the vacancy rate in buildings with smaller floor plates of less than 1,000 square metres was considerably higher at 19.2%.

Mr Guevarra described the market's vacancy profile as "fragmented", and said that posed "significant implications for both occupiers and investors."

"Relatively tight vacancy in prime assets with large floor plates of greater than 1,500 square metres means there are very few immediate options available for larger corporate occupiers."

At the end of the June 2013 quarter, larger occupiers were limited to just four buildings with floor plates over 1,500 square metres, JLL highlighted.

Looking ahead, vacancy in buildings with larger floor plates of greater than 1,500 square metres is tipped to remain "tight".

JLL is forecasting 2013 to be at the “trough of the demand cycle", with tenant demand expected to increase moderately through to 2015. It also points out that no new major supply was expected to enter the market over the next two years, with the "supply cycle forecast to reach its trough level next year."

Only three major developments are due to hit the market over the next three years - namely Daisho’s 58,000 square metre speculative development, at 180 Ann Street, which commenced without a tenant pre-commitment and DEXUS’ 55,000 sqm project, at 480 Queen St, which is 38% pre-leased to multiple tenants. The third and already fully leased project is Cbus’ 75,000 square metres project at 1 William St.

Another interesting set of numbers within the research was the divergence in the vacancy rates for prime buildings with floor plates of between 1,000 square metres and 1499 square metres, compared to equivalent secondary space. The vacancy rate for prime vacancy space was just 9.5%, while the equivalent secondary market was a massive 26%.

“There may be an opportunity for investors to acquire and upgrade B-grade assets into A-grade within this floor plate cohort," said Mr Guevarra. "The wide spread between prime and secondary vacancy makes upgrading assets particularly attractive at this time".

However, he cautioned that risks remained for investors. "While we expect some demand to return over the next two and half years, further office rationalisation may continue,” he said.

"Resource sector tenants may continue to postpone or scale back office expansion plans, while the public sector may also continue to reduce its office footprint with further moderate consolidation into existing offices."