Consumer anxiety at its lowest level since mid 2013: NAB

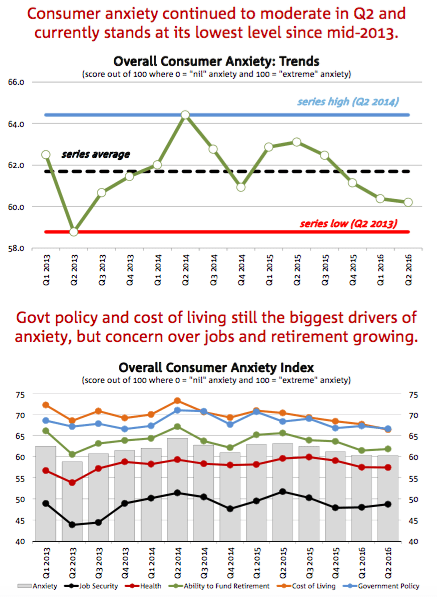

Consumer anxiety has fallen for the fourth straight quarter due to improvements in the labour market and an upswing in the non-mining economy according to the The NAB Consumer Anxiety Index, Q2 2016.

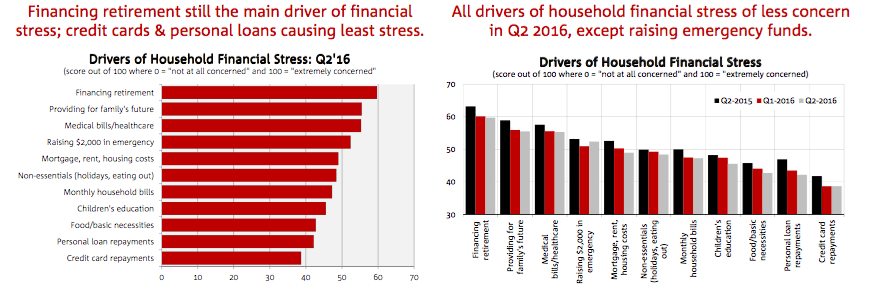

The NAB Consumer Behaviour Survey: Q2 2016, conducted across two weeks in May after release of the 2016-17 Federal Budget found chief among concerns and financial stress were financing retirement, providing for family and healthcare.

NAB Chief Economist Alan Oster said this is the fourth survey in a row where overall consumer anxiety has trended downward, with consumer anxiety is now at its lowest level since half-way through 2013, and well below its long-term average.

“While we continue to expect moderate growth in consumer spending throughout 2016, this is contingent upon further pick-up in labour market conditions and risks associated with further declines in the household savings rate,” he said.

The NAB Consumer Behaviour Survey: Q2 2016 also found consumers continue to focus spending on ‘essential’ items such as paying down debt, medical and utility bills, and groceries, above ‘non-essential’ items such as entertainment, travel and eating out.