Australian housing finance February 2016: Westpac's Matthew Hassan

GUEST OBSERVER

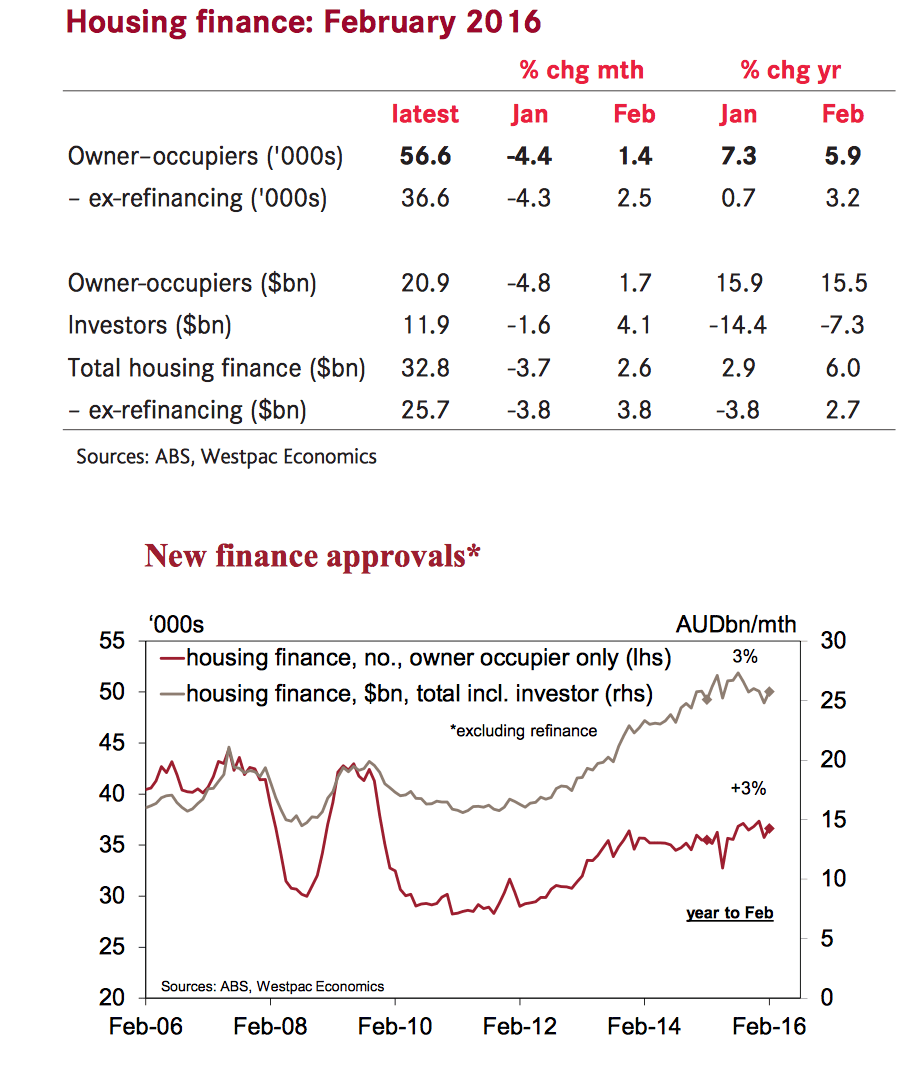

Australian housing finance approvals ticked up in Feb, in line with expectations and confirming other indicators suggesting markets have had a better start to 2016 after a weak finish to 2015.

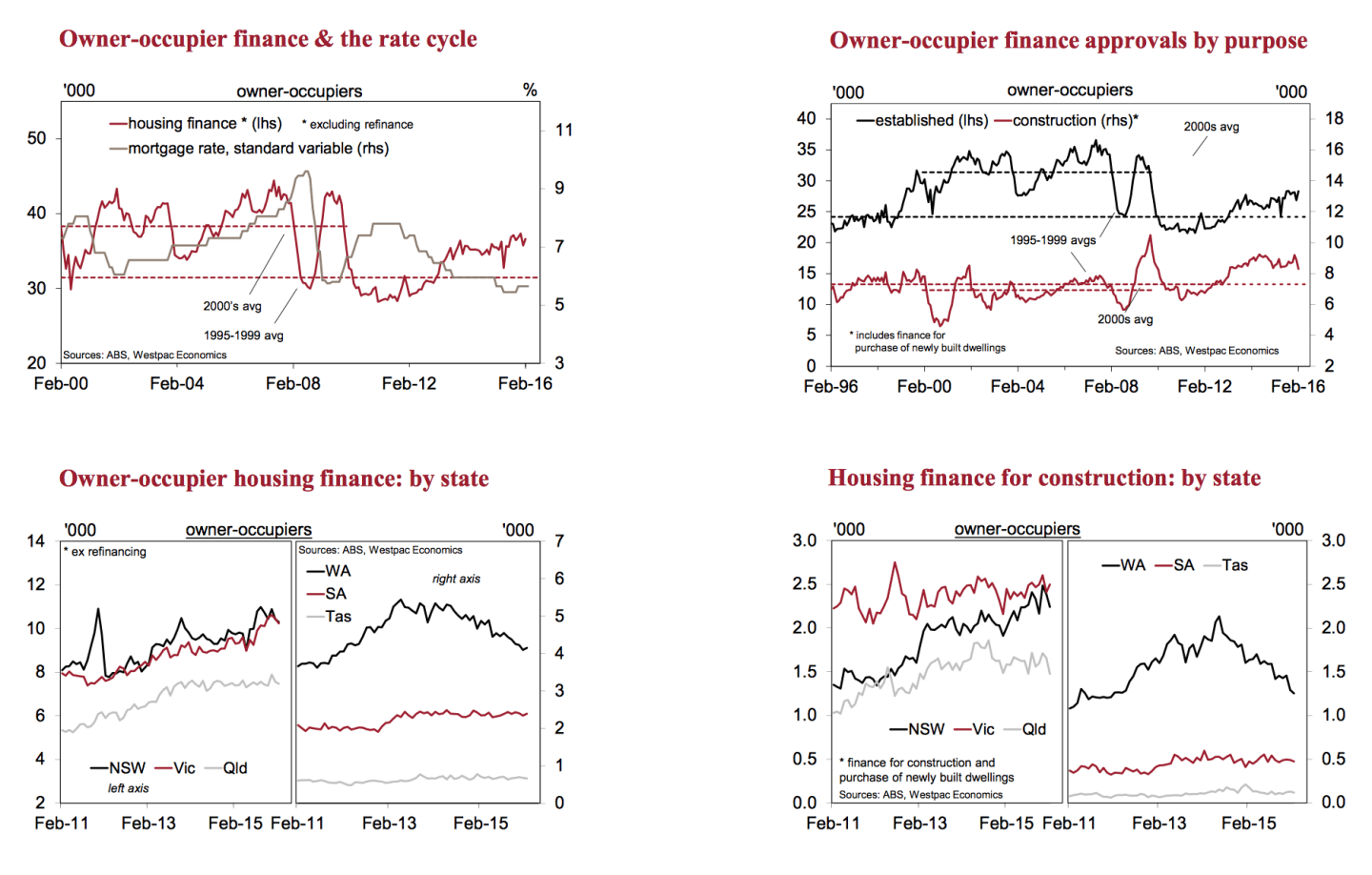

The detail showed a surprisingly solid gain for investor loans but continued softening in construction-related finance approvals.

The number of owner occupier approvals rose 1.7 percent in Feb, recovering about half of Jan’s 4.8 percent fall (revised down from –3.9 percent).

Click to enlarge

That compares to the market forecast of a 2 percent gain – the revision to Jan bringing the final result more in line with Westpac’s 1 percent call.

Note that the holiday low period tends to make monthly housing data choppier and less reliable at the start of the year.

‘New’ owner occupier approvals (ex refi) were a little firmer, up 2.5 percent mth but with annual growth more moderate (3.2 percent yr vs 5.9 percent yr including refi).

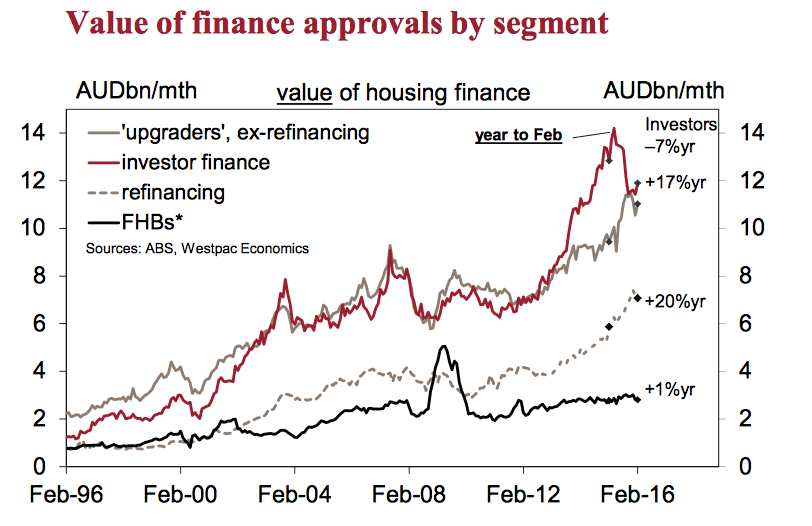

The value of housing finance approvals to investors was a mild upside surprise, lifting 4 percent mth after a 1.6 percent dip in Jan.

The total value of finance approvals to both owner occupiers (ex refi) and investors was up 3.8 percent mth, 2.7 percent yr.

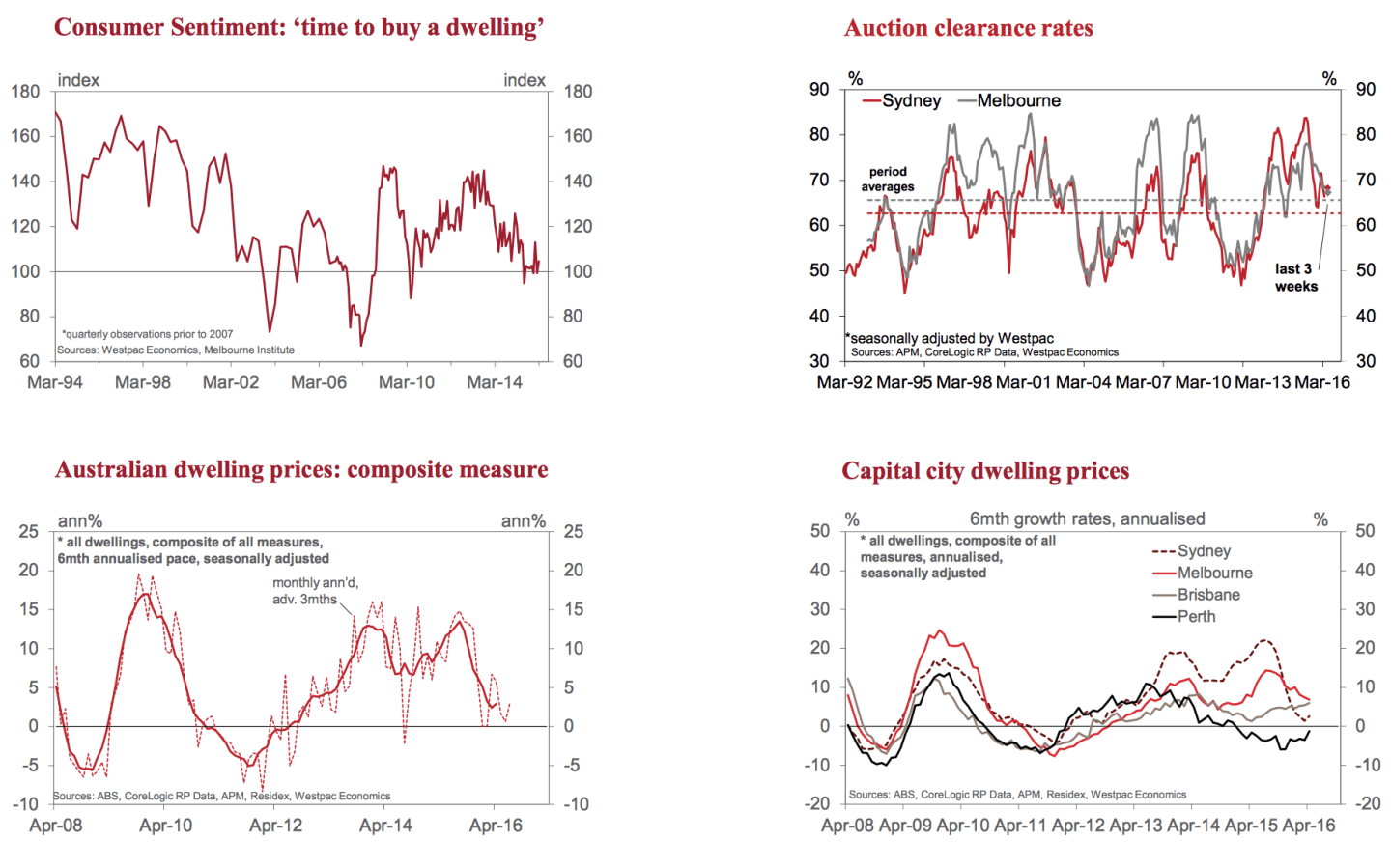

Overall, the picture points to a relatively steady start to the new year, something also apparent from auction market activity.

Matthew Hassan is senior economist with Westpac.