How our capital cities will perform from now to 2016: Simon Pressley

Forecasts from 2014 to 2016 around Australia.

Sydney

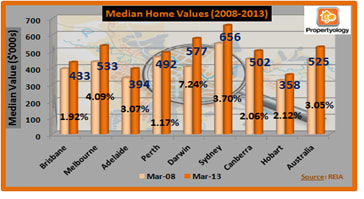

Sydney’s home price growth since the GFC has been an average of 3.7% per annum, slightly above the national average of 3.05%. While the market was very strong in 2013, high volumes of new apartment sales to Asian buyers was a main driver and I have sustainability concerns as well as questioning resultant changes to the social fabric.

Several major projects will be good for Sydney’s economy. This includes Barangaroo ($6B), Crown Casino ($1.2B), Darling Harbour ($2.5B), WestConnex Motorway ($10B), and North West Rail Link ($8.5B). A second Sydney airport and further sale of state assets to fund additional infrastructure projects will dominate tabloids. I expect Sydney to continue to perform slightly above the national average. Housing supply will continue to be tight, although there is more in the construction pipeline.

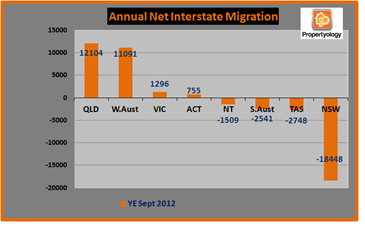

Metropolitan Sydney is the most expensive property market in the country and a reason for investors to look elsewhere. The more affordable Western Sydney has high unemployment, crime, and an inefficient transport network. More Australians leave NSW than those who arrive as illustrated in the interstate migration chart below.

Brisbane

We purchased very few properties in my home town over the last couple of years – there were better opportunities for our clients elsewhere (mostly in regional locations).

A high level of engagement with Asia and a ‘How Can We Help You Do Business?’ attitude from the Newman government is resulting in improved conditions.

Queensland is the only state where the unemployment rate declined in 2013. Major projects in Brisbane include $1.1B Moreton Bay Rail Link, $1.4B airport expansion, and $3B RNA development. The CBD will benefit from several projects including the $5B Underground rail project, a new state government office block, hotels, and possible new entertainment / casino precinct.

Brisbane will also attract world-wide exposure from hosting the G20 Summit (2014) and Commonwealth Games (2018). Don’t be surprised if additional demand for accommodation comes from an in increase in people migrating from other Australian locations for Brisbane’s lifestyle, affordable housing, and employment opportunities. Housing supply is quite tight and pressure is already starting to build. Of all of the capital cities in Australia, Brisbane will perform best – I wont be surprised if we see double-digit growth.

Adelaide

Adelaide is officially Australia’s most liveable city and home to 76% of South Australians. Key industries are defence force manufacturing, motor vehicle manufacturing (which is on life support), and agriculture (not a major employer). Development projects in Adelaide’s inner-city include a new hospital, redevelopment of the Adelaide Oval, and entertainment precinct. While housing is very affordable there is considerable new supply of new apartments. Adelaide’s property market is like its economy – uninspiring. Unless major job creation projects such as Olympic Dam are announced Adelaide’s property market will continue to perform below the national average.

Perth

Over the last couple of years Perth’s property market mirrored the State’s iron ore activity. Growth in wages, employment, and record population created more demand for housing than could be supplied.

As mining projects wind down skilled labour has become more readily available for WA’s construction industry. Combine this with recent building approval and land supply data and it would appear that housing supply is set to increase significantly. Perth has the most active first home buyer market in the country, meaning reduced demand for rental accommodation and a rise in vacancy rates.

While there have been job losses in WA’s mining industry Perth’s economy is still buoyant due to an unprecedented level of major projects. This includes hospitals, highways, casino expansion, entertainment and sport precincts, railway and airport upgrades, and inner-city revitalisation. There is a lot to like about Perth although housing has become very expensive. Perth’s property market will be firm, although not spectacular.

See over page for the other four capitals

Canberra

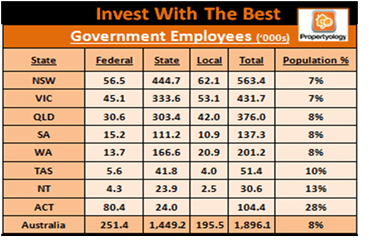

The Nation’s capital has a very high reliance on government employees (politicians, military training bases, federal police academy). The incoming federal government has flagged the possibility of up to 12,000 job cuts and it stands to reason that a significant portion of these will be in Canberra. On the supply side, the construction pipeline is growing. Canberra’s property market will perform below par for the foreseeable future.

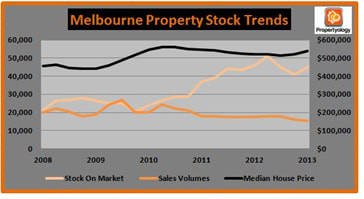

The Victorian economy has a high reliance on manufacturing and State Government’s primary strategy appears to be to stimulate the construction industry (as illustrated in this chart) – this persistent over-supply is to the detriment of property investors.

Large volumes of new apartment sales to the Asian buyers is likely to shield what will otherwise be a property market with low yields and below-par performance in general.

Darwin

Darwin has been Australia’s best performing capital city over the five years with an average change in median values of 7.24%. Demand for additional accommodation has come from major projects such as the Icthys LNG plant, a marine supply base, and correctional facility.

To address its very expensive housing the NT government has an accelerated land release strategy and housing supply is likely to work against the property investor grain. While its geography will lend itself to Asian-related projects a big segment of Darwin’s population is transient and I have concerns for the sustainability of Darwin’s property market.

Hobart

Hobart’s recent economy is summed up by its incredibly high unemployment rate of 8.1% and some of its youth are therefore heading to the mainland. Most commentators have been very critical of Hobart’s property market.

There are opportunities for economic growth through tourism, agriculture, and science and housing is very affordable. I have an open mind on Hobart.

Simon Pressley is Managing Director of Propertyology, a full-time property market analyst, accredited property investment adviser, and the 2012 and 2013 REIA / REIQ Buyer’s Agent of the Year.