Quarterly inflation data, the Australian dollar and Chinese data to guide RBA thinking on possible August rate cut

It is still “likely” that the RBA will cut the cash rate in August to 2.5%, says the Westpac economics team led by chief economist Bill Evans.

However, the outcome will be heavily dependent on two bits of economic data to be released between now and the August 6 RBA meeting, as well as what happens to the Australian dollar.

The two pieces of data are the second quarter Chinese growth figures “tentatively” due out on July 15 and Australia’s second quarter CPI figures, due out on July 24.

In its analysis of yesterday’s very short (six paragraphs) monetary policy decision statement by governor Glenn Stevens, Westpac highlighted a repeat of the line that “the inflation outlook, as currently assessed, may provide some scope for further easing, should that be required to support demand".

Source: Commonwealth Bank

Westpac also places emphasis on the RBA's view on the Australian dollar.

In his statement yesterday, Glenn Stevens said the Australian dollar had depreciated “by around 10% since early April, although it remains at a high level”.Westpac interprets this to mean that the currency is “at a less restrictive level but it is not actively stimulating growth or aiding the transition from mining to non-mining led growth”.

“A further decline in the currency – seen as a possibility – is viewed as required for this to occur.

“The currency move is also not seen as a threat to the inflation outlook which the Bank continues to see as remaining consistent with the medium term inflation target,” says Westpac.

Westpac does not provide any commentary on the importance of Chinese growth apart from mentioning the importance of the second quarter data figures.

In research published last week, Citi Research identified a strong link between Chinese economic growth and demand for housing.

Ahead of yesterday’s decision, the ‘shadow’ RBA board strengthened its call for the cash rate to remain on hold until most needed highlighting that “uncertainty about the global economy is rising and bond, equity and currency markets are reacting violently”.

The shadow board, comprising noted economists, including former RBA board member Warwick McKibbin in a think tank hosted by the Australian National University, also mentions the importance of China commenting that “China's authorities are attempting to rebalance their economy by reining in credit and imposing tougher financial rules”.

“This has led to a temporary spike in the interbank rate as financial institutions are scrambling for liquidity.

“On Monday, 24 June 2013, the Shanghai stock index suffered its worst one-day loss in nearly four years. The big question is whether China's authorities will be able to engineer a soft landing or whether Chinese markets, and the economy, will experience further severe disruptions," says the shadow board.

Commonwealth Bank chief economist Michael Blythe notes the easing bias remains, but with “some subtle hints of a rethink on the inflation outlook” by the RBA as well as a “generally positive view on economic prospects”.

Blythe notes that the RBA’s description of the inflation outlook has “shifted since the May Board meeting from one that “would afford scope to ease further” to one that, in yesterday’s statement, “may provide some scope for further easing” (his emphasis).

He says there is a risk that the second quarter inflation of around 0.4% would leave underlying inflation undershooting the RBA’s target band of between 2% and 3%, “underwrites our call for an August rate cut and a terminal cash rate for this cycle of 2.5%

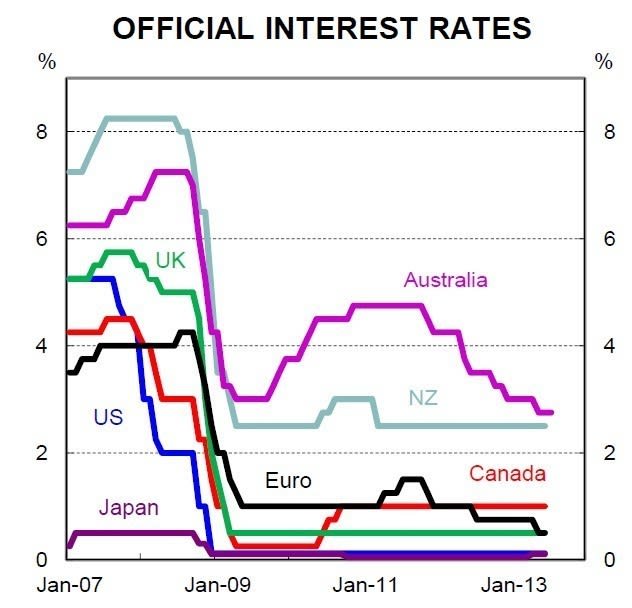

A cash rate of 2.5% would take the cash rate to a new record low, though still well above interest rate settings of other first-world economies.

Source: Commonwealth Bank

The previous lowest proxy measure of the cash rate (official cash rate settings date back to August 1990) was 2.89% in August in January 1960.