Canberra unit market at six o'clock with strong demand for new stock: Experts

Canberra unit prices were one of the stronger-performing property markets in 2011, with only a small correction in prices.

Century 21 chairman Charles Tarbey and SQM Research director Louis Christopher say the Canberra unit market is heavily tied to the civil service and the government in power.

However, as units are generally more affordable than houses, the unit market outlook is fairly rosy.

According to Colliers, current building approval figures and the large number of projects expected to come onto the market over the next three years suggest an oversupply of apartments is looming.

“However, the requirement for developers to obtain high levels of pre-commitments in order to receive financing for new residential projects is expected to create a barrier to entry for many projects,” says Colliers.

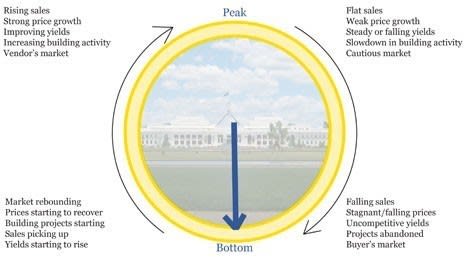

Time: Six o'clock

Set within a framework of particularly low vacancy rates, increasing rents and greater-than-average population growth, Colliers says new stock can be adequately absorbed by the market.

“Colliers International anticipates the likelihood of the cash rate declining further in 2012, coupled with the low vacancy rate and higher-than-average wages, will result in demand for new apartments within Canberra remaining resilient.

“Although a gap in the median price between the inner-north and the inner-south precincts will remain, it is anticipated the price disparity between the markets will lessen as new projects settle.”

Population: 358,000

Median unit price: $430,000

Unit price growth in February 2012: 1%

Annual unit price growth to December 2011: -1.4%

Annual unit price growth to July 2011: -5.8%

Rental yield: 5.5%

To find out where your capital city's house or unit market is on the property clock, download our free eBook.