Liberal win, APRA loosening and pending RBA rate cut sees SQM's Louis Christopher forecast price recovery

SQM's Louis Christopher thinks that dwelling price rises may materialise from the second half of the year as demand increases as a result of an expected improvement in confidence.

He added so far this year the national market this year has fallen by another 3.8 percent.

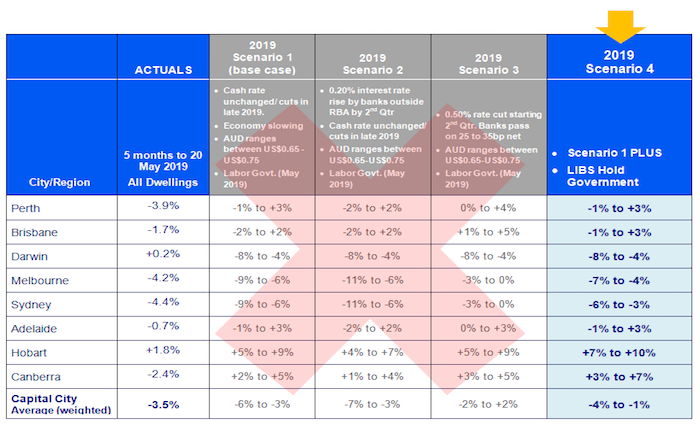

"Our base case forecast, released in our 2019 Housing Boom and Bust Report back in November 2018, was for a total 2019 dwelling price fall of between 3 percent to 6 percent.

"It would be fair to say that up until this past weekend the market was heading towards the bottom end of that forecast."

Christopher noted his 2018/19 Housing Boom and Bust report had a scenario 4 which followed a Liberal victory with interest rate cuts late in 2019.

He anticipates the national housing market could record a price fall for this calendar year of between 1 percent to 4 percent.

"We believe the Liberal victory means increasing buyer confidence in the market which was severely lacking as a result of the anticipation of the change in negative gearing and capital gains tax by a Labor Government."

But Christopher considers an upside on his scenario 4 forecast which did not take into account additional loosening on credit lending with APRA set to drop the 7 percent theoretical interest rate for banks to use when calculating serviceability by borrowers.

"This move should mean that more loan applicants will qualify for a loan and/or their borrowing limits will increase."

Following the May statement by the Reserve Bank, Christopher noted it appears a cut in the cash rate next month is almost a certainty.

"Scenario 4 does not take into account an earlier than expected rate cut.

"If there was such a cut over the course of June, July and/or August, it is likely the market would respond and demand for residential property would increase over and above our scenario 4 forecast.

"Needless to say a combination of loosening credit restrictions plus a cut in interest rates, increases the risk of another housing boom which I am sure that is not what the ‘powers that be’ would want, but they may well yet get."

Christopher noted the Australian housing market still contains headwinds which include:

- The Sydney and Melbourne markets are still in overvaluation despite the price corrections that have occurred since mid-2017.

- Ongoing restrictions on home lending in the form of a more conservative HEM and reduced purchasing power multiples on reported borrower net income.

- Ongoing global trade tensions causing some economic uncertainty

- Ongoing high housing Debt to GDP levels

- Elevated rental vacancy rates, particularly for Sydney.

- Elevated listings in Sydney and Melbourne

"These headwinds should initially prevent another rapid housing boom from developing.

"However, if we are to see a rate cut of 50 basis points or more over the next 2-3 months, combined with today’s announcement by APRA, all cards are off the table for 2020.

"And for 2019, our scenario 4 estimates may well end up being too conservative with the risks plainly being on the upside.

SQM's initial forecast for 2019 was:

Click here to enlarge:

Source: SQM Research