Staff reporterDecember 7, 2020

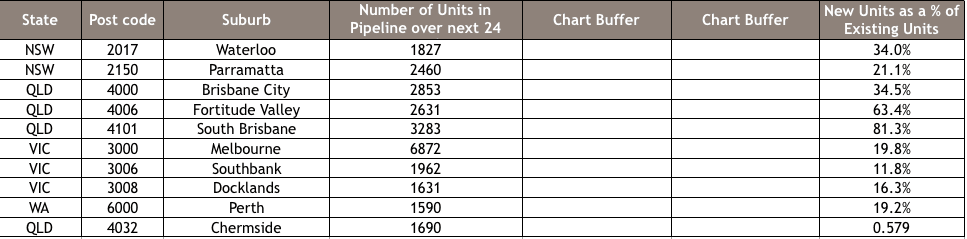

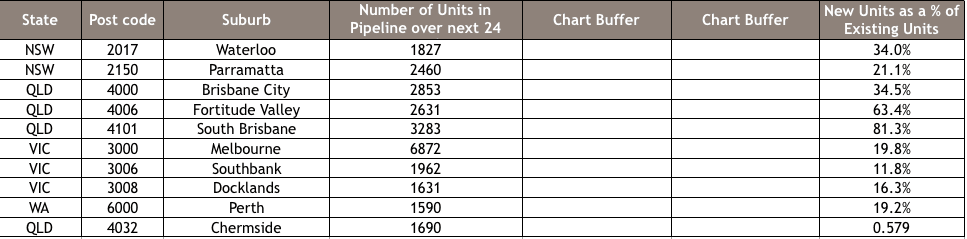

Brisbane's inner-city apartment market has about 10,000 more apartments in the pipeline than it should, says the newly active property research outfit RiskWise.

RiskWise suggests as early as June 2016 price growth was -1.8 per cent with 17,417 units in the pipeline – an addition of 24.5 per cent to the stock.

Price growth was again negative at -2.2 per cent inn 2017, but pipeline supply crept up to 19,194 units, accounting for 27 per cent of existing supply.

"The issue of oversupply is not a new problem and has been there for a few years," Mr Peleg said.

"The continuous weakness of the unit market in inner-city Brisbane should have raised red flags for developers and lenders," he told Fairfax Media.

"Overall, it seems they were too optimistic about the projected market value, and it is highly likely that the price they paid for the land was also too high."

This year RiskWise has price growth at -2 per cent, with the pipeline at 14,813 units, accounting for 20 per cent of the supply.

RiskWise said a healthy level for any market should be no more than five per cent of existing supply.

He sees more defaults on settlement.

"Defaults have been rising and will continue to do so," he said.

This time last year The RiskWise Property Review Best and the Worst Off-The-Plan Suburbs in Australia report identified several inner city locations in Brisbane that were vunerable.

It advised there was only a small number of suburbs where OTP units have the potential to deliver a solid capital growth.

Fortitude Valley (Qld) were among those classified as having the highest risks, Peleg said this time last year.

Click here to enlarge