All quiet on the McGrath share trading front

Trading in McGrath shares were without fanfare this morning despite speculation there could be some serious activity today.

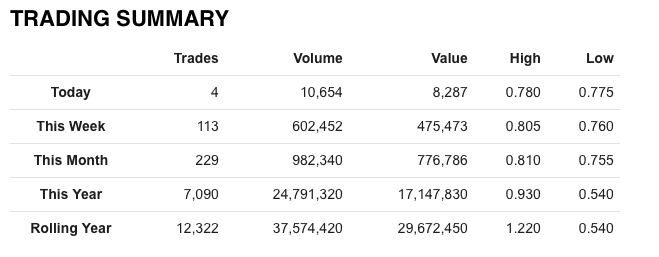

There were just four small trades in the first two hours.

Any block trade was likely to come after the trading closed, after market today, rather than as massive special.

Despite the perceived overhang, the share price has gone up a touch in recent days.

TRADING SUMMARY

A block trade, which is being handled by stockbroker Wilsons, was to become available for purchase after some 46.3 per cent of shares in the company was due to come out of escrow.

The Drummoyne-based activist investor Matthew Donnellan was reputedly lining up to acquire a designated 15 percent stake.

The shares are being mostly offered to the market by former McGrath agents and senior executives.

The 14.66 percent stake would make the second biggest shareholding behind founder John McGrath.

The 14.66 per cent combined stake in McGrath was created by the shares of former McGrath director of sales Matt Lahood, Geoff Lucas the former McGrath chief operating officer who has since moved to artisan bakery group Sonoma, and former agents Ben Collier, Stephen Chen, the Leichhardt agent Shad Hassen and Brad Gillespie, along with a remaining McGrath agent Bethwyn Richards.

The rival real estate agents - now at The Agency - hope selling the shares as a block could achieve a premium price.

McGrath CEO Cameron Judson previously advised McGrath remained a "a long-term holder of stock" but didn't advise further on any future purchasing or privatisation plans.

More than half of the shares set to come out of escrow are owned by founder John McGrath.

Later this month another 7 per cent of shares owned by Shane Smollen and other Smollen associates come out of escrow .

Last month, The Australian Financial Review's Street Talk column reported that Anchorage Capital, Adamantem Capital, Advent Partners and Crescent Capital Partners were among firms taking a close look at the country's third-biggest real estate sales group.

The shares floated at $2.10 in the initial public offering in late 2015.

McGrath shares closed at 76 cents on Thursday and we at 78 cents today.

Perpetual and Argo rank as third and fourth largest shareholders.