Insurer Genworth says rate hikes could increase mortgage stress in mining-fed economies

Leading mortgage insurer Genworth has cautioned that rising home lending rates may further increase mortgage stress in mining-focused regions such as Queensland and WA.

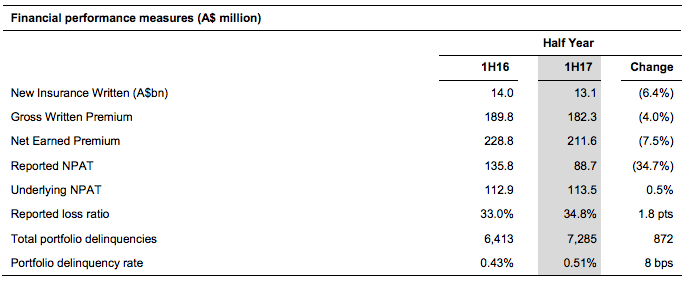

The insurer sounded the caveat at a presentation of its half-yearly results, which showed a sharp 34.7% fall in its net profit after taxes at $88.7 million

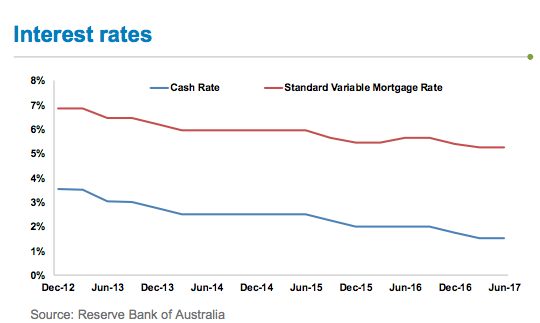

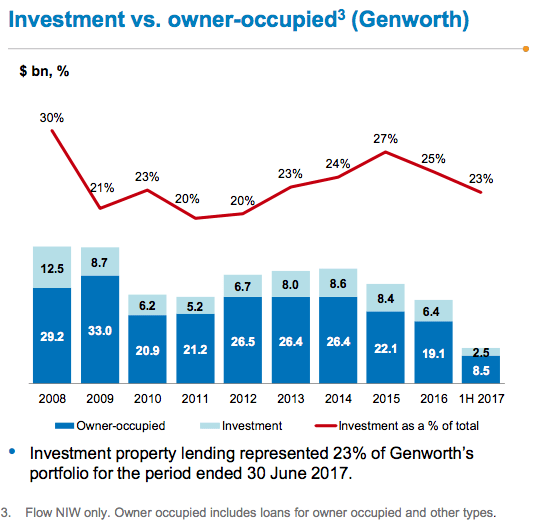

Banks have been making out-of-cycle rate increases amid tighter regulatory conditions and efforts to rein-in investor lending.

CEO Georgette Nicholas noted the “challenging market dynamics, including elevated mortgage delinquencies in resource-exposed regional economies and a smaller high loan-to-value ratio (LVR) market” while reaffirming its full-year outlook.

The latest Census data showed that mortgage stress had eased, but even a small interest rate rise could send many households, and even the economy, back onto struggle street.

Mortgage stress is defined as spending 30 per cent or more of household income on home loan repayments.

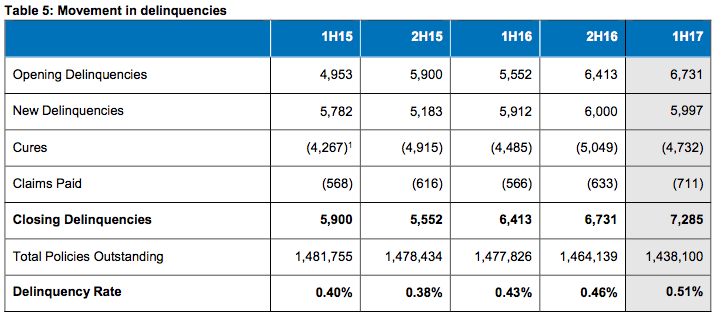

Genworth, which has about 30 per cent share of the mortgage insurance market, said there was an increase in the number of delinquent loans relative to a year ago.

An increase in new delinquencies, particularly in Queensland and Western Australia, although in a slower pace, lifted its overall delinquency rate.

It said the “performance in Queensland and Western Australia remains challenging and delinquencies are elevated due to the slowdown in those regional and metropolitan areas that have previously benefited from the growth in the resources sector”.

However, New South Wales and Victoria continue to perform strongly, although job losses in Victoria's manufacturing industry had contributed to a slight rise in mortgage delinquencies there as well.

While economic conditions have moderated recently as the economy continues to transition away from the mining investment boom, the insurer expects house price growth to moderate in 2017 following regulatory measures to slow the growth in investment lending and limit the flow of new interest-only lending.

Mortgage interest rate increases, particularly for investor and interest only loans, and recent changes to minimum bank equity requirements may also impact price growth this year, it said.

It said weaker activity in Queensland and Western Australia was continuing to offset growth in New South Wales and Victoria.

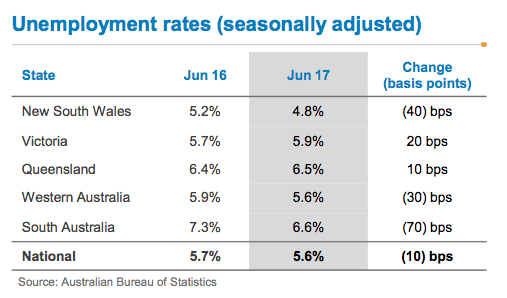

"The national unemployment rate remained steady at 5.6 per cent in June 2017 and key labour market indicators remain mixed. The underemployment rate continues to be elevated, implying a greater degree of spare capacity in the economy than indicated by the unemployment rate alone," Genworth said in a note to investors.

"Wage growth is also subdued, especially due to the transition away from mining-led activity and low actual and expected inflation. These labour market dynamics are increasing the instance of mortgage stress in certain regional economies and Genworth expects these trends to drive elevated mortgage delinquencies in these regions in 2017."