Rising property prices, onerous deposits and overseas competition drive NSW FHB grant changes

Rising property prices, onerous deposits and competition from local and overseas investors has driven changes to the first home buyer grant system in New South Wales with a number of changes being introduced July 1, 2017.

Glenn Stevens, former governor of the Reserve Bank of Australia said as incomes have risen and preferences about housing have changed, the prices commanded by land in the most desirable locations have increased a great deal.

"The NSW economy has been outperforming other regions of the country, helping incomes to rise and employment to grow faster than elsewhere, and attracting more people, particularly as the mining investment boom tailed off," he said.

"This came after a fairly lengthy period of underperformance in NSW following the 2000 Olympics – some of it is ‘catch-up’.

"So in a way, some of what we see are the sort of challenges associated with a growth economy.

"Most observers agree that the supply side of the market in general has struggled to keep up with demand.

"To be sure, construction rates are presently at record highs.

"But there is a stock issue: the previous period of underbuilding leaves a cumulative shortfall in the number of dwellings, estimated by the Department of Planning to be as large as 100,000 dwellings.

"If our objective is housing being affordable in an environment of growth in population and income, we need to have the supply side able to respond to demand in a more elastic way.

"Most importantly, NSW needs a plan for growth.

"Leaders need to explain what we need to do to accommodate more people, why growth without a plan is a not a good outcome – but why an even worse outcome would be stagnation."

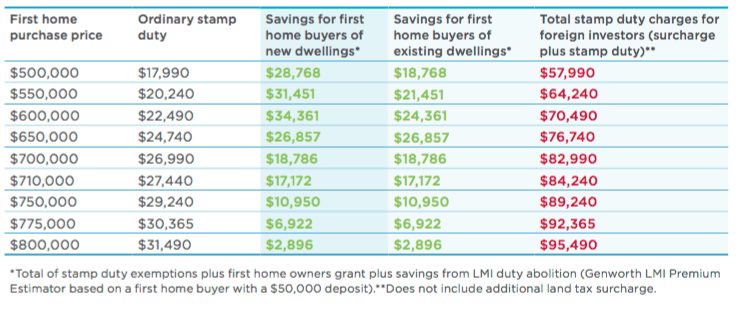

Change to stamp duty and concessions include:

• abolition of stamp duty for all new and existing homes up to $650,000, with stamp duty discounts for homes up to $800,000;

• a $10,000 First Home Owners Grant available to builders of new properties worth up to $750,000 and purchasers of new properties worth up to $600,000;

• abolition of insurance duty on lenders’ mortgage insurance;

• a doubling of the foreign investor surcharge from four percent to eight percent on stamp duty and a rise from 0.75 percent to 2 percent on land tax;

• the abolition of the off-the-plan transfer duty concession for residential purchases by investors.

In releasing the package, NSW Treasury said given that housing prices reflect supply and demand, this housing undersupply has meant that competition for housing is high and has pushed up prices.

"Over the past 25 years, NSW has experienced significant population growth," it said.

"From 1991 to 2016, the number of people living in the state increased by 31 percent – growing from 5.9 million to 7.7 million residents.

"Sydney’s population growth was even stronger – rising 36 percent from 3.4 million to 4.7 million people over the same period.

"But as the population grew, the previous government failed to maintain sufficient supply of housing across Sydney and New South Wales.

"Between 2000 and 2010, dwelling completions across NSW declined substantially.

"In Sydney, the decline was even more severe with less than half the number of homes completed in 2010 as there were in 2000.

"NSW Treasury’s 2016 Intergenerational Report estimates there was accumulated undersupply of 100,000 dwellings by the end of 2015. That is, even if no one else moved to Sydney an additional 100,000 dwellings would be needed to meet this pent-up demand.

"Since 2011, the NSW Government has made housing supply a priority. However whilst there has been a significant recovery in building activity in these last few years, the years of low activity between 2000 and 2010, combined with a growing population, has resulted in demand for housing remaining strong."

"In addition to the undersupply, an extra 725,000 dwellings are estimated to be required in the Greater Sydney area over the next 20 years to cater for projected population growth.