Property demand slows in April: REA Group's Nerida Conisbee

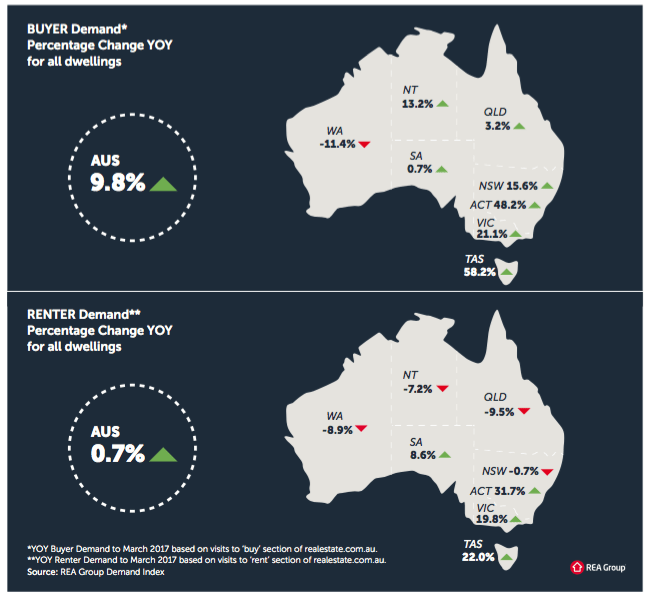

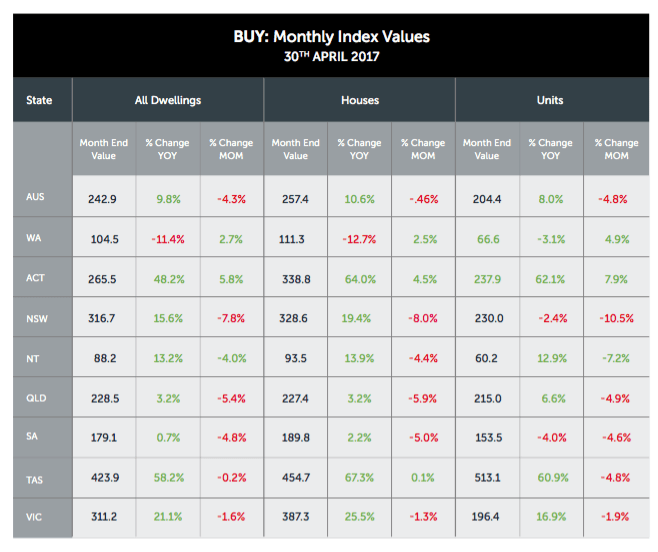

APRA's cooling measures and restrictive lending practices by banks has driven the REA Group Property Demand Index down by 4.3 percent for April month on month.

New South Wales saw the biggest drop in buyer demand in Australia in April, driven by unaffordability cutting buyers out in Sydney according to Nerida Conisbee, REA Group chief economist.

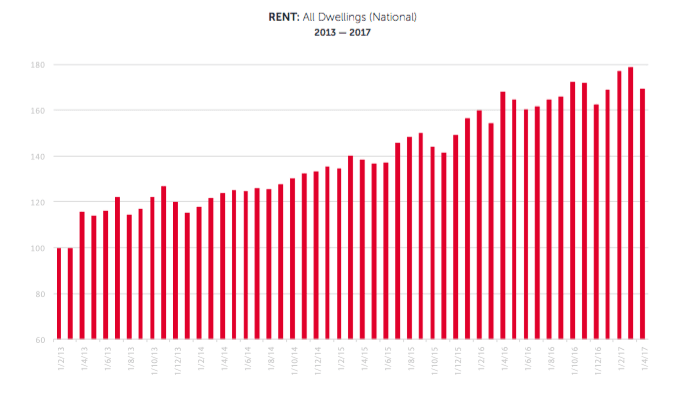

She said demand is still well above the same time last year and higher than the previous peak in November 2016, adding in December 2016, demand also dropped slightly when the banks increased interest rates independently of the RBA however, buyers ploughed back into the market in January and by March we hit another peak in demand.

"It’s impossible to predict if this will happen again and if buyers are purely reacting to the changes. Time will tell as we head into winter," she said.

"New South Wales saw the biggest drop in buyer demand in Australia in April, driven by unaffordability cutting buyers out in Sydney.

"So are we finally at the peak? It’s unlikely in Sydney, but lower levels of demand means that price growth will moderate and April median national house price data suggests the market slowed considerably during the month.

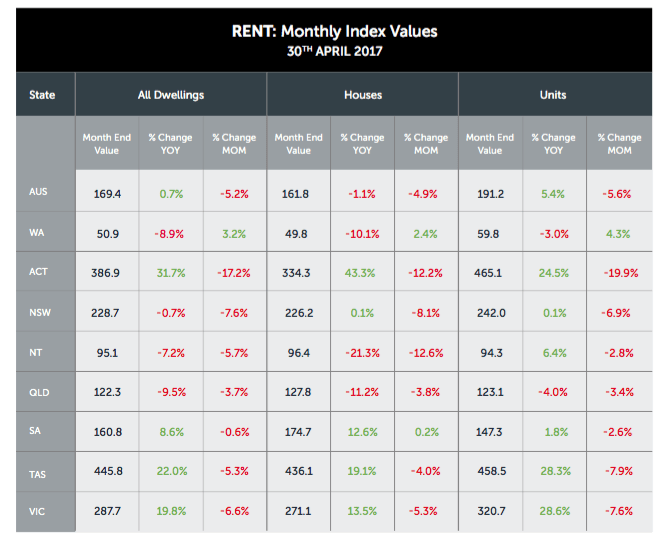

"Rental demand also saw a decline in April, suggesting that high levels of investor activity has now provided su cient rental housing. It’s likely that rental rates will also continue to moderate as a result.

"Given relatively low levels of development compared to Queensland and Victoria, New South Wales apartment demand has surprisingly declined significantly in 2017.

"Overall demand levels remain well above where they were 12 months ago, suggesting that it’s too early to say if the market has peaked.

"New South Wales also saw a drop in rental demand over the past 12 months suggesting that rental unaffordability is leading to fewer people being able to live Sydney.

"Due to the high house prices, Sydney buyers are most sensitive to banks increasing rates, which are expected to continue to rise.

"Despite very high levels of supply, Victoria saw only a relatively small drop in buyer demand in April. Rental demand also declined suggesting the investor activity is now providing sufficient rental housing for tenants.

"These drops suggest that price growth for buyers and renters will continue to slow.

"Although drops were experienced over the month, year-on-year demand continues to be positive and levels are well above what was experienced at the same time last year.

"Queensland experienced the second highest drop in buyer demand in April after New South Wales, however demand is still higher than it was 12 months ago.

"Rental markets are showing worsening conditions driven by high levels of supply but also relatively slow jobs growth. Rental demand is lower than it was 12 months ago.

"The situation in Brisbane is very different to on the Gold Coast. Gold Coast suburbs continue to see high levels of demand from buyers and renters due to lower levels of supply, the Commonwealth Games and other spending on infrastructure supporting jobs growth.

"Buyer demand in South Australia saw a decline in April, consistent across most states and territories, however demand remains slightly higher than it was 12 months ago. High levels of apartment development have led to poorer demand conditions for this type of housing and demand is now down year-on-year.

"Rental demand remains resilient with only a small drop over the month and growth continuing year-on-year. This suggests that jobs growth is solid in South Australia given the disconnect between buyer and renter demand.

"There is still very strong buyer demand in Tasmania, but the index fell slightly in April.

"Demand for houses continued to rise however the index fell for units, while renter demand also showed a decline. Even with the decline, there is no guarantee that prices will fall, with the index continuing to be well up on the same time last year.

"With the rest of the country stumbling, Western Australia showed increasing demand from both buyers and renters over the month of April.

"It’s still too early to tell whether the West Australian residential market has turned a corner given that year-on-year declines are still occurring.

"If national cooling measures were not in place and banks were more closely following RBA behaviour on rates, it’s conceivable that Western Australia would be close to turning a corner. These measures, which are largely in place for the Sydney and Melbourne markets, are likely to continue to dampen demand in the West.

"Australian Capital Territory was a standout in April, one of the few markets to see an increase in demand from buyers, with the index up year-on-year as well as over the month.

"Despite high buyer demand, rental demand took a hit, perhaps driven by changes to employment in the territory, as well as relatively strong levels of investor activity. Despite the April drop, year-on-year growth remains strong.

"Northern Territory saw a drop in buyer demand over the month, however the annual rate is still positive, suggesting the housing market is in the early stages of recovery. Rental demand declined on the back of weak jobs growth in the Northern Territory.