Australian millennials' home ownership rate among the lowest: HSBC report

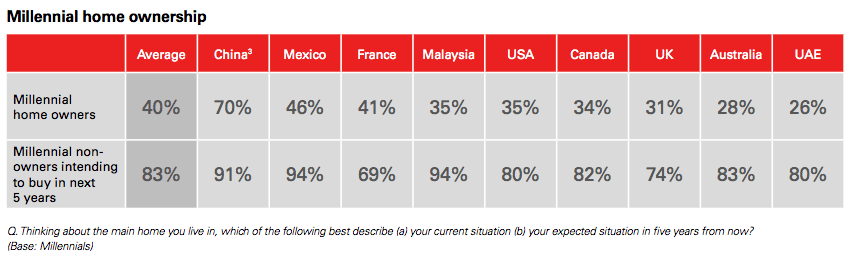

Home ownership among Australian millennials is among the lowest, with less than a third (28 percent) owning one, with a majority citing high property prices as a major barrier, says a new survey by HSBC.

The findings are contained in HSBC’s report, ‘Beyond the Bricks’, and comes just a month ahead of the May budget when the government is expected to reveal a housing affordability package.

Other findings of the survey, which was conducted in nine countries, reveal that 83 percent of Australian millennials intend to buy a home in the next five years. It found that while Australian millennials’ desire to own a home was no different from their global counterparts, the barriers to home ownership in Australia were higher.

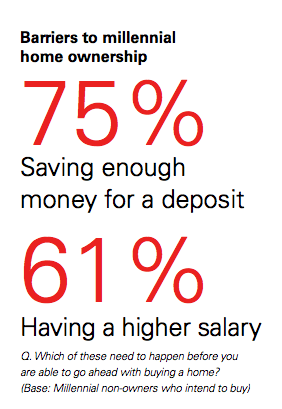

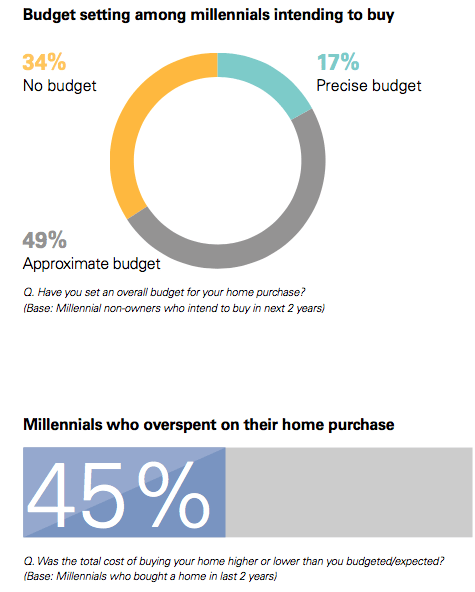

Three quarters (75 percent) of Australian millennials say the challenge of saving for the deposit for a home loan is their biggest barrier, but only 17 percent of Australian millennials intending to buy a home have a precise budget.

Additionally, 45 percent of Australian millennials who do own their own home say they have overspent on their original budget, showing that many are not prepared for the realities of owning real estate in Australia.

“The deposit for a home loan is the biggest initial cost of owning a home, but buyers also need to factor in the costs of stamp duty, legal fees, mortgage insurance, building inspection fees and in some cases renovation costs,” said Alice Del Vecchio, head of Mortgages, HSBC Australia.

Establishing a budget to buy a home is a vital step before buying a home, said Del Vecchio, and should factor in for some changes in property prices, allowing for price increases from the time one starts to search for properties.

“It is not uncommon to look for more than six months to find the right home, and often prices to enter the market have moved.”

The survey was conducted among 9,000 people in nine countries.

Home ownership in Australia among millennials (between ages 19 and 36) fares only marginally higher than millennials in the United Arab Emirates (26%), and well below those in Mexico, who have one of the highest rates of home ownership (46 percent). China was at the top with a huge 70 percent millennials owning a home.

The average figure was 40 percent.

Australian millennials said their second-biggest barrier to owning a home was having an insufficient salary to save, with 61 percent saying they needed a higher salary before they could buy a home compared to just 54 percent of millennials in the UK.

Average property prices in Australia increased by 5.4 percent in 2016, while in 2017 real wages are expected to increase by only 1.6 percent.

Even RBA Governor Philip Lowe has described the combination of high household and low wages growth a sobering combination.

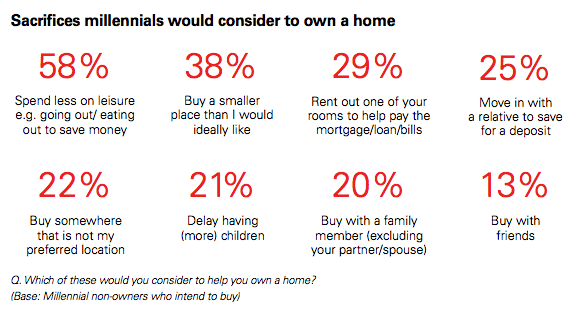

“Despite the rising costs, millennials overwhelming still want to own a home in Australia. The dream certainly isn’t dead. This research demonstrates that a lack of preparation and understanding of the realities of owning real estate however can stall or even deflate those dreams,” says Del Vecchio.