Despite expansion, McGrath listings down by 20 percent as exits take a toll

Residential property group McGrath Ltd, hit by recent high-profile exits, reported a 72 percent fall in its pro-forma net profit after taxes (NPAT) for the half-year ended December 31, 2016 from the previous year, with both sales and overall property listings down.

Its shares hit a 60 cents record low in morning trading.

The company had issued a profit warning in January with McGrath Estate Agents telling shareholders that the second half results would be materially weaker than the first half given “fewer agents and the continued low listing landscape”.

It gave out a similar message in its outlook, saying, "Challenging market conditions expected to continue, as seen through lower listing volumes." Stock listings fell 20 percent in the six months to December, amid a tightened listings landscape across the major capital cities.

Chief executive Cameron Judson said in the ASX release that the company had “commenced a strategic review with a renewed focus on improving productivity and performance of each of our existing segments and McGrath is exploring new revenue opportunities.”

As at 31 December 2016 the network comprised 28 Company owned offices and 68 Franchise offices with 648 agents operating within those offices.

The spread of offices is across the Eastern seaboard with a high concentration in New South Wales.

The Company entered the Victorian market in the prior year, a stated objective and strategic move to bolster the national market share.

The total number of offices in Victoria currently stands at 8, and the contribution was $0.5bn in sales value for the 6 months to 31 December 2016.

Total agents has increased marginally over the period to 648.

Agents in the Franchise offices increased 7 percent to 405 however agents in the company owned offices decreased 8% to 243.

Although statutory NPAT rose $0.4 million to $2.7 million, the company said pro-forma NPAT was down 72 percent to $2.4 million. The earnings included an impairment charge of $2.2 million.

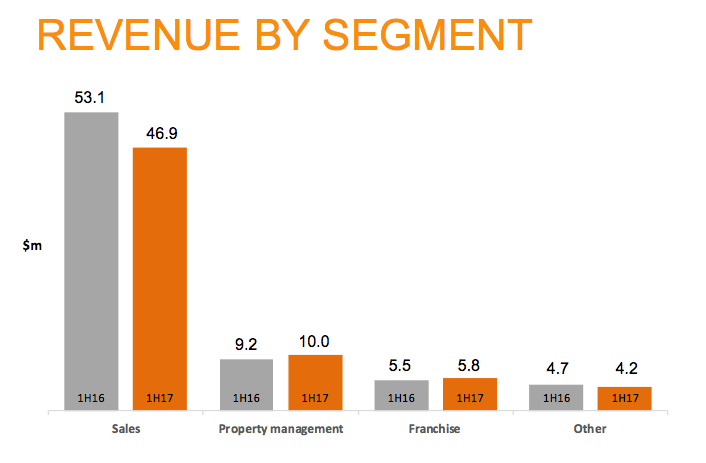

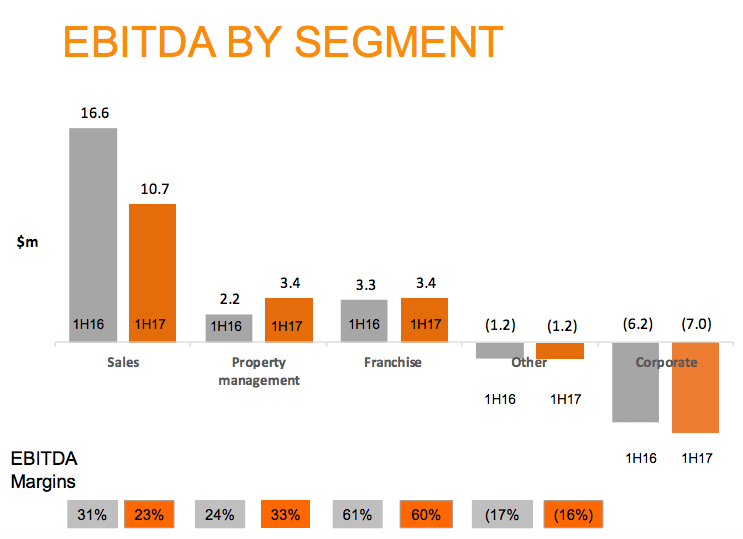

Pro forma revenue down 11 percent to $67 million while earnings before interest, taxes, depreciation and amortisation (EBITDA) fell 37 percent to $9.3 million.

Company-owned sales fell to $3.5 billion from 2,544 deals during the period from $3.9 billion and 2,866 sales in 1H FY16. Meanwhile, franchise services reported 4,222 sales during the period with a value of $3.8 billion.

It opened three offices during the six months, all in New South Wales; Forestville, Wahroonga and Blacktown, and has plans to open offices in Yarraville (Victoria) and San Souci, Berowra and Toukley, all in NSW.

The company declared a fully franked dividend of 1 cent per share to be paid out on March 28.

The stock price has dropped to a third from its IPO price of $2.10 in 2015. It last traded at 64 cents per share.

The company is trying to halt the exodus of agents with its ‘McGrath Future’, a programme that offers incentives to high performing agents.

Property Observer reported earlier that veteran agents who recently quit the McGrath Estate Agency are set to launch as The Agency.

The latest departure is Philip Waller.

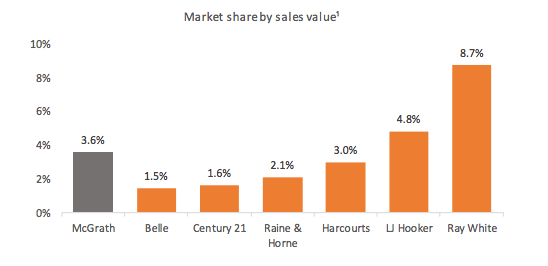

McGrath told its shareholders that its market share had risen amid the tightened listings landscape.

It calculates its market share nationally is now 3.6 percent.

The McGrath Estate Agency's Oxygen Home Loans department settled $443 million in mortgages during the period for the half year ending 31 December 2016 .

The number of rental properties under management at McGrath's company-owned offices has increased to 7,498 as of 31 December 2016.