Home building numbers hover near record highs: Craig James

Craig JamesDecember 7, 2020

GUEST OBSERVER

New council approvals to build houses or apartments are volatile on a monthly basis.

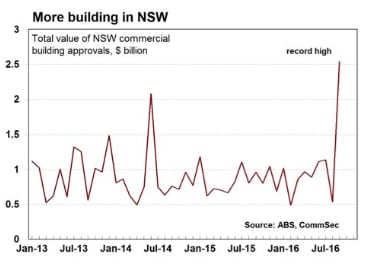

But overall the amount of building is still hovering near record highs. But there was a new ingredient in the mix in September – a sharp lift in commercial building approvals.

While not disclosed by the Bureau of Statistics, the project boosting the total seems to be the $2 billion Crown Sydney resort that includes retail, entertainment and hotel accommodation components. While just one – albeit big – project, it still adds to demand for labour and materials and will support building activity through to 2020.

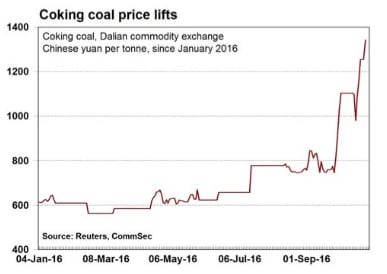

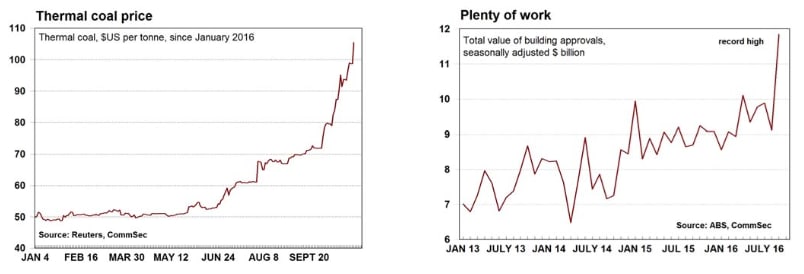

The sharp price gains for iron ore and thermal and coking coal point to higher incomes in Australia and higher tax revenues for the Federal Government. The higher prices reflect stronger Chinese economic activity, especially a resurgence in residential building. In terms of coal, a reduction in Chinese coal output has served to boost import demand and prices. But overall the news is good for Australian resource regions and good news for the Federal Budget.

As the Reserve Bank noted yesterday, consumer and business confidence levels are above longer-term averages. Low interest rates, rising real incomes and solid confidence levels should support spending in the lead up to Christmas.

The National Fiscal Outlook neatly presents in one place the position of Commonwealth and State Government finances. There are no major surprises and nothing to spook rating agencies. Infrastructure spending is up, expenses are down and lower revenues reflect slower nominal economic growth. But to some extent the document may already be ancient history. The economy is picking up pace, higher commodity prices will boost government coffers and inflation looks to be lifting from lows.

Australian government debt is set to peak near 19 percent of GDP – one of the lowest debt ratios of major advanced economies. And the path to fiscal surplus remains intact.

What do the figures show?

Building Approvals:

Dwelling approvals fell by 8.7 percent in September – the fourth decline in five months. In trend terms, approvals fell by 0.6 percent.

Over the past year 237,822 new homes were approved, just shy of the record high 240,919 in the year to October 2015.

House approvals rose by 1.7 percent in September – the first rise in four months. Meanwhile ‘lumpy’ apartment approvals fell by 17.5 percent in September after falling by 2.9 percent in August and rising by 24.1 percent in July.

Dwelling approvals in September were down by 6.4 percent on a year ago in seasonally adjusted terms but up 2.1 percent in trend terms.

Dwelling approvals across states and territories in September: NSW (-13.3 percent); Victoria (-15.6 percent); Queensland (-11.7 percent); South Australia (+9.4 percent); Western Australia (+5.6 percent); Tasmania (-4.0 percent).

In trend terms, approvals fell by 6.0 percent in the Northern Territory but rose by 15.9 percent in the ACT.

The value of all commercial and residential building approvals soared by 29.9 percent in September to a record high of $11.8 billion. Residential approvals fell by 4.4 percent with new building down by 4.6 percent while alterations & additions fell by 2.2 percent. Commercial building lifted by 118.9 percent in September to a 7-year high of $5.5 billion.

Fiscal outlook

The Parliamentary Budget Office has released the National Fiscal Outlook report. The PBO says Commonwealth net debt will lift to $356.4 billion (18.8 percent of GDP) in 2018/19 compared with $346.6 billion (18.2 percent of GDP) at the 2015/16 mid-year estimate (MYEFO). Net debt is to peak at 19.2 percent of GDP in 2017/18 before improving to reach 17.8 percent of GDP in 2019/20.

The PBO said: “According to Commonwealth and state government 2016/17 budgets the projected national fiscal deficit from 2015/16 to 2018/19 has deteriorated by $14.9 billion (from a total of $122.3 billion at the time of the mid-year updates to $137.1 billion).

The deterioration in the projected fiscal outlook from 2015/16 to 2018/19 is due to a downward revision in projected revenue of $18.1 billion along with an upward revision in net capital investment of $2.8 billion, partially offset by a downward revision in expenses of $6.0 billion.

“Relative to the 2015/16 mid-year fiscal updates, the Commonwealth’s projected fiscal deficit from 2015/16 to 2018/19 has increased by $8.9 billion (from $96.1 billion to $105.1 billion), driven primarily by a decline in projected revenue, partially offset by a reduction in projected expenses and net capital investment.”

Consumer confidence

The ANZ/Roy Morgan consumer confidence rating rose by 0.4 percent to 114.1 in the week to October 30. Confidence is down 1.0 percent over the year but above the average of 112.4 since 2014. Three of five components of the index fell in the latest week:

- The estimate of family finances compared with a year ago was down from +9 to +8;

- The estimate of family finances over the next year was up from +21 to +26;

- Economic conditions over the next 12 months was down from +0 to -3;

- Economic conditions over the next 5 years was down from +6 to +5;

- The measure of whether it was a good time to buy a major household item was up from +32 points to +35 points.

The Bureau of Statistics' monthly Building Approvals release contains figures on local council approvals to build residential structures such as homes and units as well as commercial premises such as offices and shops. Approval is one of the first stages of the construction ‘pipeline’ and is thus a key leading indicator of future activity. An increase in approvals would point to stronger future activity for construction-related companies.

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

What are the implications for interest rates and investors?

The Reserve Bank has received ample justification for its decision to leave rates on hold. The value of building approvals has hit fresh highs and the lift in iron ore and coal prices will serve to lift labour demand, spending and economic activity in resource regions.

CommSec expects the Reserve Bank to remain on the interest rate sidelines for an extended period. The job market is in decent shape, consumers and businesses remain confident and home building is just shy of record highs. And importantly, inflation is projected to rise over the next two years.

Craig James is the chief economist at CommSec.

Craig James

Craig James is the Chief Economist at CommSec, interpreting ‘big picture’ economic and financial trends.