Rental yields in capital cities are below the 15-year average: QBE Housing Outlook

Yields in the capital cities are below the 15 year average, according to QBE’s latest housing report.

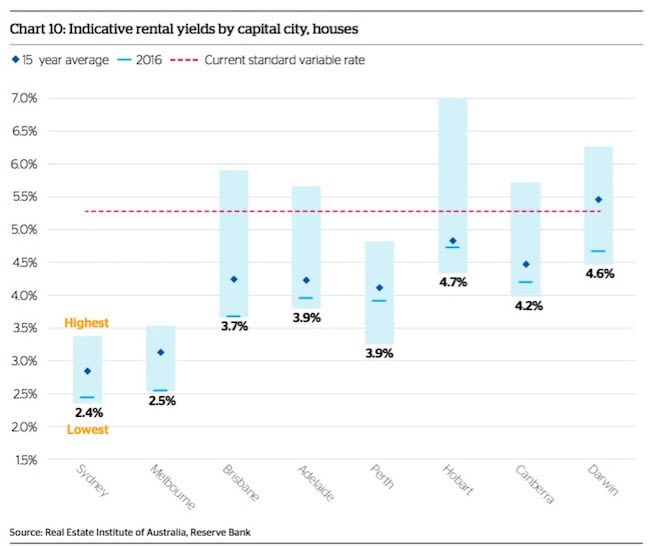

This can be seen in the chart below, which shows movement in indicative rental yields for houses by capital city. The indicative yield is calculated as the median three bedroom house rent divided by the median house price.

The indicative yield slightly understates actual yields, as the median house price is reflective of the whole market (investors and owner occupiers) while rents are reflective of just properties in the investment market.

Investment properties are more likely to be priced below the median house price of all dwellings, although achieve a typical rent. Nevertheless, movement in the indicative yield should correspond with actual yields.

QBE compared the rental return with the cost of financing by using the measurements for indicative rental yield and the standard variable interest rate respectively.

• In Sydney and Melbourne, indicative rental yields for houses are well below other capital cities, with stronger house price growth in these two capitals over the past three years widening the gap. At June 2016, the indicative rental yield for houses in Sydney was 2.4% and in Melbourne was 2.5%. For Melbourne, this was the lowest yield on record, for Sydney, yields are at their lowest level since 2004.

• In Adelaide and Perth, yields at June 2016 were on par at 3.9%. In Canberra, yields were a little higher at 4.2%. Adelaide’s yield has varied over the past 10 years, while sharp falls in rents in Perth have seen its yield decline. In Canberra, yields rose in the year to June 2016 as the fall in rents stabilised.

• Brisbane’s yields have fallen to 3.7% in 2015/16 as house price growth has been above the minimal rise in rents over the year. This is the lowest level recorded.

• In Darwin weaker rental growth has resulted in a continued decline in housing yields in 2015/16, to 4.6%. Darwin has the highest indicative house yield of the capital cities, just edging out Hobart which had yields relatively stable at 4.6% during the year.

Yields in all capital cities are below the 15-year average. Despite the low yields, the corresponding low mortgage interest rates means the gap between rental yields and interest rates in most capital cities remains narrow.

In some instances, selected properties in individual markets are likely to be positively geared, particularly with the current ability of purchasers to obtain a rate better than the current standard variable rate.