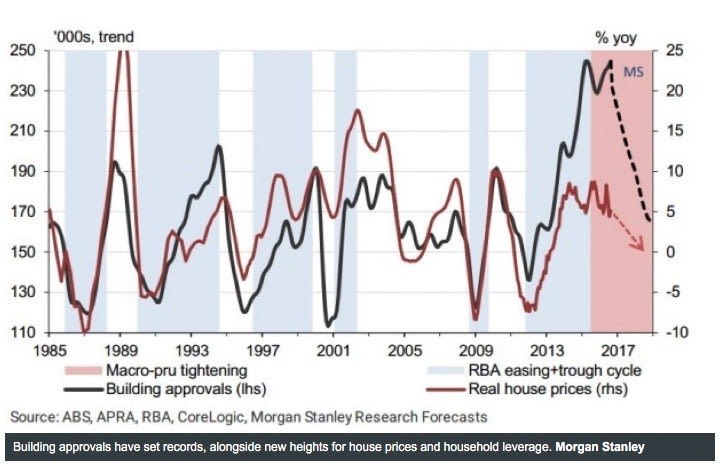

Housing boom to decline through 2018 as soft rental market, oversupply bite: Morgan Stanley

The property market may be in for a hard landing as early has 2017, according to investment bank Morgan Stanley’s recent predictions.

The reasons cited are a soft rental market, an oversupply of new apartments and worsening affordability, says an article in the Australian Financial Review based on Morgan Stanley’s outlook.

It predicts apartment approvals to fall by more than half over the next two years as settlement risks and a sharp cut in development financing hurts developers.

"In short, we believe the growth contribution from the housing boom has already peaked and look for a plateau over 2017 and decline through 2018," strategists Daniel Blake, Steven Ye, Chris Nicol and Antony Conte write.

"New apartment projects should slow sharply as focus turns to settlement of the existing pipeline."

The outlook is based on more pessimistic expectations about net migration rates than others, according to Morgan Stanley, and is the result of a new index — MSHAUS — combining six factors including oversupply, rental vacancy rates that could rise to 4.5 percent from 3 percent in two years, tighter lending standards and lower expected growth in home values.

The index is in a range close to its lowest level since 2004, says the report.

"A growing overbuild, deteriorating rental market conditions, further worsening in housing accessibility, tighter credit supply and more subdued price expectations all suggest a further softening in the outlook over 2017," it says.

Planning approvals of apartments, townhouses and semi-detached homes will fall to 57,000 in the fourth quarter of 2018 from 124,000 in trend terms in July this year, the report says.

Settlement risk – both for individual buyers and whole developments – is a major concern.

"In our view, the greatest vulnerability is settlement risk on the 160,000 apartments that we forecast completing through end 2017," the report says. "Listed developers report low failure rates currently, but also confirm credit availability has tightened, especially for foreign investors."

It also applies to buildings, despite the growth of alternative financing sources.

The report says the nearly $120 billion in settlements due by end-2018 makes this a genuine concern.

The rental market is also the softest since 2003, it says.

"We think they will weaken further, on the back of an increasing apartment overbuild. Rent inflation has already slowed sharply and is running at a record low of 0.9 percent, year on year."