Darwin has the highest vacancy rates while NSW records highest rental growth: QBE Housing Outlook

Darwin has the highest residential rental vacancy rates with Perth following closely behind, according to QBE’s latest housing report.

The vacancy rate is calculated as the number of unoccupied rental dwellings as a percentage of the total rental stock and is sourced from a survey of state Real Estate Institute members.

The vacancy rate in each city is a measure of the balance of rental demand and rental supply. A vacancy rate of 3% in a market is considered balanced, where rents on average will rise broadly in line with inflation.

• In Sydney, since 2006 there has been a considerable deficiency of residential dwelling stock after an extended period of low new dwelling construction. Given the extent of the dwelling shortage, vacancy rates have remained tight at 1.8% in June quarter 2016, and the return to a balanced rental vacancy rate is unlikely to occur until beyond 2018/19.

• In Melbourne, vacancy rates were below the balanced market level of 3% in 2013/14 and 2014/15. However, with record dwelling completions vacancy levels are now closer to balance at 2.7% in June quarter 2016. With dwelling completions on track to increase further in 2016/17, vacancy rates in Melbourne are expected to move above 3% over the year.

• Brisbane vacancy rates increased marginally to 2.8% at June 2016; still close to the balanced market rate. In Adelaide, vacancy rates have risen to 3.3% in the same period. Vacancy rates in both cities are anticipated to continue to trend upwards. In Brisbane, the forecast is due to upcoming dwelling completions outpacing demand, and in Adelaide the excess of dwelling stock may rise further due to weak population growth.

• Perth (6.0%) and Darwin (6.4%) recorded the highest vacancy rates among all capital cities at June 2016. Rising new dwelling completions, rapidly slowing net overseas migration inflows and falling interstate migration levels, as a result of the collapse in mining investment are causing an exit from rental properties. As a result, the pace of new rental tenants coming to the market is failing to keep up with the pace of new additions to the rental stock.

• In Hobart, vacancy rates remain at the upper end of the 2–3% band. Elevated dwelling completions relative to population growth are keeping the market around balance.

• In the Australian Capital Territory, declines in rents appear to be attracting new tenants with its vacancy rate falling to 2.5% in June 2016.

With both states estimated to experience a rising dwelling surplus, the downward trend in vacancy rates is not expected to continue.

Rental growth, as calculated from the rental component of the Consumer Price Index, was strong in the latter half of the 2000s after a period of underperformance in the first half of the decade. In recent years, rental growth has generally been moderate, despite vacancy rates remaining tight in all capital cities up to 2013. This suggests there may be some rental affordability constraints preventing stronger rises.

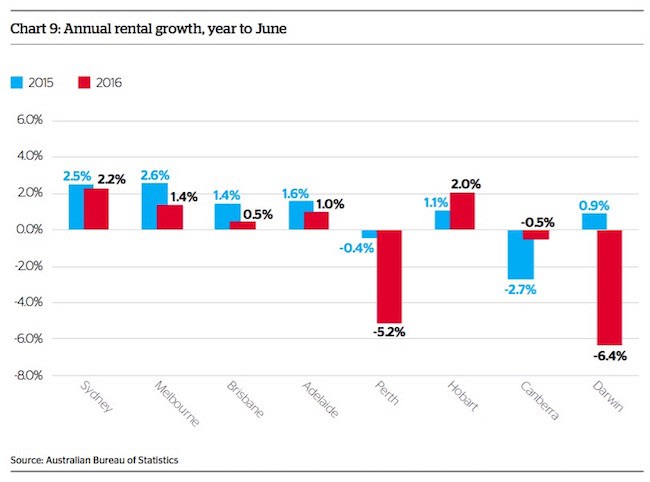

• With a deficiency of dwellings in place and low vacancy rates, New South Wales had the highest level of rental growth of 2.2% in 2015/16. In Hobart, a lower vacancy rate of 2.8% assisted the second highest level of rental growth of 2% in 2015/16. Melbourne and Adelaide, with rental growth of 1.4% and 1% respectively, experienced minimal rental growth as their respective vacancy rates rose above the balanced market rate over the year.

• Brisbane and Canberra rents stayed fairly static in 2015/16, despite a low vacancy rate in Canberra. Canberra recorded a 0.5% decline in rents, which is an improvement on its 2.7% decline in 2014/15.

• In Darwin and Perth, rents declined by 6.4% and 5.2% respectively in 2015/16.This reflects the high level of vacancy rates in each capital city. In both states, while new dwelling supply continues to rise, falling resource investment spending is leading to significant reductions in migration and subsequent weaker tenant demand.