Residential price uptrend stalls in New York: UBS bubble index

The UBS Global Real Estate Bubble Index score for New York remains relatively unchanged at 0.13, which is in the fairly-valued territory.

The rebound in price growth rates has largely run out of steam, particularly at the high end, the latest update noted.

Growth rates in the second quarter halved compared to the previous year and remain below the countrywide average.

Supply expansion and the prospect of higher mortgage rates should dampen any overly optimistic price expectations in the short run, says UBS.

Real house prices in the New York metropolitan area are almost 25% lower than they were 10 years ago. In the second quarter of 2016, residential prices increased by less than 2% in inflation-adjusted terms, about half the previous year’s rise. It was the fourth consecutive year that real price growth in New York lagged the US average.

The city remains one of the most expensive and unaffordable cities in the world. A skilled-service worker from the New York area would need to work for about 11 years to buy a 60 square metre unit near the city center.

Most notably, rents are more than 50% higher in real terms than they were in 2006, making New York rents one of the highest worldwide. Consequently, the price-to-rent in Manhattan is below average compared to most other financial centres.

In Manhattan, house prices dynamics were stronger in the last couple of years than in the overall New York region, propelled by demand from global investors and a series of new luxury developments. The tide has turned, however, as the luxury market looks increasingly oversupplied.

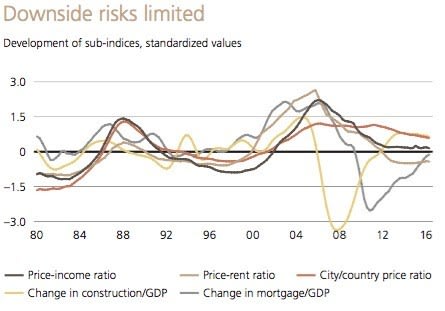

A historically fair valuation, wage growth and low interest rates are supportive and should limit downside risk for the broader housing market, the UBS report predicts.