Sydney, Melbourne, Canberra home values on the up: CoreLogic

CoreLogic's latest capital city housing market indicator has found Sydney home values increased by less than 4 percent over the past three months, Melbourne's by 3.4 percent and Canberra up by 1 percent.

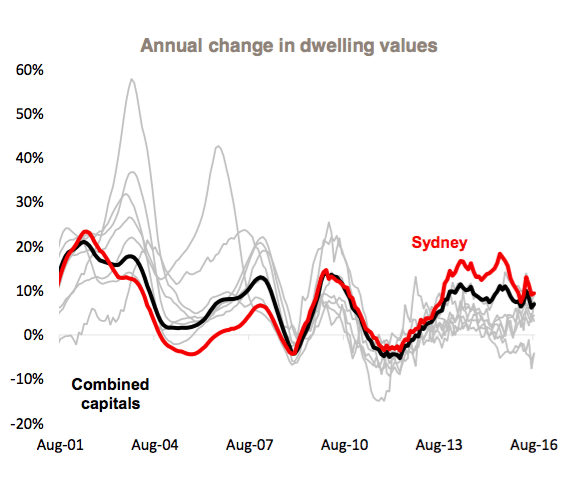

Sydney home values have increased by 3.9 percent over the past three months and are 9.4 percent higher over the past year. The annual rate of value growth has slowed from a peak of 18.4 percent in July 2015

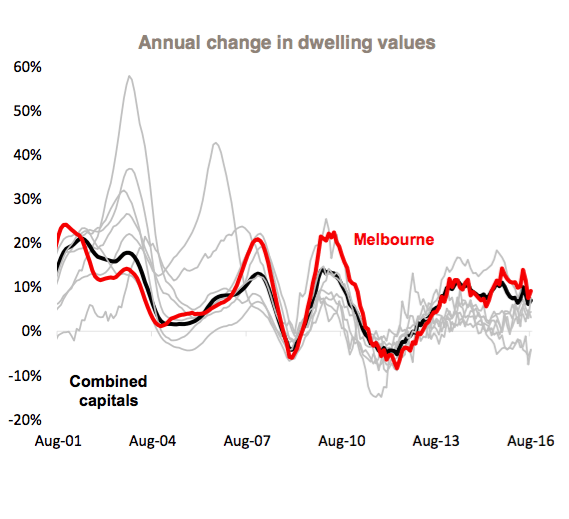

Melbourne home values have increased by 3.4 percent over the past three months and are 9.1 percent higher over the past year. The annual rate of value growth has slowed from a peak of 14.2 percent in September 2015

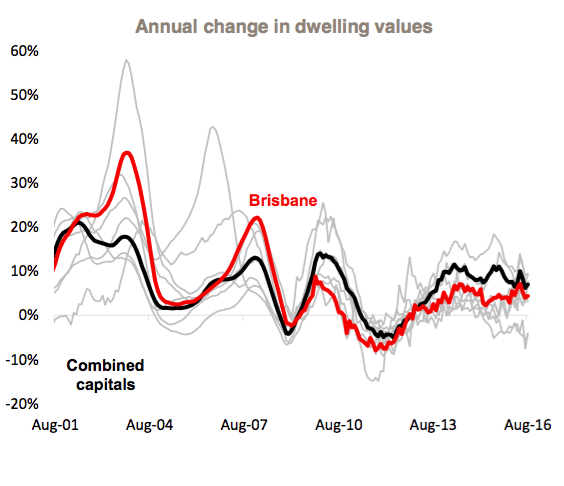

Brisbane home values have fallen by 05 percent over the past three months and are 4.4 percent higher over the past year. Over the past five years, Brisbane home values have increased by a total of 12.2 percent.

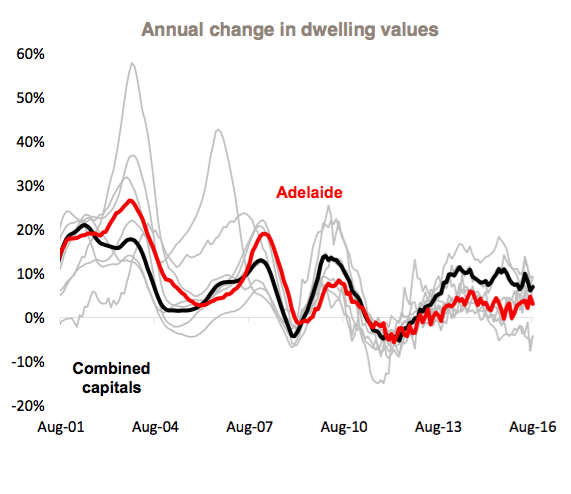

Adelaide home values have fallen by 0.8 percent over the past three months and are 3.1 percent higher over the past year. Values have increased by just 7.0 percent over the past five years.

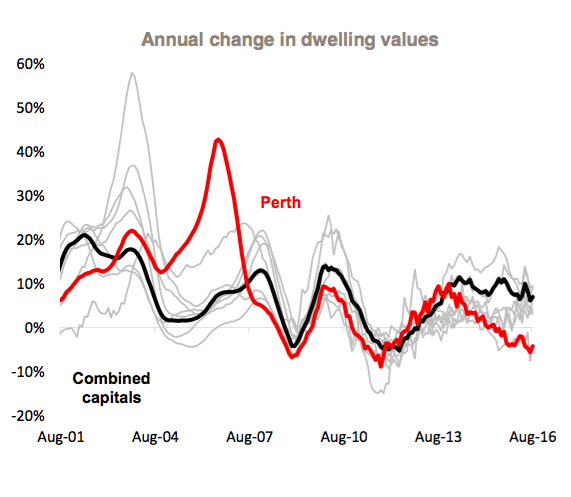

Perth home values have fallen by 1.5 percent over the past three months and are 4.2 percent lower over the past year. Values have fallen by 8.1 percent from their peak in December 2014.

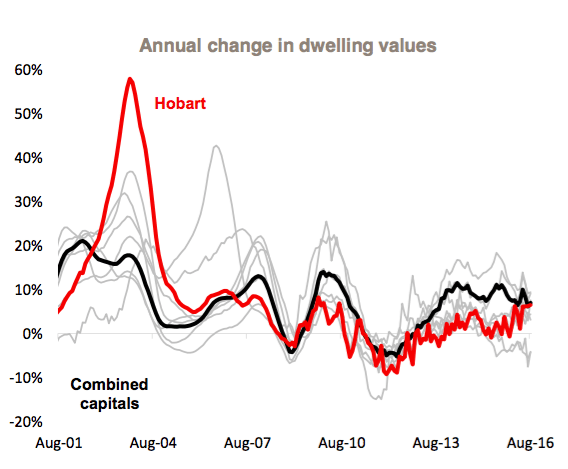

Hobart home values have increased by 2.0 percent over the past three months and are 6.5 percent higher over the past year. Values have increased by just 14.1 percent over the past 10 years.

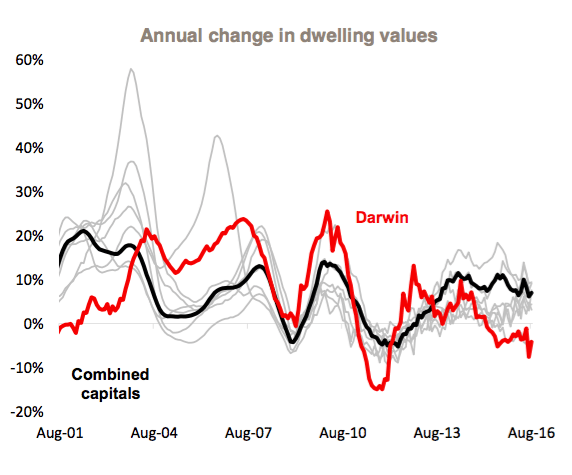

Darwin home values have fallen by 3.9 percent over the past three months and are 4.2 percent lower over the past year. Values are currently 9.1 percent lower than their recent peak in May 2014.

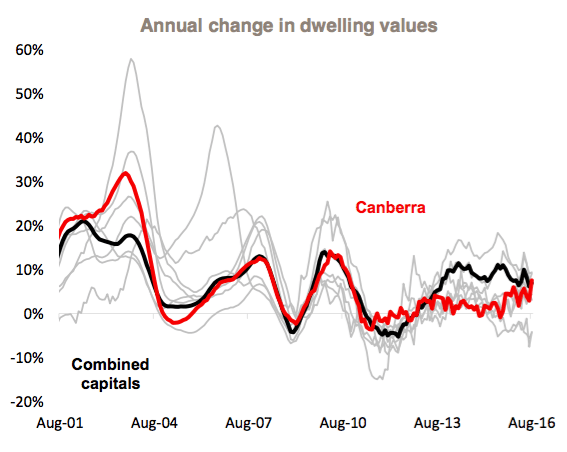

Canberra home values have increased by 1.0 percent over the past three months and are 7.6 percent higher over the past year. Values have increased by just 12.6 percent over the past five years.