Rural returns and land values: HTW's Tim Lane

GUEST OBSERVER

The continuing question of what return a rural property can demonstrate has been the source of many discussions between valuers, investment managers and accountants involved in financial modelling of rural assets.

Buyer motivation, data access and credibility, commodity and seasonal fluctuations are among the variables that influence a decision about how much someone will pay for an asset.

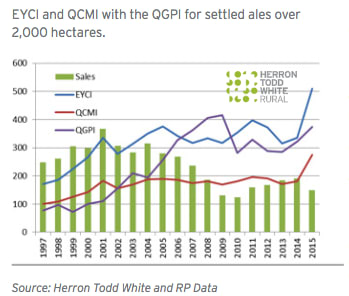

So while a complex calculation can be built, I asked my research guy Rick, if he could simply overlay the Eastern Young Cattle Indicator (EYCI) and Queensland Cow Market Indicator (QCMI) across the Queensland Grazing Property Index (QGPI) as reported annually by Herron Todd White and see what came up.

The result is per the graphic below and it reveals a very interesting story.

EYCI and QCMI with the QGPI for settled ales over 2,000 hectares

For the period 1997 to 2004 the result reflected that the land values moved in line with, but six months behind the underlying commodity movements with a high conviction.

From 2004 to 2009 however the value of rural land growth to the peak of the market in 2009 was significant with values increasing 62% on the median price in the five years, the ECYI decreasing 15.5% and the QCMI decreasing 10.6%. In other words the driver of land value was not reflective of the commodity return. This disconnect was also highlighted in the QRAA Rural debt surveys in 2009 and 2011.

From 2009 to 2013 the conviction between the land value and commodity return come back into relative alignment, but largely because of the fall in values not the rise in commodity prices.

2014 and 2015 then show the impact of the significant shift in the beef pricing and subsequent impact on land values. The rate of growth in the curve for the EYCI and QCMI is as sharp as at any point in the past 20 years which is no surprise for those in the industry. The jump in land values however is possibly more of a surprise.

So the question then moving forward for all stakeholders is what is the sustainability of the commodity market pricing relative to current sale yard, processor grids and live export pricing? There are potential risks out there (Indian frozen buffalo, Brazil exports etc) that could place a cap on prices and possibly see a reduction in the market place. If this were to occur, the logical view would be that the land values if still following the lag period would adjust accordingly or at least flatten out.

I have recently presented to a few banks and corporate clients and commented that the rapid rise in values in some sense has actually in my mind brought time forward. Where we thought the values may get to in say 2018 have been achieved in 2015 and 2016. The shift has been good for vendors and agents are reporting across the country that it is harder to find or list assets relative to the demand currently. Does the market settle a bit to draw breath or does demand see another level of value shift in land? Only time will tell.

Conclusion: Forecasting the land value movements based on the commodity price overlay which has a six month lag may be a good guide to looking at least into the short term land market values. This assumes the conviction between the commodity outlook and the land values remains high. Of course valuers are not there to forecast or predict the future. They deal with settled sales evidence in a consistent manner of analysis so that our clients have a consistent reference for the conclusions drawn.

The Australian Farm Institute has for its winter edition sought to investigate this question and I was fortunate enough to be asked to contribute to the discussion.

For those interested in reading the five articles from industry and educational institutions, go to the website www.farminstitute.org.au and you can subscribe to the journal. The process of writing this article was good in that it really challenged me to look nationally for information and data to see where the value relationship to land and returns sits based on settled sales over many years.

Tim Lane the national rural director at HTW and can be contacted here.