Leading Index consolidates further: Westpac's Bill Evans

GUEST OBSERVER

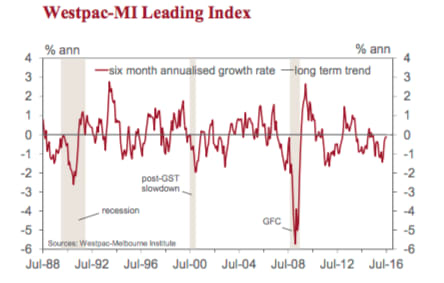

The six month annualised growth rate in the Westpac- Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, rose from –0.15 percent in June to –0.12 percent in July.

The signal from the reading for the Index in July is consistent with the message from June.

While the growth rate of the Index remains below zero, indicating a continuation of the below trend momentum seen over the last 15 months, it has improved significantly since the start of the year. Indeed, this latest reading suggests growth over the next three to nine months will be almost around trend. That outlook is more consistent with Westpac’s forecast for growth holding steadily around a 3 percent pace over the course of both this year and next year.

The Leading Index growth rate has lifted from being 0.92% below trend in February to 0.12 percent below trend in July.

The main contributors to this growth improvement are: commodity prices (+0.64ppts); the sharemarket (+0.52ppts); US industrial production (+0.19ppts); and dwelling approvals (+0.04ppts). Partially offsetting these improvements have been a deterioration in aggregate monthly hours worked (–0.40ppts); the Westpac MI Consumer Sentiment Expectations index (–0.10ppts); and the Westpac –MI Unemployment Index (–0.06ppts). The yield curve spread exerted slightly more downward pressure over the period (–0.03ppts).

In assessing the components of the Index that have contributed to the lift since the start of the year, improving international conditions have been largely responsible for the result. These components (the share market, commodity prices and US industrial production) have been consistently supportive despite global shocks and uncertainties particularly associated with ‘Brexit’; the US election; Fed interest rate policy; and China’s efforts to deal with a structurally slowing economy.

The Reserve Bank Board next meets on September 6. Having, as expected, cut rates at its August meeting to 1.5 percent we expect that it will hold rates steady next month.

Markets are not anticipating another move until November. At this stage we expect rates will be held steady in November. The two recent rate cuts have been in recognition of the sharp downgrade in the inflation outlook. No improvement can be expected in that outlook although the September quarter inflation report is likely to confirm that prospects for a further deterioration in the inflation environment are limited.

Momentum in the domestic economy, particularly around the labour market, is likely to improve over the next few months. Furthermore, developments in the commodity markets and the outlook for US interest rates are likely to take some pressure off the Australian dollar allowing the Reserve Bank to be patient.

BILL EVANS is chief economist of Westpac.