June increase for new home lending: HIA

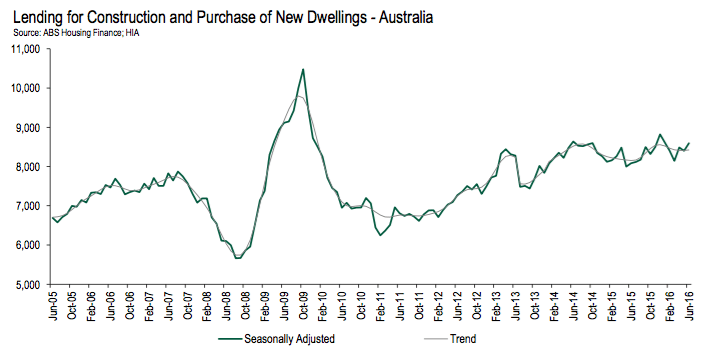

Figures from the ABS show a healthy rise in home lending finance during June, according to Shane Garrett, senior economist for the Housing Industry Association.

In June 2016, the number of loans to owner-occupiers for dwelling construction rose by 2.1 percent, seasonally adjusted, while loans for new homes grew 2.7 percent.

New home lending volumes went up by 2.3 percent over the month and 6.3 percent higher than June 2015.

Shane Garrett, HIA senior economist said the RBA cut its interest rate at the beginning of May so June’s housing finance results are the first month’s data to fully capture the effect of cheaper mortgage costs.

“Encouragingly, prospective homebuyers seem to have taken advantage of the lower interest rate environment as evidenced by today’s positive results for new home lending,” he said.

“June was also dominated by the close federal election campaign which was the source of some uncertainty across the economy. Today’s data indicate that the benefits of lower interest rates trumped any reluctance by buyers to enter the market during the tight election race. It’s therefore likely that last week’s interest rate cut will help bolster activity on the new home building side."

Loans to owner occupiers constructing or purchasing new homes increased in a number of states over the year to June 2016 when compared to the same period last year. The strongest growth was in Victoria (19.1 percent) New South Wales (10.8 percent) and Queensland (4.3 percent). Falls were recorded in Western Australian (20.7 percent), and the Northern Territory (17.7 percent) and Tasmania (3.5 percent).