Weaker housing approvals, trade deficit blowout: CommSec's Savanth Sebastian

GUEST OBSERVER

A weaker set of economic results. A modest slide in the number of dwelling approvals, and a substantial rise in the trade deficit. The only positives to be taken out of the data related to the rise in the value of building approvals. Overall there is nothing in the data to stop the Reserve Bank from cutting interest rates if they deem it necessary.

The housing sector continues to bubble along at a healthy pace. Home prices remain resilient despite changes in regulation and tighter lending standards that have been adopted by the banking sector. Importantly the pipeline of new building will continue to support broader-based economic growth over the coming 12-18 months.

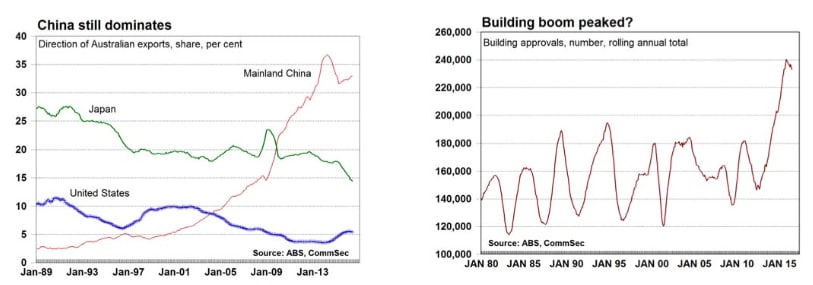

Over the past year 233,246 new homes were approved, easing further from the record high 240,842 in the year to October 2015. The anticipated lift in housing supply should ensure a more balanced environment – in essence house price growth is likely to be more contained over the medium term.

The housing sector isn’t the hotly contested issue it was a year ago, but still the Reserve Bank will keep a close eye on the sector, particularly in Sydney and Melbourne.

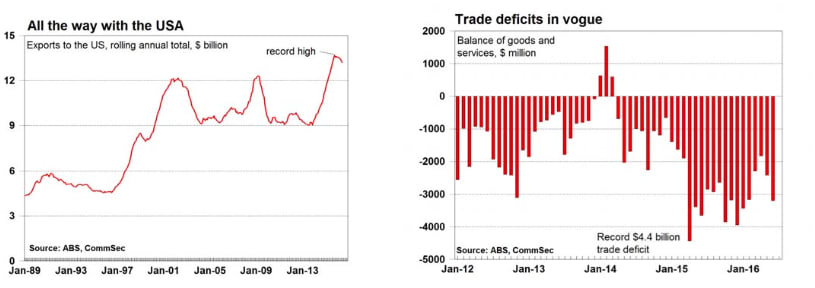

The trade accounts remain firmly in the red. Not only have the trade accounts been in deficit for over two consecutive years, but the 12-month rolling annual deficit came in at a sizeable $35.7 billion. However the trade data doesn’t have the impact on the currency that it once did.

What do the figures show?

Building Approvals:

Dwelling approvals fell by 2.9 per cent in June after falling by 5.4 per cent in May. In trend terms, approvals fell by 0.9 per cent in June.

Over the past year 233,246 new homes were approved, easing further from the record high 240,842 in the year to October 2015.

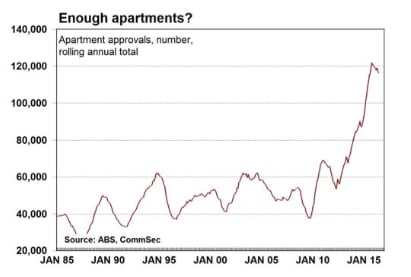

House approvals fell by 2.4 per cent in June after a 0.5 per cent rise in May (private sector fell by 2.3 per cent). Meanwhile ‘lumpy’ apartment approvals fell by 3.4 per cent in June after falling by 10.7 per cent in May. Private sector apartment approvals fell by 2.4 per cent in June.

Dwelling approvals in June were down 5.9 per cent on a year ago with house approvals down 5.5 per cent while apartments are down by 6.3 per cent.

Across states and territories in June: NSW (-4 per cent); Victoria (+4.1 per cent); Queensland (-2.1 per cent); South Australia (-12.3 per cent); Western Australia (+2.4 per cent); Tasmania (-23.6 per cent). In trend terms, approvals rose by 3.6 per cent in the Northern Territory and by 2.8 per cent in the ACT.

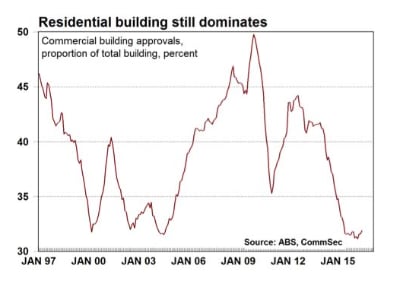

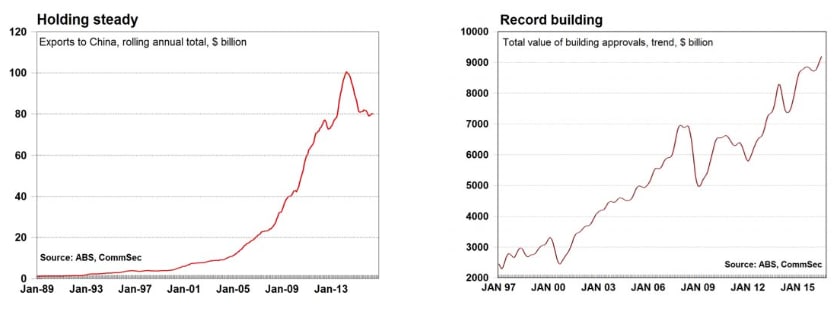

The value of all commercial and residential building approvals rose by 5.3 per cent in June after falling by 10.7 per cent in May. Residential approvals fell by 1.5 per cent with new building down by 1.2 per cent while alterations & additions fell by 3.8 per cent. Commercial building rose by 20.8 per cent in June to be up 18.8 per cent on a year ago.

International trade:

Australia’s trade deficit widened from $2.42 billion in May to $3.2 billion in June. It was the 27th consecutive monthly deficit. The rolling 12-month deficit eased from $36.2 billion to a 7-month low of $35.7 billion.

In June, exports of goods and services fell by 0.8 per cent (goods down 1.1 per cent) while imports of goods and services rose by 2 per cent (goods up 2.6 per cent). Exports are down 0.9 per cent on a year ago, while imports are down by 2.3 per cent.

Within imports, consumer imports rose by 7.4 per cent with capital goods imports up by 2.9 per cent while intermediate goods imports fell by 1.1 per cent.

Consumption goods imports are up 8.9 per cent on a year ago while capital goods imports are up 8.6 per cent and intermediate goods imports are down by 18 per cent.

Australia's annual exports to China stood at $80.1 billion in the year to June. Annual exports were down 1 per cent on a year ago. Exports to China accounted for 32.9 per cent of Australia's total exports.

Australia's annual imports from China eased from $61.4 billion to $61.3 billion in the year to June, up 7.6 per cent on a year ago. Imports from China accounted for 23.3 per cent of Australia's total imports.

Australia's rolling annual trade surplus with China held near recent 5-year lows. The annual trade surplus was $18.7 billion in June – but well down from the record high of $51.2 billion set in April 2014.

Australia annual exports to the US eased from $13.3 billion to $13.2 billion in the year to June and down from a record high of $13.69 billion in the year to October 2015. The share of annual exports going to the US eased from a 7-year high of 5.5 per cent to 5.4 per cent.

Australia’s annual exports to India eased further from the two-year high of $10.34 billion set in the year to December 2015 to $9.52 billion in the year to June.

What is the importance of the economic data?

The Bureau of Statistics' monthly Building Approvals release contains figures on local council approvals to build residential structures such as homes and units as well as commercial premises such as offices and shops. Approval is one of the first stages of the construction ‘pipeline’ and is thus a key leading indicator of future activity. An increase in approvals would point to stronger future activity for construction-related companies.

The monthly International Trade in Goods and Services release from the Bureau of Statistics provides estimates on exports and imports of physical goods (such as coal, beef and computers) and services (such as travel receipts). The balance of goods and services (BOGS) is a narrower description of Australia’s external position than the current account estimates. The import data is a useful gauge of consumer and business spending while exports reflect global demand as well as domestic influences such as drought.

What are the implications for interest rates and investors?

While new council approvals to build new homes appear to have peaked, activity levels are still healthy. But now investors and builders need to do more research to ensure that the projects they are interested in remain viable with competing projects. There is certainly potential for indigestion in certain towns and regions as new projects are completed and the stock is absorbed.

The Reserve Bank will closely monitor developments in China and financial markets more generally. Encouragingly the Reserve Bank has plenty of firepower to provide stimulus to the economy, especially given the low inflation environment.

Savanth Sebastian is an economist for CommSec