Rental yields at record low with dwelling values at record high: July CoreLogic index

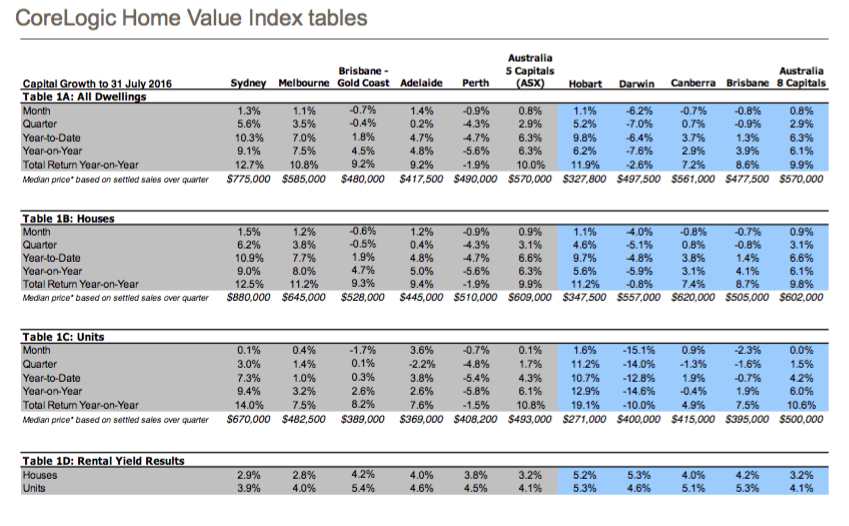

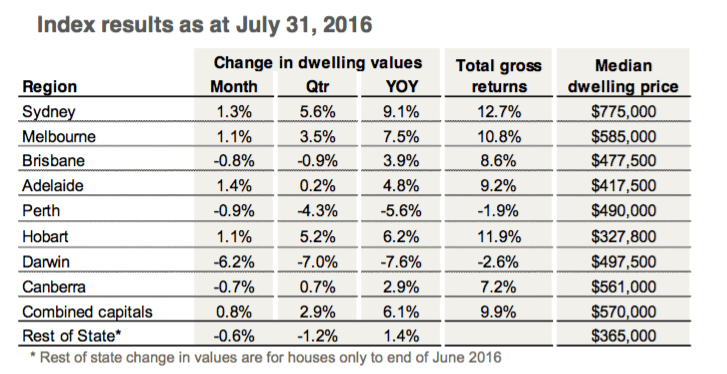

Home values rose 0.8 percent over July, with the combined capital city dwelling values some 6.3 percent high over the first part of the year according to the July CoreLogic Hedonic Home Value Index.

Four capital cities recorded a fall in dwelling values over the month with capital city rents down over the month, some 0.6 percent lower over the past twelve months.

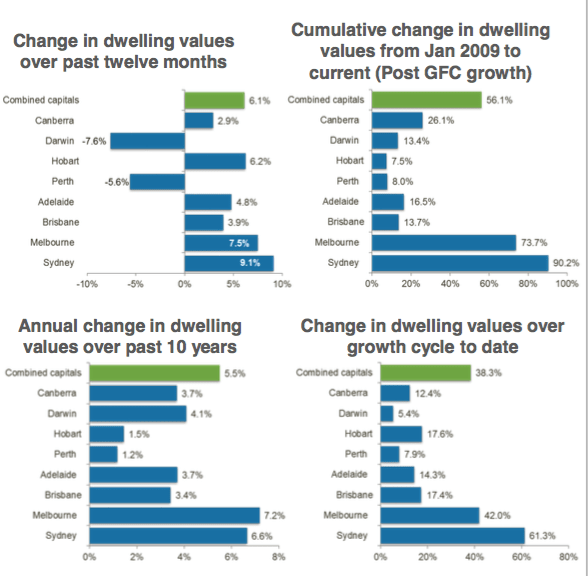

Sydney and Melbourne have also seen the annual rate of growth slip back to below 10 percent, with the July indices showing a respective 9.1 per cent and 7.5 per cent capital gain over the past twelve months according to CoreLogic head of research Tim Lawless.

He said these figures demonstrate the strength in the Sydney and Melbourne growth trend with dwelling values across the two largest capitals recording a cumulative 61.3 percent and 42.0 percent over the cycle to date.

“The recent moderation in the rate of capital gains should be viewed as a positive sign that growth in dwelling values may be returning to more sustainable levels. However, the growth trend rate is still tracking considerably faster than income growth resulting in a deterioration of housing affordability,” he said.

“Using Sydney as a case in point, the Australian National University estimates that Sydney household incomes have grown by approximately 4.5 percent per annum since June 2012 while dwelling values are up 12.1 percent per annum.

“The erosion in housing affordability is likely to be one factor working to slow housing demand across price sensitive market segments. We’re also seeing first home buyers are at lower levels across most states, and in particular, at record low levels of participation across Sydney. The latest ABS housing finance data shows that first home buyers in New South Wales now comprise of a record low 10.4 per cent of all new owner occupier housing finance commitments.

“The latest growth in dwelling values comes at a time when rental conditions remain soft. Capital city rents were down again over the month to be 0.6 per cent lower over the past twelve months.

"The recent fall in weekly rents has pushed capital city rental yields to a new historic low of 3.3 percent with Melbourne now recording the lowest gross yield for houses at 2.8 percent, while Sydney now shows the lowest yield profile for units, averaging 3.9 percent gross.

"If the pace of capital gains continues to trend lower, low rental yields are likely to lead to financing challenges due to tighter serviceability requirements and the impact on cash flow, not to mention a potential increase in rental supply resulting in higher vacancy rates.”