Time to buy dwelling index dips: Westpac consumer sentiment update

The ‘time to buy a dwelling’ index declined 2.7 percent following a 12.1 percent surge in May according to the Westpac–Melbourne Institute Consumer Sentiment report for June.

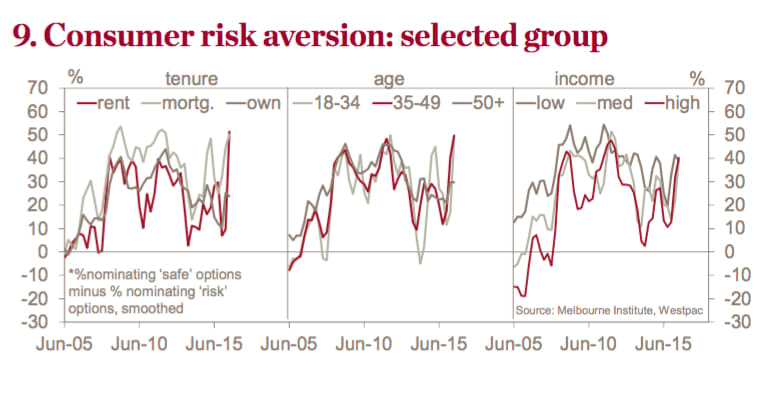

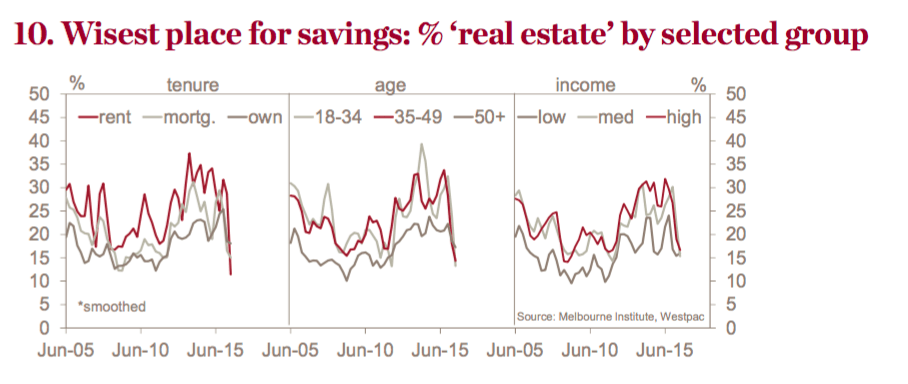

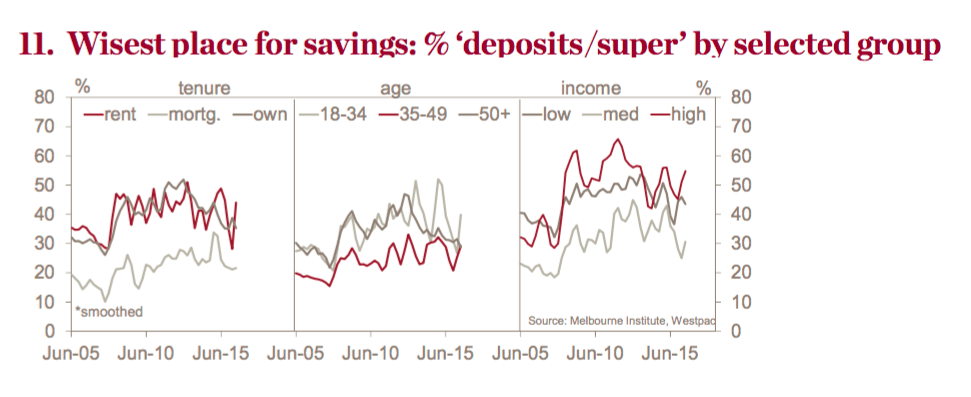

The report found a rise in risk aversion driven by a sharp drop in the number of consumers favouring ‘real estate’ as the wisest place for savings towards ‘deposits’.

The biggest rise has been among 18-34 year old’s, renters and those on annual incomes of $60-100k, noted the report.

"Conversely, risk aversion has actually eased slightly for those aged over 55, those on low incomes, and those who own their homes without a mortgage," it said.

"The detail suggests views on ‘real estate’ are at the heart of the risk averse move with potential changes to tax policy the likely catalyst. The sub-groups driving the move are those that would be broadly seen as ‘prospective home buyers’.

"This in turn suggests the move could well reverse if next month’s Federal election results in no change.

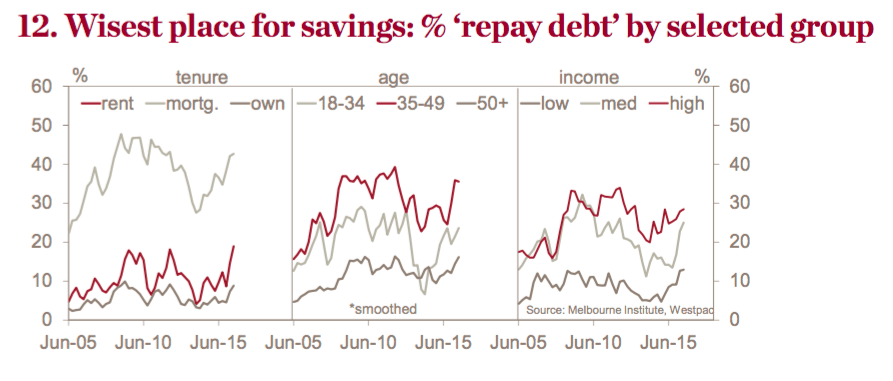

"Renters show a particularly sharp fall in the proportion favouring ‘real estate’ but with corresponding rises more evenly split between ‘deposits/super’ and ‘repay debt’.

"The skewed move towards ‘repay debt’ is even more pronounced for those on middle incomes but less so for 18-34 year olds."

"The sub-groups that have seen risk aversion ease reported smaller falls in the proportion favouring ‘real estate’ and tended to see little or no change in proportions favouring ‘deposits/super’ but a slightly higher proportion favouring ‘repay debt’. "