Economic uncertainty is filtering into global house prices: Knight Frank

Knight Frank's Global House Price Index for Q1 2016 reports Asian markets are stumbling.

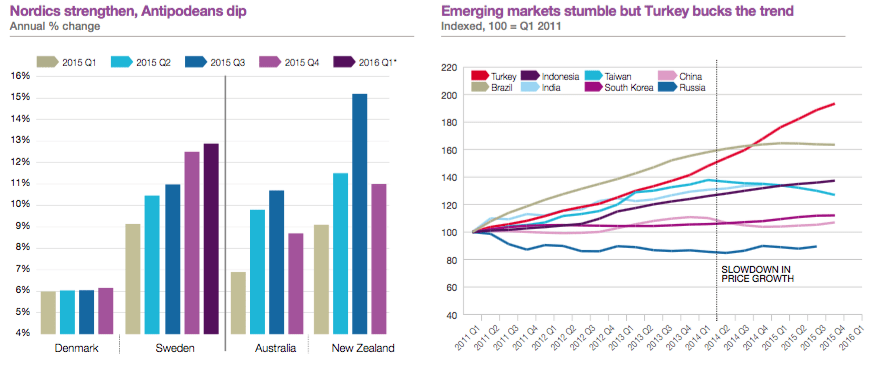

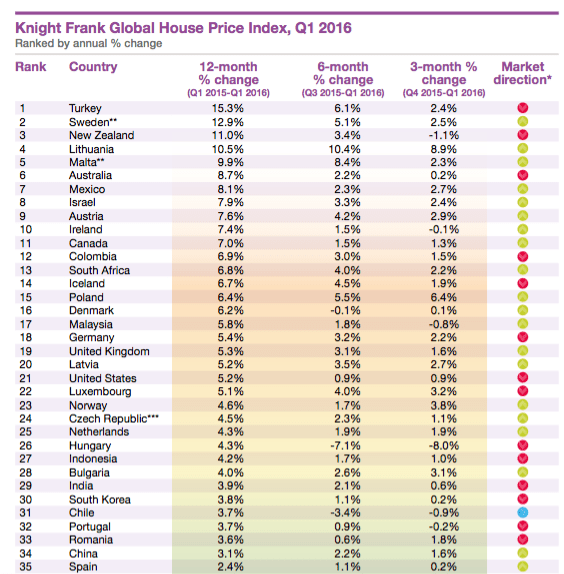

In the 6th position on the index, house prices in Australia increased 8.7 percent year-on-year, down from the 4th position in the previous quarter, although growth is still trending above the 10-year annual average of 4.2 percent. Looking back, the last previous low of 5.1 percent annual growth for houses was recorded in January 2014.

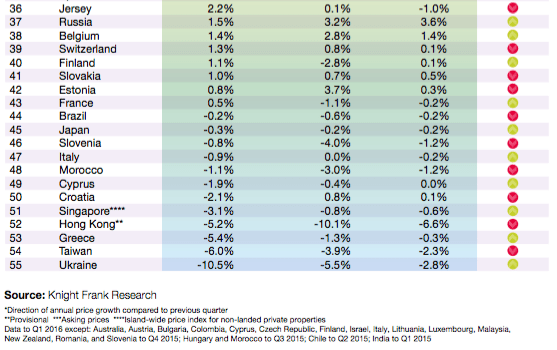

Singapore, Hong Kong and Taiwan have all seen prices decline by between 3 percent and 6 percent in the year to March 2016, a combination of sluggish economic growth, regulatory measures and new supply are restraining price growth.

Nicholas Holt, Head of Research for Asia Pacific, says the slowdown in growth across many emerging Asian economies has weighed on residential property markets.

Indonesia and Malaysia are feeling the impact of the wider macro-economic slowdown.

India continues to suffer from pockets of oversupply and a gap in pricing expectations between developers and buyers.

"The Chinese market is still seeing polarised performance, where Tier-1 and large Tier-2 cities are seeing price growth; whilst smaller Tier-2 cities, Tier-3 and Tier-4 cities are struggling with high unsold inventory.”

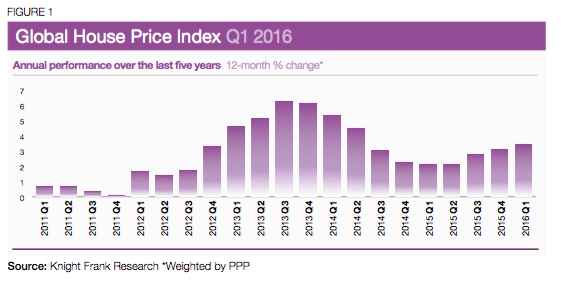

The index grew by 3.4 percent on average in the 12 months to March 2016, but top performing countries such as Australia are seeing their rate of annual price growth slow.

According to Michelle Ciesielski, Director, Residential Research Australia the overall growth in annual capital values has returned to more sustainable levels in 2016 – close to that experienced just over two years ago in the Australian mainstream housing market.

“Despite confidence from better-than-expected GDP growth in the March 2016 quarter (to 3.1 percent), a fall in unemployment (to 5.7 percent) together with the cut of 25 bps to the official cash rate in May 2016 to 1.75 percent, it is possible we will see a further uptick in investor lending, and modest growth in capital values along the Australian east coast in the coming months.

“However, it is unlikely we will see price growth as strong as experienced in the peak of mid-2014 and late-2015.”

Kate Everett-Allen, Partner, International Residential Research, noted the US and the UK are largely treading water, price growth in the first three months of 2016 equated to 0.9 percent and 1.6 percent respectively, linked in part to political worries, notably potential Brexit in the UK and the US presidential election.

House prices in New Zealand increased 11 percent year-on-year but have slipped marginally from their peak in Q3 2015.

Weaker economic growth and regulatory changes in the form of higher deposits for investors have dampened demand.