April housing finance shows first home buyers up slightly: ABS

The ABS April housing data suggests first home buyers are re-emerging, possibly filling the void of investors.

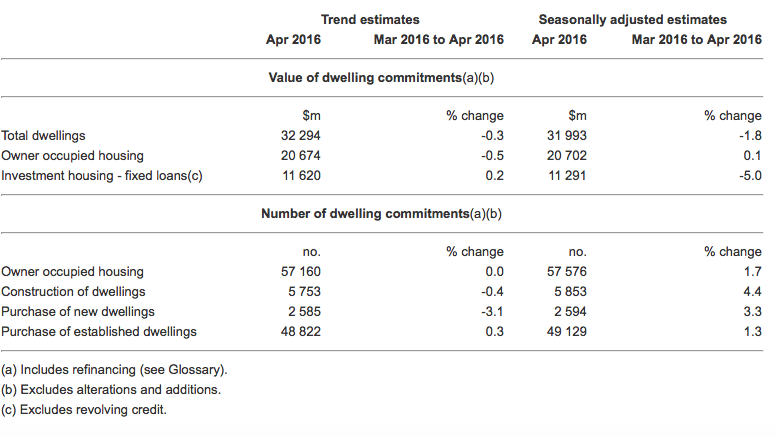

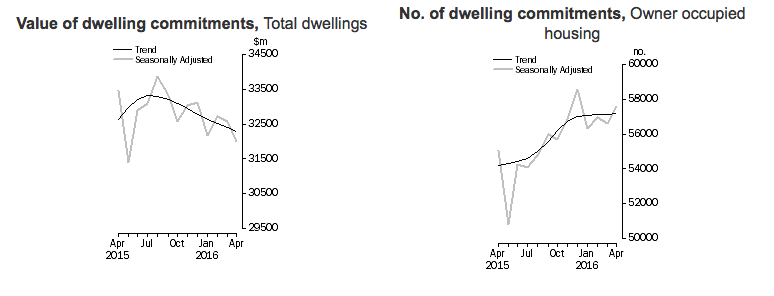

The value of lending to Australian housing investors fell in April, according to figure released by the Australian Bureau of Statistics (ABS) earlier today.

The value of investor lending was down 5 percent from March to $11.291 billion in seasonally adjusted terms.

The value of new lending to owner-occupiers ticked up by 0.1% to $20.702 billion.

The number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 14.4 percent in April 2016 from 14.2 percent in March 2016.

Between March 2016 and April 2016, the average loan size for first home buyers rose $1,900 to $330,600.

The average loan size for all owner occupied housing commitments rose $4,300 to $361,500 for the same period.

At the end of April 2016, the value of outstanding housing loans financed by Authorised Deposit-taking Institutions (ADIs) was $1,490b, up $8b (0.5%) from the March 2016 closing balance.

Owner occupied housing loan outstandings financed by ADIs rose $7b (0.7 percent) to $960b and investment housing loan outstandings financed by ADIs rose $0.9b (0.2 percent) to $530b. Bank housing loan outstandings rose $7b (0.5 percent) during April 2016 to reach a closing balance of $1,448b.

Owner occupied housing loan outstandings of banks rose $6b (0.7 percent) to $927b and investment housing loan outstandings of banks rose $0.9b (0.2 percent) to $521b.

Between March 2016 and April 2016, the number of owner occupied housing commitments (trend) rose in Victoria (up 51, 0.3 percent), South Australia (up 19, 0.5 percent) and the Australian Capital Territory (up 7, 0.7 percent), while falls were recorded in New South Wales (down 50, 0.3 percent), Queensland (down 24, 0.2 peace t), Western Australia (down 13, 0.2 percent), Tasmania (down 10, 1.2 percent) and the Northern Territory (down 2, 0.6 percent).

The seasonally adjusted estimates rose in Victoria (up 314, 1.9 percent), Queensland (up 156, 1.5 percent), New South Wales (up 128, 0.7 percent), Tasmania (up 71, 8.4 percent), the Northern Territory (up 22, 7.3 percent), Western Australia (up 17, 0.3 percent) and South Australia (up 7, 0.2 percent), while a rise was recorded in the Australian Capital Territory (down 10, 0.9 percent).

The ABS housing finance figures released today indicated that new home lending to owner occupiers experienced solid growth during April, said the Housing Industry Association.

During April 2016, the number of loans to owner occupiers for dwelling construction increased by 4.4 per cent with loans for the purchase of new homes rising by 3.3 per cent.

Overall, new home lending saw growth of 4 per cent during the month but was 5.9 per cent lower than a year earlier.

“Today’s official figures confirm that demand for new home purchase across Australia remains very strong,” remarked HIA senior economist Shane Garrett.

“Even though the amount of new home lending for owner occupiers peaked over a year ago, current loan volumes remain elevated by historic standards.

"This means that activity on the ground over the remainder of 2016 will be healthy,” predicted Shane Garrett.

“May’s interest rate reduction is likely to provide some impetus to new home lending over the coming months."