Sydney's surprise 6.6 percent quarterly surge: CoreLogic RP Data Hedonic Home Value Index

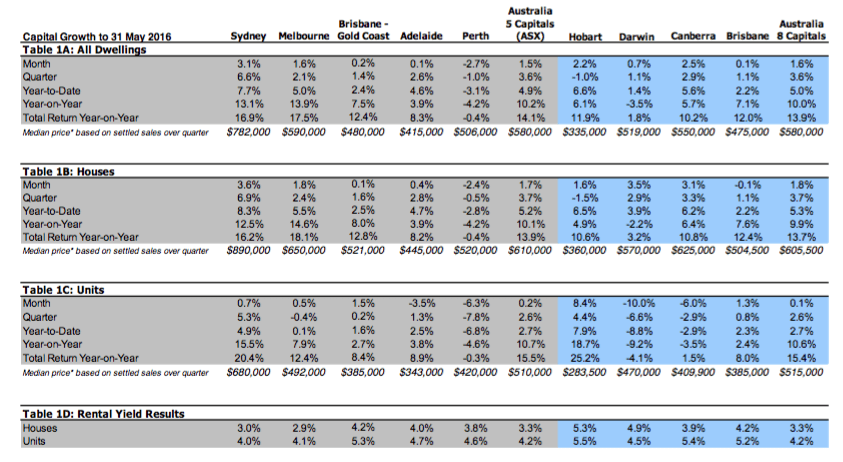

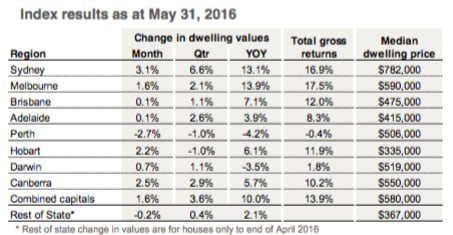

Dwelling values across the combined capital cities of Australia rose by 1.6 percent in May, according to CoreLogic RP Data.

According to the CoreLogic Hedonic Home Value Index Results, released today, the strong May numbers were largely the result of a surge in Sydney dwelling values which were up 3.1 percent over the month and 6.6 percent over the quarter.

CoreLogic state arise of more than 1 percent month-on-month was also recorded in Melbourne (1.6 percent), Canberra (2.5 percent) and Hobart (2.2 percent).

Perth was the only city to record a fall in dwelling values over the month, down 2.7 percent.

The annual rate of growth has moved substantially higher to reach 13.1 percent per annum after reaching a recent low point of 7.4 percent per annum growth over the 12 months ending March 2016.

Despite Sydney’s bounce in the trend rate of growth, Melbourne’s housing market is still recording the highest annual rate of capital gain at 13.9 percent.

CoreLogic head of research Tim Lawless said the high rate of auction clearance has demonstrated a remarkable bounce back after tracking below 60 percent during December with Sydney’s auction market recording a clearance rate as low as 52.9 percent in December.

“The extent to which investors are fuelling the latest surge in Sydney home values is difficult to quantify, however housing finance data to March shows investors, as a proportion of all new mortgage commitments, have been trending higher since reaching a recent trough in November last year at 42.9 percent. The March data shows investors now comprise of 47.6 percent of all new mortgage commitments which is the highest proportional reading since August last year," he said.

“Anecdotal evidence suggests investor numbers may have increased further from this time, with some lenders reversing the tighter lending requirements that were previously in place for investment purposes as growth in investor related credit tracks well under the APRA speed limit of 10 percent per annum.

“Lower mortgage rates are likely to have a positive effect on consumer confidence and housing market conditions, with the standard variable mortgage rate now at its lowest level since 1968.

“While the annual pace of growth has clearly reversed direction on the latest few months of data, the trend is still relatively fresh and may be short-lived.

“Despite lower mortgage rates in May, lending conditions are tighter now than they were a year ago. Recent data from APRA highlights that interest only lending is now at its lowest level since March 2013 and new mortgages with an LVR (loan to value ratio) higher than 90 percent are at the lowest reading since March 2011.

“With the federal election only a month away, we can expect housing to remain in the spotlight more than usual."