Internet, agriculture lead industry gains: CommSec's Craig James

GUEST OBSERVER

Industry data: The ABS has released performance data for Australian industry sectors in the last financial year.

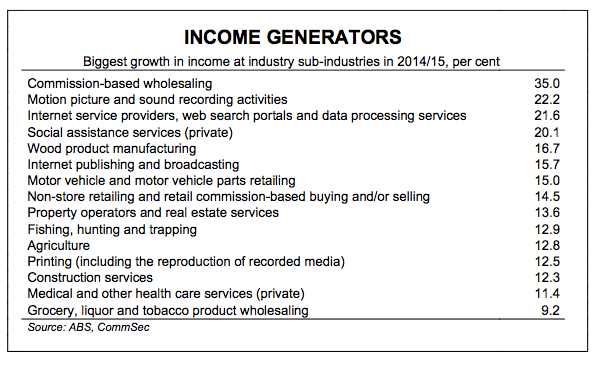

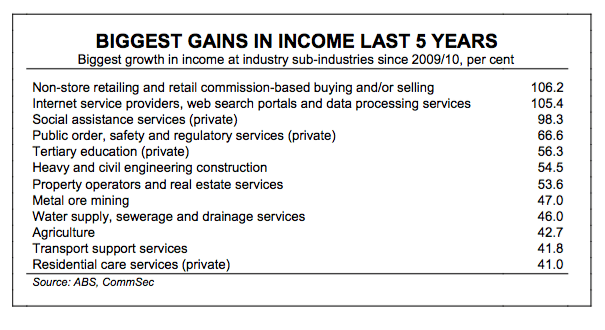

Leading the gains in income growth in 2014/15 was “Commission-based wholesaling” (up 35 per cent). Over the past five years income in the “Non-store retailing and retail commission-based buying and/or selling” sector more than doubled as did income for “Internet service providers.”

Profitable companies: In 2014/15, 78.7 per cent of industries made a profit, up from 78.4 per cent in 2013/14 and 77.4 per cent of businesses in 2012/13.

The detailed data on regions and industries are important for businesses researching markets.

What does it all mean?

The shift away from bricks and mortar stores to online and non-traditional sellers stands out in the latest industry performance data. The biggest gain in income across the 80 sub-industries last financial year was by “Commission based wholesaling” (up 35 per cent). But internet service providers, internet publishers and “non-store retailing” (online stores) were represented towards the top of the income generators in 2014/15.

Over the past five years, again online retailers and internet service providers were amongst the industries recording the biggest gains in income.

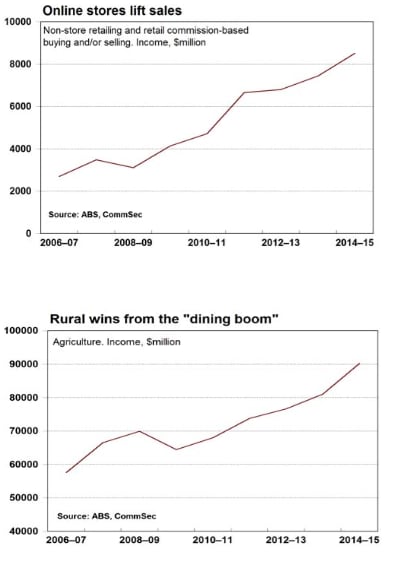

The rural sector has been amongst the broader winners over recent years. Since 2006/07, profits across the Agriculture sector have lifted almost 12 per cent a year with income growth averaging 6 per cent.

Overall the industry data confirms the health of Australia business with almost 79 per cent of operators making a profit in 2014/15.

What do the figures show?

In 2014/15, 78.7 per cent of industries made a profit, up from 78.4 per cent in 2013/14 and 77.4 per cent of businesses in 20 12/13.

In 2014/15, industry income rose by 1.5 per cent with expenses up 2.0 per cent. Earnings before income, tax, depreciation and amortisation rose by 4.3 per cent – the fastest gain in four years.

Industry value added lifted 2.9 per cent in 2014/15; employment rose by 0.5 per cent; wages and salaries rose by 2.3 per cent.

What is the importance of the economic data?

The Bureau of Statistics releases detailed data on industries and regions and general social surveys at regular points over time. The data is useful in gauging perspectives on the economy.

What are the implications for interest rates and investors?

Aussie businesses and consumers generally have a poor understanding of the best performing industry sectors. Many believe that Australia has little to offer apart from mining and despair about the state of the manufacturing sector.

Amongst the biggest income generators over 2014/15 were Agriculture (+11.3 per cent), Healthcare (+10.8 per cent, Rental, hiring and real estate services (+10.7 per cent) and Construction (+7.3 per cent). Mining income fell 14.6 per cent but total industry income still lifted 1.5 per cent.

Over the past eight years profits in the Agriculture sector have grown on average by 12 per cent with income growth averaging 6 per cent.

As our Agriculture strategist is fond of saying – Australia is well underway in moving from the mining boom to the dining boom, benefitting from Asian demand for our food and beverage products.

Craig James is the chief economist at CommSec.