GUEST OBSERVER

New business spending on buildings and equipment fell by 5.2 percent in the March quarter after an upwardly-revised 1.8 percent lift in the December quarter.

Spending on buildings fell by 7.9 per cent in the quarter while spending on equipment fell by 0.6 percent. Investment is down 15.4 percent over the year.

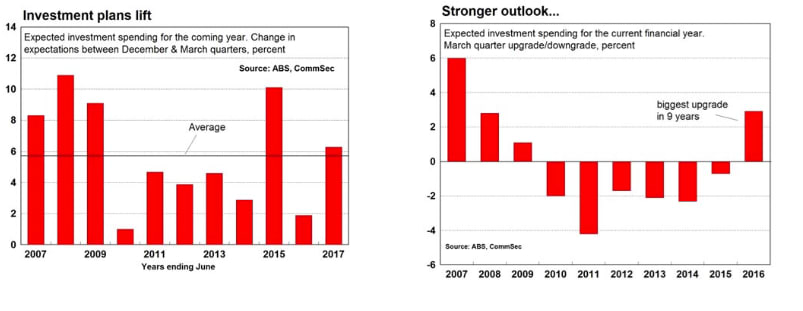

Best lift in spending plans in nine years: The sixth estimate for investment in 2015/16 is $126.82 billion, up 2.9 percent on the fifth estimate (December quarter) and the biggest upward revision in almost a decade.

Expected business investment in 2016/17: The second estimate of investment in 2016/17 is $89.2 billion, up 6.3 per cent on the first estimate and the second best lift for an equivalent period in eight years.

Sectors:

Mining investment fell by 12.0 percent in the March quarter (seventh straight decline), while manufacturing spending fell by 10.3 pe cent but spending by “other selected industries” rose by 1.8 percent.

The investment data is important for companies in mining services, construction, transport and other industrial sectors.

What does it all mean?

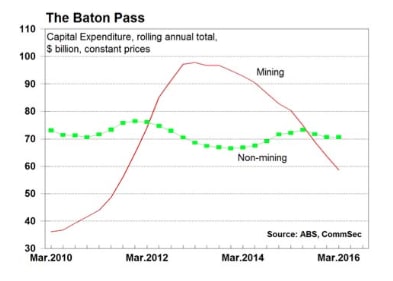

The unwinding of the mining construction boom is proceeding to plan. New investment in the mining sector is continuing to ease as the sector moves from the construction phase to production. Essentially new production capacity had to be put in place.

That has happened, and now businesses are going about the job of shipping higher volumes of iron ore, coal, gold and gas to other parts of the world.

Investment outside mining and manufacturing continues to lift although it is by no means going gangbusters. Over the past six months, investment outside of mining and manufacturing has lifted by over seven per cent. As the Reserve Bank Governor noted this week, what is required in Australia is more innovation and risk taking.

The encouraging aspect of the latest investment report is the upgrade to spending plans. Investment plans for the current year were revised up when they are usually revised

down at this time of the year.

And the near 3 per cent

upgrade in the quarter was the best in almost a decade. At

the same time the coming year’s investments plans were lifted by more than 6 percent.

You would expect that the budget measures for small and medium-sized businesses will further lift investment plans in the coming year.

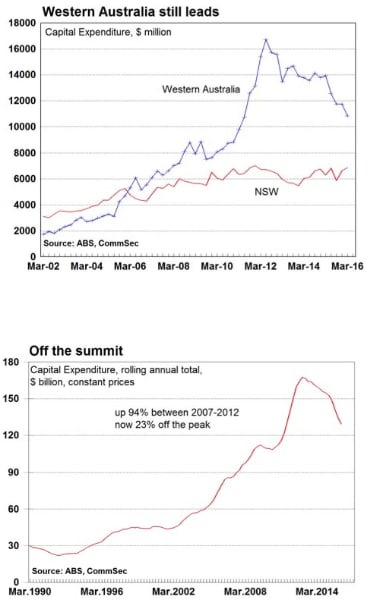

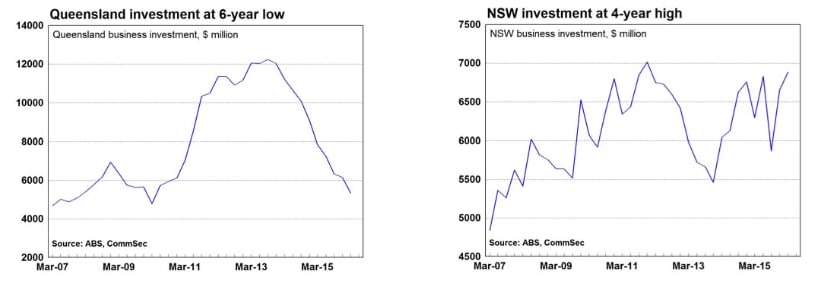

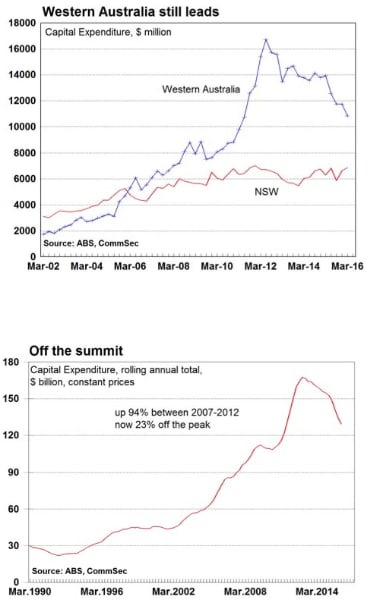

Investment in Queensland continues to slump, hitting 6- year lows. By contrast NSW investment is at 4-year highs.

The unwinding of investment in Queensland is progressing faster than that in Western Australia, which is a surprise. Despite easing over recent years, Western Australia still remains the investment powerhouse in Australia with investment spending more than 50 per cent higher than second-placed NSW.

What do the figures show?

Private business investment

Overall: New business spending on buildings and equipment fell by 5.2 percent in the March quarter after an upwardly-revised 1.8 percent lift in the December quarter.

Spending on buildings fell by 7.9 percent in the quarter while spending on equipment fell by 0.6 per cent. Investment is down 15.4 percent over the year with buildings down by 18.8 percent while equipment is down by 9.2 percent.

Sectors:

Mining investment fell by 12.0 per cent in the March quarter (seventh straight decline), while manufacturing spending fell by 10.3 per cent but spending by “other selected industries” rose by 1.8 per cent after a 5.3 per cent increase in the December quarter.

States:

In seasonally adjusted terms investment rose in just three of the eight states and territories in the March quarter. Investment rose the most in Tasmania (up 16.4 per cent to a near 3-year high), followed by NSW (up 3.4 per cent to 4-year highs). Investment fell most in the Northern Territory (down 17.5 per cent), followed by Queensland (down 13.0 per cent), ACT (down 12.5 per cent), Western Australia (down 7.6 per cent), South Australia (down 2.3 per cent) and Victoria (down 0.2 per cent).

Prices:

The overall deflator for investment goods fell by 0.4 per cent in the March quarter – the first fall in 31⁄2 years. The cost of buildings and structures fell by 0.4 per cent while the cost of equipment fell by 0.6 per cent. Over the year, the cost of investment goods rose by 1.5 per cent – the smallest gain in a year. The cost of buildings rose by 0.5 per cent while the cost of investment equipment rose by 3.1 per cent.

Forecasts:

The sixth estimate for investment in 2015/16 is $126.82 billion, up 2.9 per cent on the fifth estimate (December quarter) and the biggest upward revision in nine years.

The second estimate of investment in 2016/17 is $89.2 billion, up 6.3 per cent on the first estimate and the second best lift for an equivalent period in eight years.

What is the importance of the economic data?

“Private New Capital Expenditure and Expected Expenditure” is released quarterly by the Bureau of Statistics. The figures show both actual and expected spending by businesses on tangible assets such as new buildings, machinery and office equipment. The figures are obtained after sampling 8,000 private business units.

What are the implications for interest rates and investors?

The Reserve Bank had always expected that the unwinding of the mining construction boom would be an extended process. And it is turning out that way. But investment is lifting outside mining and manufacturing. And businesses are becoming more confident about spending money to boost future prospects for their operations.

The use of technology and productivity measures are allowing businesses to use equipment a little longer as well as making better use of offices and factories. So one reason that businesses aren’t lifting investment is because they are operating more efficiently. It is all about reducing costs in a low inflation world.

The Reserve Bank may cut rates again. Indeed we are factoring in a quarter per cent rate cut in August. One reason is because the Reserve Bank hopes that monetary policy still works to boost spending, investment and hiring. But also rate cuts are being considered because Australia is no longer the high inflation country it once was. Rates can fall closer to that in other advanced nations.

Craig James is the chief economist at CommSec.