Inner Brisbane apartments a huge draw with investors in spite of record supply: BIS Shrapnel

Inner Brisbane projects a picture of surging demand for off–the–plan apartments since 2013, creating record supply in future, while units rented out occupy a major share of all apartments in the area, according to the latest findings from research firm BIS Shrapnel.

Demand for Inner City apartments from investors shows little signs of abating in the short term despite its impact on rents, with completions to peak in 2016/17 at more than 7,000 apartments. Also, Brisbane's relative affordability compared with Sydney or Melbourne means more investors will choose Inner Brisbane apartments (IBA), says the paper titled Inner Brisbane Apartments Market Brief 2016.

The research focuses on indicators relating to demand, supply, rents and prices.

The major locations in Inner Brisbane to see developments on a large scale are CBD/Spring Hill, Inner East, Inner North, West End, Toowong, Woolloongabba and Hamilton.

APARTMENT PROFILE

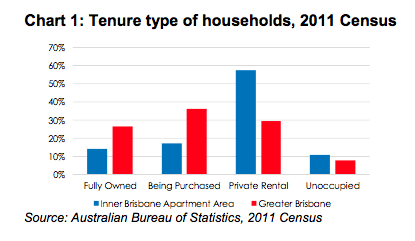

Rental apartments account for 58 percent of total apartments in the IBA area, considerably higher than the 29 percent share for all dwellings across Greater Brisbane. This highlights the preference of investors to purchase properties close to good transport links and major commercial, retail and entertainment centres, where tenant demand is likely to be greatest.

Owner occupied dwellings represent 31 percent of IBA area stock, with a slightly greater share of these having a mortgage (being purchased). Conversely, a significantly higher 63 percent of Greater Brisbane dwellings are owner occupied.

Unoccupied dwellings—those that are held as second homes or kept empty as a speculative investment— comprise 11 percent of total apartment stock in the IBA area, compared to 8 percent across Greater Brisbane. It is expected that this level will increase from 2014/15, given the level of overseas demand and the potential that many may be held and not released to the rental market.

DEMAND PROFILE

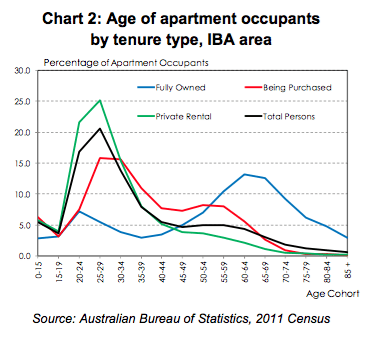

The age profile of apartment residents suggests that people first rent when moving into the IBA area, with 47 percent of occupants in rental households aged 20 to 29 years old. If people remain in, or move into, the IBA area beyond 30 years of age, there is a higher propensity to purchase an apartment.

Households with a mortgage are mostly younger, with 50 percent of people occupying an apartment being purchased aged 30 to 54 years old. Within fully owned apartments in the IBA area, the demographic is older, with 59 percent of occupants in these apartments aged 55 years old and over.

Demand Drivers

An analysis of the age profile of apartment residents suggests three main groups driving occupier demand: students, younger adults, and older empty nester adults.

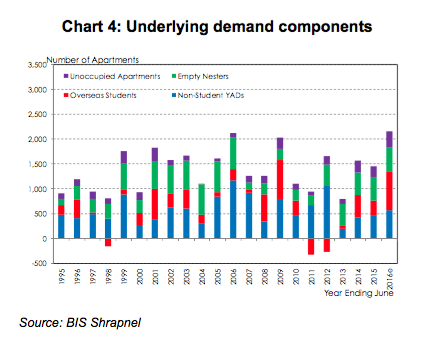

Students account for 17 percent of the IBA population, with 56 percent being overseas students. Overseas students create instant demand for accommodation, opting to reside close to their place of study. After a post-GFC decline, overseas student enrolments have been in recovery mode since 2014, driven by a lower Australian dollar. The improvement has occurred across all education sectors.

The young adult apartment population is typified by those in white collar employment. Inner Brisbane employment growth has been weak in recent years due to State Government cost cutting and a reduction in mining services jobs. There is evidence that the decline may have bottomed out, although the recovery is likely to be slow (Chart 4).

Empty nesters are classified as those aged 45 years old and over, being either singles or couples without children. Empty nesters comprised 28 percent of the non-student adult population in the IBA area at the 2011 Census.

INVESTMENT

Rental Vacancy Rates

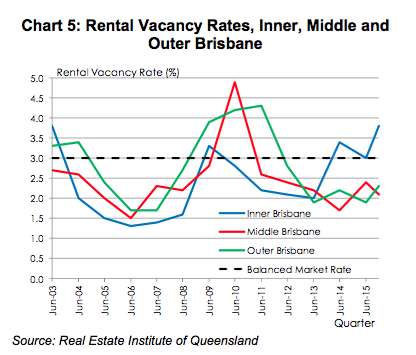

Vacancy rates in Inner Brisbane remained below the balanced market rate of 3 percent from June 2004 through to June 2013, except at June 2009, when a rapid reduction in standard variable rates and the introduction of boosted incentives to first home buyers during 2008/09 encouraged existing and potential tenants to become owner occupiers.

Unlike Middle and Outer Brisbane, vacancy rates in Inner Brisbane have increased since 2013/14, reaching 3.8 percent at December 2015. While some of this rise may reflect the rate of new stock coming to the market and the time required to fill the stock, the steady rise in vacancy rates through 2014 nevertheless suggests that an excess of rental stock is emerging within Inner Brisbane.

Table 1 (main picture) outlines the weighted median two bedroom (the most common type of unit) rent and weighted median unit price of the IBA area post codes, along with an indicative yield representing the rent divided by the price.

Unit rental yields increased to a peak of 5.52 percent at June 2012, and remained at a similar high level over the following year. Combined with the low interest rate environment, investor demand strengthened and drove solid unit price growth of 5.9 percent in 2013/14.

Relatively low borrowing costs also reduced cash outflows for investors and diminished the necessity for landlords to increase asking rents, particularly with low borrowing costs making it easier for tenants to shift to owner occupation. As a result, rental growth remained below 1 percent per annum since 2012/13. Unit yields eased to a low of 5.08 percent at June 2015.

Rising vacancy rates will limit rental growth in 2015/16 to an estimated 0.1%. Moreover, preliminary data suggests unit prices may have declined, as the record level of apartment completions in 2015/16 creates increased competition and has a negative impact on resale prices. With a decline expected in prices of 2 percent in 2015/16, the indicative yield for a two bedroom apartment in the IBA area will improve slightly to 5.19 percent at June 2016.

SUPPLY PIPELINE

Off–the–plan apartment demand within the IBA area has escalated from 2013, attributed to attractive yields, low or volatile returns for other investments and low interest rates. The rise in off–the–plan sales has allowed a greater number of projects to reach sufficient pre-commitment levels to obtain finance and begin construction. As a result, the IBA Area experienced a sharp increase in apartment completions in 2014/15 to 2,920 apartments. The period between peak demand and the subsequent lag of pipeline supply reaching the market has apartment completions set to soar to record levels over the next few years. In 2015/16, we estimate that approximately 3,250 apartments will be completed, surpassing the record high set just the year before.

In the short term, demand for Inner City apartments from investors shows little signs of abating despite the potential impact on rents and prices of further sizeable new additions to the rental stock across Inner Brisbane. Based on the current pipeline, completions are on track to peak in 2016/17 at over 7,000 apartments, of which investor owners will continue to form the bulk of underlying demand. Relatively less expensive apartment prices, and more attractive rental yields compared to their respective home markets, is likely to sustain demand for IBA stock from investors in Sydney and to a lesser extent, Melbourne. Similarly, this should also see overseas investors increasingly favour Inner Brisbane apartments over Sydney or Melbourne with demand from other countries also underpinned by a preference to invest in more transparent and stable political environment.

Consequently, IBA Area completions are on track to escalate above the record levels in 2015/16, increasing to a peak of 7,182 apartments in 2016/17, 6,468 apartments in 2017/18 and 5,497 apartments in 2018/19. The West End and Inner North precinct will be the mainsource of new apartments in the IBA area over the three years to 2018 accounting for 60 percent of all new supply. Apartment completions as a proportion of total IBA area is expects to be next greatest in CBD/Spring Hill (13 percent) and Toowong (10 percent).