Banks set to pocket $21 million as they play rate cuts: Finder.com.au

Finder.com.au have suggested that banks will make $21 million of extra profit in the coming weeks as they delay passing on on the rate cut.

All four major lenders, as well as a further nine have announced interest rate reductions to their standard variable home loan rates after the Reserve Bank cut two days ago.

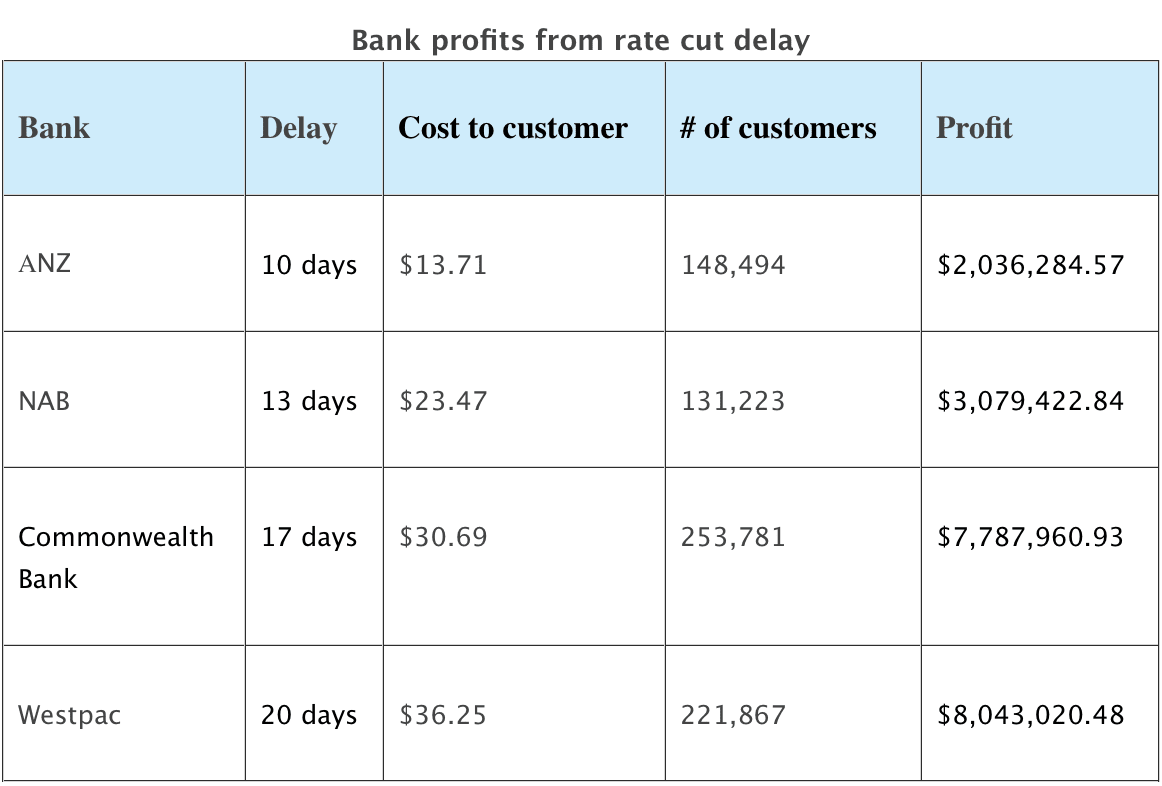

Westpac has announced they will pass on the full Reserve Bank cut of 0.25 percent, but only from May 23, which will earn them at least $8 million in the next fortnight.

NAB are too to pass, however they will do it a week earlier than Westpac on May 16 which will pocket them $3 million in repayments.

Commonwealth Bank will cut but not until May 20, earning them an extra $7.7 million.

The quickest change will be at ANZ whose change will start from May 13, however they aren't passing on the full 0.25 percent, therefore will take an extra $2 million in payments.

Combined, the big four are set to earn roughly $1.25 million each day they withhold their rate cuts from consumers.

Money expert at Finder.com.au Bessie Hassan suggests more than 750,000 home loan customers with the big four banks will miss out on $26 on average until they pass the cute.

“The longer a bank holds on passing on a rate cut, the more money they'll squeeze from Aussie pockets before finally adjusting their rates. So it's no surprise we're seeing them taking more time to pass on discounts,” she says.

“Interestingly, it’s often a different story when rates are heading north.”

Ms Hassan warns borrowers to keep an eye on their home loan interest rates.

“We urge customers to be checking if their lender has passed on the rate cut as some could be taking advantage of the situation.”

Ms Hassan says it’s the responsibility of the borrower to keep track of movements and then try to negotiate a better deal with their lender.

“If you’re still not happy with what’s on offer, it’s time to start shopping around.”