RBA concerned by rising Aussie dollar: CBA's Savanth Sebastian

GUEST OBSERVER

The Reserve Bank Board minutes make it clear that policymakers are waiting on more timely economic data to gauge how the economy is tracking.

However the minutes have also set the scene for next week inflation data and the subsequent May 3 Board meeting – highlighting potential triggers for an interest rate cut.

What makes the prospect of another rate cut a possibility in coming months is the discussion on the Australian dollar. Board members noted that the rising Australian dollar might “complicate ” the economic recovery –essentially hamper the rebalancing efforts “towards non-mining sectors of the economy ”.

A super low inflation result would pave the way for the Reserve Bank to cut rates again. However it would need to feel confident that a rate cut would have the desired impact in driving the Aussie dollar lower. Most central banks that have eased monetary policy in the past few months have seen their currency continue to strength. In addition it is difficult to justify another rate cut in light of unemployment falling to a 2ó-year low. No doubt if a slowdown due to the Federal election took place it could just tip the balance towards a rate cut.

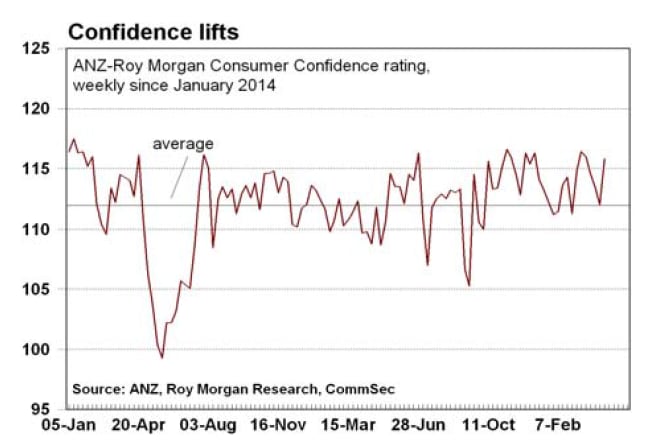

Consumer confidence rose for the first time in five weeks. The Aussie dollar is holding near US77 cents; interest rates are stable; and petrol prices are low. However the deciding factor for the decent lift in confidence last week would have to be the upbeat employment data last week and the rally in sharemarkets.

Unemployment fell to a 2ó-year low, while the ASX 200 index rose by 4.5 per cent – marking the strongest weekly rally since October last year.

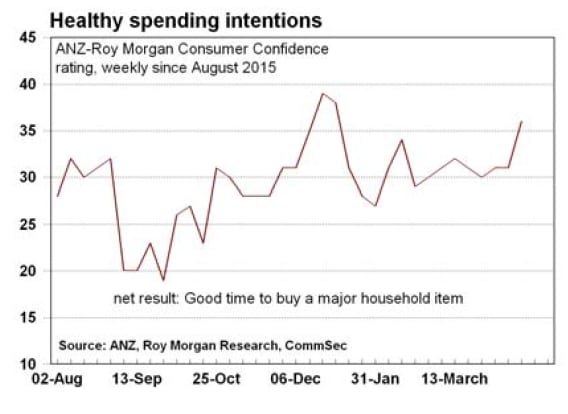

The good news for retailers is that consumers are seemingly looking forward to the next year with a healthy level of optimism.

Consumers continue to believe it is a good time to buy a car, fridge, washing machine or television. The estimate of whether it was a good time to buy a major household item was at the best levels in since early January. Certainly retailers don’t seem to be in a rush to lift prices, so affordability is good.

It may be that the looming discussion of a potential July 3 Federal election will dampen confidence levels in the next few months. In fact Qantas announced that the upcoming Federal election had resulted in “some softness in demand”. However the fundamentals are still sound.

What do the figures show?

Consumer confidence

The weekly ANZ/Roy Morgan consumer confidence rating rose by 3.8 points (3.4 per cent) to 115.8 in the week to April 17. Confidence is up 6.4 per cent over the year and above the average of 112.1 since 2014. Four of the five components of the index rose in the latest week:

The estimate of family finances compared with a year ago was up from +3 to +7;

The estimate of family finances over the next year was down from +29 to +26;

Economic conditions over the next 12 months was up from -6 to +1;

Economic conditions over the next 5 years was up from +3 to +9;

The measure of whether it was a good time to buy a major household item was up from +31 points to +36 points.

The key quotes from the Board minutes:

International conditions: “Indicators of global economic activity had eased a little over recent months, but were still consistent with growth in Australia's major trading partners remaining at a slightly below-average pace in the March quarter.” … “Members observed that these measures had been particularly weak for the Asian region.”

Domestic economy: “More recent data had suggested that the Australian economy had continued to grow at a moderate pace in early 2016 and that activity had continued to rebalance towards the non-mining sectors of the economy.”

Australian dollar: “The Australian dollar had appreciated by almost 7 per cent against the US dollar over the past month. It had appreciated by 4 per cent on a trade-weighted basis, reflecting stronger domestic economic data, the rise in commodity prices and the fact that the renminbi (which has the highest weight in the trade-weighted basket) had depreciated by only slightly less against the Australian dollar than had the US dollar. At the time of the meeting, the Australian dollar was around its highest level since mid 2015.”...

“Members noted that an appreciating exchange rate could complicate progress in activity rebalancing towards the non-mining sectors of the economy”.

Monetary policy: “Members judged that there were reasonable prospects for continued growth in the economy, with inflation close to target. The Board therefore decided that the current setting of monetary policy remained appropriate. New information would allow the Board to reassess the outlook for inflation and decide whether the improvement in labour market conditions evident last year was continuing. Continued low inflation would provide scope to ease monetary policy further, should that be appropriate to lend support to demand.”

What is the importance of the economic data?

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

The Reserve Bank releases minutes of its monthly Board meeting a fortnight after the event. The minutes give a guide to Reserve Bank thinking on interest rate settings. What are the implications for interest rates and investors?

CommSec doesn’t expect any change in the cash rate for the foreseeable future. Underlying inflation remains at the bottom of the 2-3 percent target band but should lift over 2016.

Savanth Sebastian is an economist for CommSec