Adelaide house, unit values to climb 0.2 percent: NAB

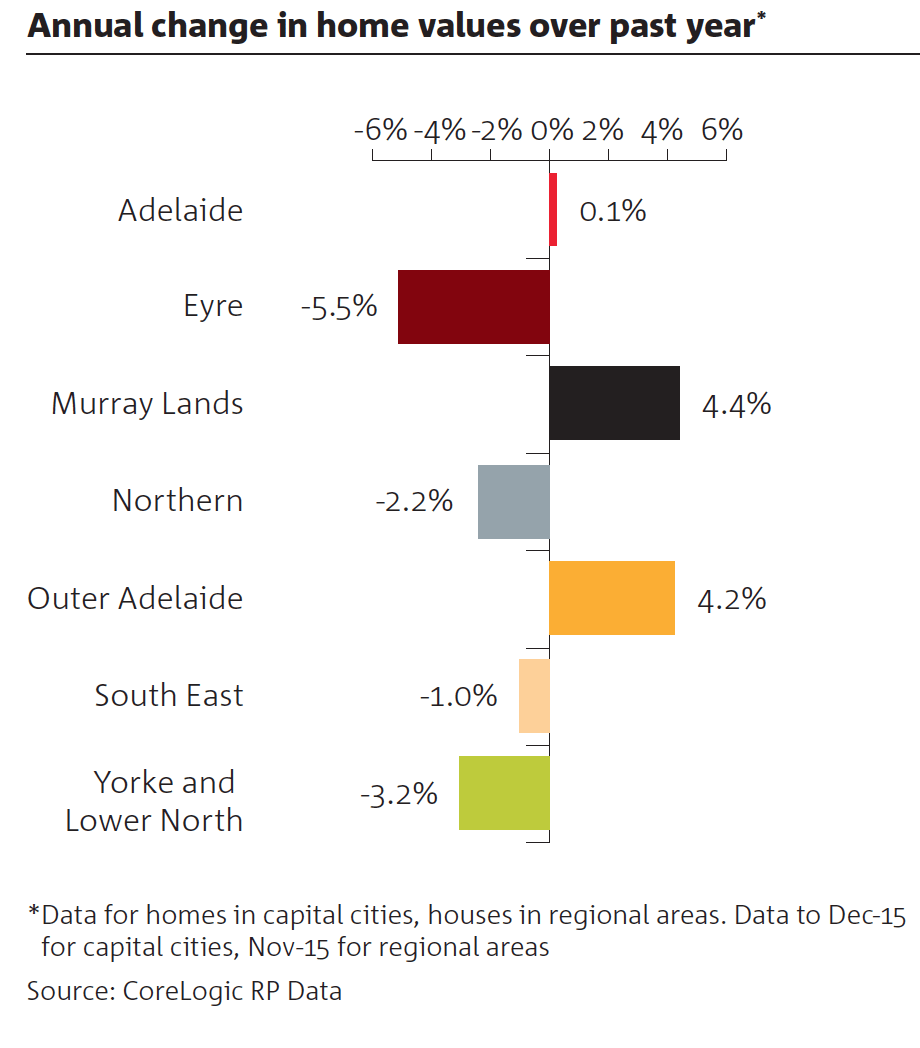

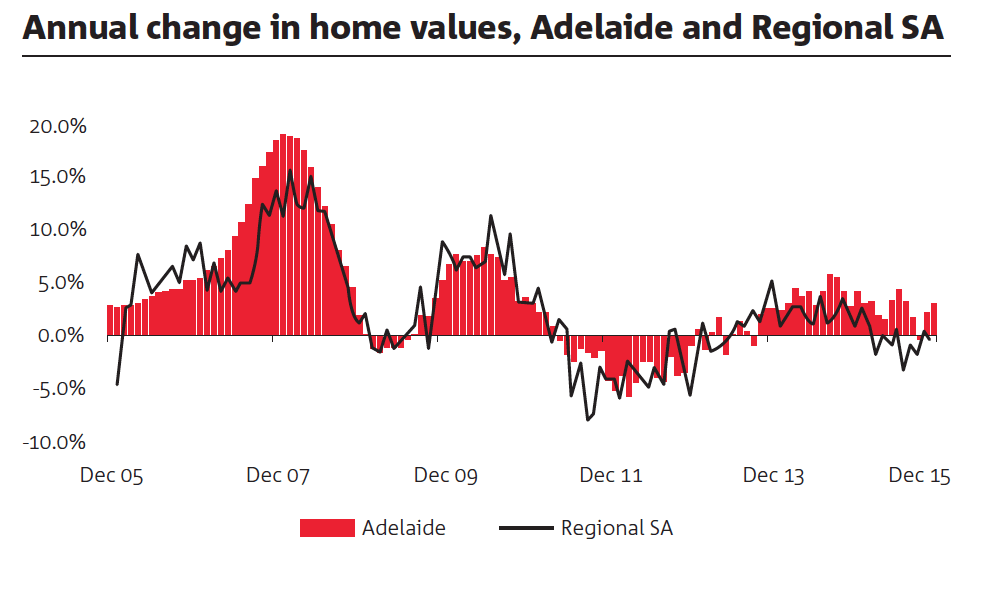

The Adelaide housing market saw home values remain virtually unchanged in 2015, with the CoreLogic index recording a 0.1 percent slip in home values over the 2015 calendar year.

But the latest NAB housing insights report suggest very modest growth is likely for 2016

The relatively steady conditions across the South Australian capital have moderately outperformed the broad regional market across the state where values were down 0.4 percent over the year.

Longer term, however, the regional market (+2.1 percent) has outperformed the state’s capital (+1.9 percent) over the past five years.

The fairly flat housing market conditions across Adelaide reflect relatively soft economic conditions where uncertainty is heightened due to the planned closure of the automotive manufacturing sector in the north of the City. Soft conditions across the mining and resources sector as well as low rates of population growth are contributing to the flat housing market conditions in Adelaide and across the regional housing markets of the state.

The Murray Lands, which is a very large, primarily agricultural region of eastern South Australia, has shown the largest increase in home values, with a 4.4 percent rise over the year.

The underperformance of the Adelaide housing market has largely been a reflection of deteriorating economic conditions in South Australia. The local economy has been challenged by unfavourable demographic factors, weak commodity prices, as well as the long-term structural decline of its manufacturing base. It also lacks the industry mix and job opportunities to draw workers back to the state as the national economy rebalances towards non-mining activity, although the lower AUD is supporting tourism arrivals and expenditure.

Lacklustre economic performance is expected to continue over 2016, which will severely limit employment and wages growth, with flow on effects for the local housing market.

According to the NAB Property Survey, sentiment towards residential property in SA/NT is especially weak (SA/NT and WA are the only states where sentiment is negative), and deteriorated even further in the fourth quarter.

Consequently, respondents are now expecting even larger declines in house prices than they reported in Q3 2015, although rental expectations posted a surprising improvement. Given NAB’s expectation for the local economy, population and household income growth to remain subdued, both house and unit prices are expected to remain relatively flat in 2016.