Lendlease half-year financials to December 2015 up 12 percent

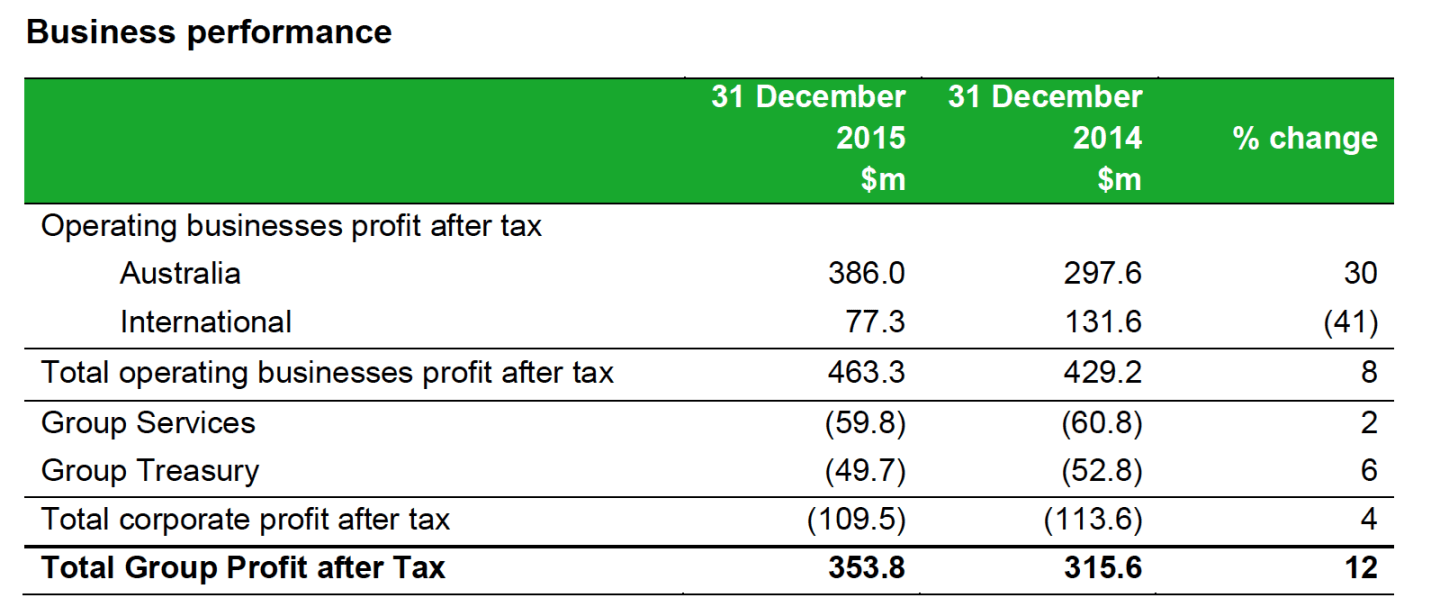

Lendlease delivered profit after tax for the half year ended 31 December 2015 of $353.8 million, declaring earnings per stapled security of 60.9 cents, up 12 percent.

Compared to the corresponding period's profit after tax of $315.6 million the December half-year figures are up 12 percent.

Lendlease Group chief executive officer and managing director, Steve McCann said the development pipeline grew to $46.6 billion, with approximately 75 percent represented by urbanisation related projects.

"During the half we had strong sales momentum at residential projects at Victoria Harbour in Melbourne and Elephant & Castle in London and we secured planning approvals for a new urban regeneration project in Chicago,” McCann said.

“In the last six months we have settled over 650 apartments, with non-settlement at less than 1 percent versus our historic average of less than 3 percent. We maintain a disciplined approach to delivery risk and pre sales.

“Our Australian Engineering business has secured a number of key contracts during the half including the Gateway Upgrade North and Kingsford Smith Drive in Brisbane and last week we were announced as preferred on the D9 Level Crossings Removal in Melbourne with our alliance partners... the business is well placed to secure a growing pipeline of infrastructure works.”

For the half year ended 31 December 20151:

Profit after tax of $353.8 million and earnings per stapled security of 60.9 cents, up 12 percent

Interim distribution of 30.0 cents per stapled security, unfranked.

Record pre sold revenue $5.4 billion2 across residential apartments and communities, up 49 percent

$46.6 billion estimated development pipeline end value, up 15 percent

$18.6 billion construction backlog revenue, up 19 percent

$22.0 billion funds under management, up 26 percent

Strong balance sheet with $1.6 billion of cash and undrawn facilities

Return on equity of 13.4 percent